|

Dear Fellow Investor,

In mining, as in most businesses, the race often goes to the swift.

That's especially true in the rapidly evolving lithium market.

Buoyed by the demand for electric vehicles and recent improvements in stationary storage technologies, lithium-ion batteries, and their component metals, have enjoyed explosive growth.

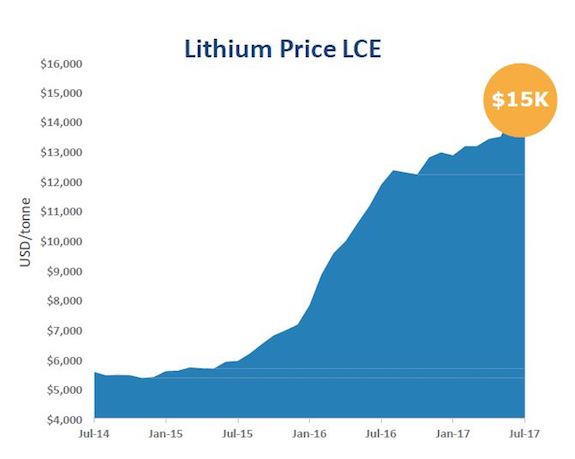

The following chart of lithium prices tells a compelling story.

Lithium prices have tripled in the last three years. Moreover, the future bodes well for sustained price increases as battery gigafactories continue to sprout up across the globe.

Here's the key for investors: The companies that can turn those higher prices into cash flow the fastest will offer investors the most leverage on those high prices.

Consider this quote from a report on lithium plays by UBS Global Research:

"Almost all of the new projects that have successfully ramped up production recently have been brownfield developments of formerly mothballed mineral concentrate operations, or operations that have been able to piggy-back on infrastructure already in situ."

With two brownfields lithium projects in California and one in southern Arkansas, Standard Lithium is following exactly that path...

And it's dead-set on winning the race to production among lithium juniors.

Ground Zero For The Clean Energy Revolution

California. Arguably no other jurisdiction in the world is more wedded to the Clean Energy Revolution than the Golden State.

California has some of the strictest emission policies in the United States and has, in Southern California and the Bay Area, two of the country's most car-dependent population centers.

So when Standard Lithium's management team had the opportunity to ink agreements with existing brine operators in San Bernardino county, it jumped at the chance.

Both its Bristol Dry Lake and Cadiz Dry Lake projects have in-situ brine operations, which means that Standard can pursue lithium projects on these two properties with reduced permitting risk and accelerated production timelines.

In a sector where long permitting and construction lead-times can kill projects, such reduced permitting risk is a huge advantage.

Two Brownfield Projects Offer Compelling Upside

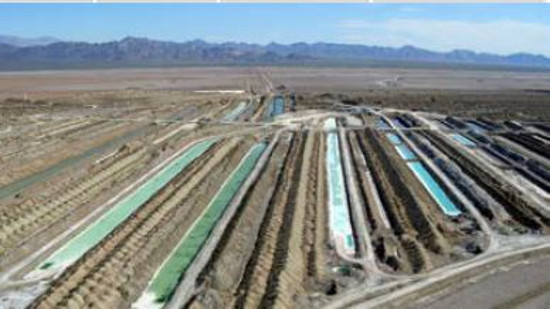

At Bristol, two active, permitted brine processing companies have operated for decades, giving Standard a ready source of raw brine to use for flowsheets, a preliminary economic assessment and a pilot plant.

The project benefits from world-class infrastructure, including a paved road and rail on site, abundant electricity and water and a skilled workforce. Plus, the deep-water Port of Long Beach is just 4.5 hours away.

Existing Industrial Brine Infrastructure at Bristol Dry Lake

Located 20 miles southeast of Bristol, Cadiz offers similar infrastructure benefits and has yielded grab samples with lithium concentrations between 112-139 mg/L.

Together, Bristol and Cadiz give Standard Lithium access to 48,000 acres of prime territory in the Mojave Desert for lithium production.

And that's not even taking into account the large position it holds on the legendary Smackover Formation....

Fast Tracking Resource Definition In Arkansas

Standard has an option agreement with TETRA Technologies for up to 33,000 acres of brine leases on Arkansas' portion Smackover Formation.

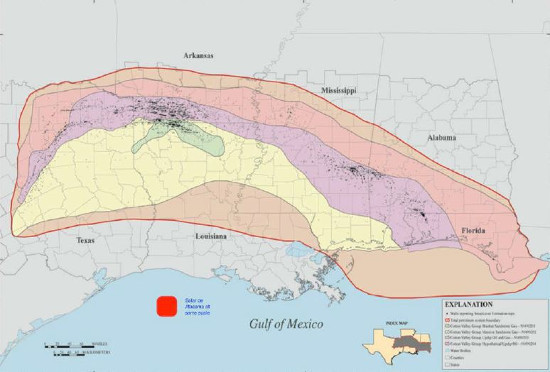

Spanning Texas, Arkansas and Louisiana, this area has been active for oil and gas development since the 1920s and has produced billions of barrels of brine over the last 80 years.

All this prior work, combined with close-by mineral and chemical extraction infrastructure, gives Standard a huge head-start as it moves forward with a resource assessment and a potential pilot test.

Map of the Smackover Formation

Standard's Smackover concession includes data from 256 exploration and production wells. Of those wells, 30 come with full core reports, including detailed resistivity and porosity data.

Given this wealth of data, the company is moving quickly to define a resource and build a pilot plant.

It's yet another example of Standard's ability to accelerate the project development curve by pursuing brownfields projects.

Follow The Smart Money

In a sign that the smart money likes Standard Lithium's strategy, the company recently closed on a C$21.6 million bought-deal financing.

In a financing market where most juniors would be thrilled to raise C$5 million (or less), the market filled Standard's coffers with the money it needs to advance its projects.

Obviously, investors are betting that Standard's accelerated path to development will make it one of the big winners in the lithium space.

With the money, the company can move forward with an aggressive development timeline for both Bristol Dry Lake and Smackover.

Ample news flow. Large projects with in-place infrastructure. A management-team committed to winning the lithium race.

It all adds up to a compelling investment story, one that makes Standard Lithium a "must-have" if you're looking for leverage on the red-hot market for this energy metal.

CLICK HERE

To Learn More about Standard Lithium.

|