The Stealth Approach To Profit From The Lithium Boom

With a proven, world-class graphite resource, tiny

Lomiko Metals (LMR.V; LMRMF.OB) offers a novel way to leverage the global feeding frenzy for lithium ion batteries.

Dear Fellow Investor,

Sky-high demand for lithium plays has sent company stock prices soaring, leaving investors to wonder if there are any good opportunities left uncovered.

Thankfully, there’s one opportunity that’s still flying under the radar — because it offers a “stealth” way to leverage the lithium boom.

Exploding Lithium

The market for electric vehicles — and the lithium ion batteries that power them — is primed to explode.

As noted, the investment community has latched on to this story with full force, sending the market caps of lithium exploration and development companies soaring.

But, in the meantime, graphite, a critical component of lithium ion battery production, has largely flown under the radar.

And while China controls the supply-side of the equation for graphite, as you’re about to see, global companies have plenty of incentive to look elsewhere for secure sources of this key commodity.

That’s where Lomiko Metals comes in. While the rest of the market was focused on lithium projects, this company was securing a key property position in flake graphite in eastern Canada.

The result? A high-potential, back-door way to play the lithium story.

Global Demand For Lithium Ion Batteries Goes Parabolic

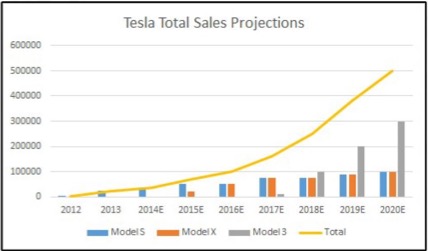

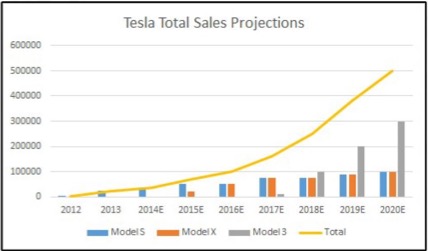

The following chart of Tesla’s estimated electric vehicle production through 2020 paints a vivid picture of where the market is heading.

With unit sales of its line of electric vehicles set to top 500,000 units by 2020, it’s no wonder Tesla is in the process of building a gigafactory for battery production.

Indeed, the overall market for electric and hybrid vehicle production its estimated to hit 4 million units by 2020, a more than quintupling of 2010 global production!

Graphite: Up To 15X More Than Lithium In Batteries

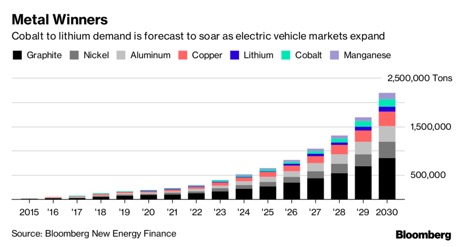

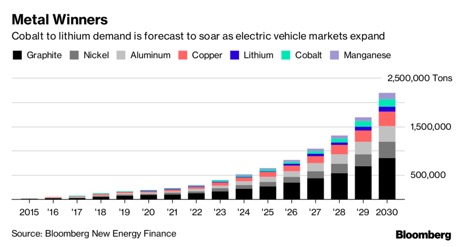

Without question, the demand equation for lithium ion batteries is cause for excitement.

But so is the corresponding demand for graphite.

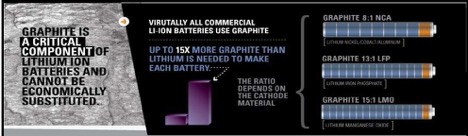

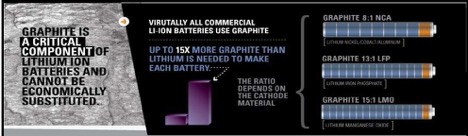

Depending on the type of battery being produced, battery manufacture can require 8 times as much graphite as lithium, going all the way to a ratio of 15:1 in some cases!

The typical Tesla Roadster electric vehicle uses 110 kilograms of graphite in its batteries.

Better still, from Lomiko’s standpoint, the type of graphite needed to power lithium ion batteries is the high-priced, limited-supply flake graphite that it has in its portfolio.

Readily Mineable Supplies Of Flake Graphite In Short Supply

As mentioned previously, China is the dominant player in graphite, supplying 70% of the world’s demand for the resource.

However, China has dramatically curtailed supply in the past year. By shutting down mines, it has reduced supply by one third from 90,000 tonnes in 2016 to 60,000 tonnes in 2017.

That sort of choke hold on the market creates a strong incentive for graphite purchasers to look elsewhere for their graphite supplies.

The problem is that there aren’t any easily developable graphite mines in the West. Most potential candidates have huge capex requirements. The graphite price would have to be significantly higher to justify mine construction on these projects.

A Virtually Turnkey Source Of Flake Graphite

And that’s where Lomiko Metals’ La Loutre flake graphite project in Quebec enters this picture.

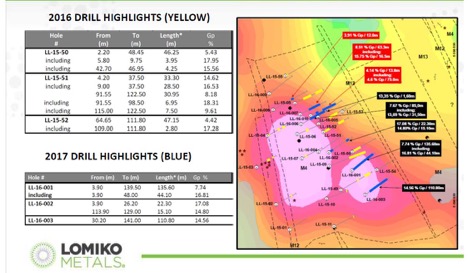

With a top-line flake graphite resource of 4.1 million tonnes of 6.5% graphite, La Loutre hosts a high-grade, near-surface resource that appears readily open-pittable (read: inexpensively mineable).

The 2,867-hecatre property has all needed infrastructure to build a mine and is located less than 200 kilometers by highway from the Port of Montreal.

It also shares geologic similarities to the nearby IMERYS graphite mine. That 20-year mine hosts a very comparable graphite resource of 5.2 million tonnes grading 7.42% graphite.

In a potential mid-term catalyst for Lomiko’s share price, the company plans to release a preliminary economic assessment on La Loutre in 2018.

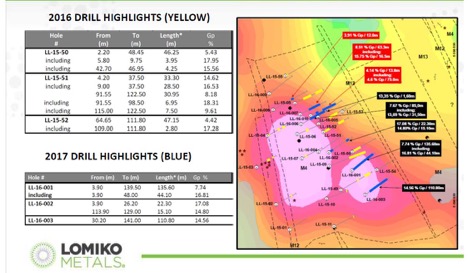

Those economics are likely to get a boost from a high-grade zone of 10%+ graphite that was outlined on the property in 2016 and 2017.

La Loutre High-Grade Zone

Better still, a 25-hole drilling program to expand and upgrade the resource is scheduled to begin this month, which means investors won’t have to wait long for potentially share-price moving news from the company.

Thanks to its drum tight share structure, Lomiko Metals share price is a tightly coiled spring, one that could well spring loose as we move into 2018.

Most lithium plays are overvalued, but Lomiko is priced to provide significant leverage on the next leg up for lithium ion batteries.

With the tailwinds of the electric vehicle market propelling the battery market to new heights, Lomiko Metals (LMR.V; LMRMF.OB) and its high-grade source of flake graphite at La Loutre are an ideal way to play the trend.

The drills are just starting to turn, making now the perfect time to build your position in this stealth lever on the lithium story.

CLICK HERE

Learn More about Lomiko Metals.

|