| A tried-and-true strategy for leverage in a precious metal bull market |

|

| Please find below a special message from our advertising sponsor, GR Silver Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Consolidating An Historic Silver-Gold District |

|

A recent acquisition by GR Silver (GRSL.V; GRSLF.OTC) and a successful financing have set the company up for significant resource growth, just as the gold and silver bull market kicks into high gear.

|

|

Consolidations of Mexican mining districts have often provided junior companies and their shareholders with a blueprint for success.

|

|

In past bull markets for gold and silver, Mexico’s large endowment of precious-metals-rich mining districts have offered mining companies the opportunity to breathe new life into those districts using modern exploration techniques.

When done well, this strategy has allowed well-managed juniors to go from explorers to developers to producers in fairly short order, and to achieve successful exits via takeouts by larger companies.

In the process, they’ve often delivered outsized leverage on rising metals prices, with significant returns to investors.

In the current bull markets for gold and silver, GR Silver (GRSL.V; GRSLF.OTC) appears to be executing this strategy to a tee, having managed to consolidate the most important high-grade silver-gold assets of the historic Rosario mining district in Mexico’s Sinaloa state.

Moreover, its recent acquisition of the Plomosas project from First Majestic Silver offers compelling synergies with its nearby San Marcial project.

Plomosas’ addition bolsters the company’s already-solid advanced stage exploration projects in the Rosario district, gives it the opportunity to double or triple its current silver-equivalent resource and comes with infrastructure that should speed its development (and that of its nearby San Marcial project).

|

|

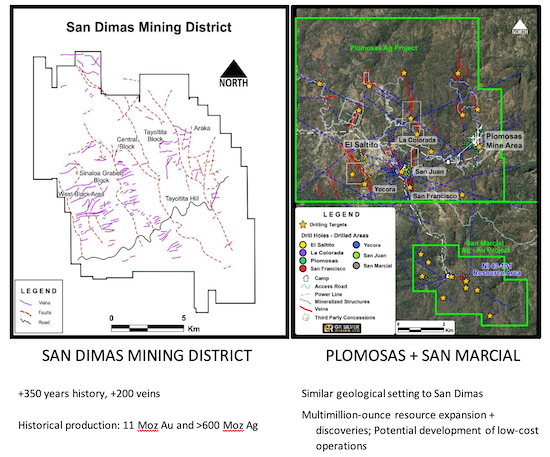

Similarities To San Dimas

|

First Majestic Silver Corp. was one of the most explosive, and explosively profitable, stories in silver exploration in the last market cycle.

And First Majestic’s experience with Mexico’s San Dimas district provides a good analog for the potential GR Silver sees with its flagship projects in the Rosario district.

San Dimas has a mining history that spans centuries, and precious metal mineralization has been identified in over 200 veins. Since first mining was reported at San Dimas in 1757, the district has generated more than 582 million ounces of silver and 11 million ounces of gold.

First Majestic acquired San Dimas in 2018 when it absorbed Primero Mining. The mine is projected to produce between 13.4 million and 14.9 million silver-equivalent ounces in 2020, and it boasts resources, in all categories, of 135.1 million ounces of silver and 1.5 million ounces of gold.

The Rosario mining district is also an historic district, one that has seen over 300 years of mining and produced multi-million ounces of precious metals. GR Silver has successfully managed to consolidate the majority of this district.

With its recent addition of Plomosas to its nearby San Marcial project, GR Silver has staked out two complementary projects that have similar geology to San Dimas.

|

|

| Like San Dimas, the silver and gold mineralization at Plomosas and San Marcial have the characteristics of low-sulphidation, epithermal silver-gold-base metal vein/breccia systems.

|

A Relationship With First Majestic Leads To The Extraordinary Plomosas Deal

| With San Dimas becoming First Majestic’s primary focus after the Primero acquisition, the company began to look for a buyer for its Plomosas holdings, one with experience in the Rosario district and that would allow it to retain a stake in the project.

In the end, it looked at what GR Silver had done in growing a resource from 23 million ounces to 40 million ounces of silver in record time at nearby San Marcial, and decided to vend the project to them.

It’s a textbook example of how important relationships are in the mining business.

First Majestic had worked with GR Silver‘s senior management when it acquired what is today one of its most profitable operations, the Santa Elena mine owned by the SilverCrest Mines. First Majestic bought SilverCrest in 2015 for C$154 million.

As a result of the relationship built during that deal, First Majestic sold the 8,500-hectare project to GR Silver for terms that consisted of C$100,000 in cash, a 2% NSR with a 1% buyback option for US$1 million, and 17.1 million shares of GRSL (equating to a 19.9% interest in the company).

These terms represent a small percentage of the total invested to date in exploration, which includes more than 500 drill holes, geophysics and underground development totaling US$18M and on-site infrastructure worth close to US$30 million.

|

Plomosas Came With A Wealth Of Data

|

Those terms were truly a win-win, as they gave First Majestic shareholders exposure to the substantial upside of Plomosas, San Marcial and the rest of GR Silver’s Rosario district portfolio.

There is, however, a standstill agreement in place for two years that provides GR Silver’s experienced management team two years to fast-track resource expansion and discoveries.

The $18 million of data on Plomosas, which included unreleased assays from more than 500 drill holes with attractive silver and gold results, has given GR Silver a ready-made source of news flow…and a clear path to quickly generate a series of precious-metal resources for the project in the next 12 months.

The initial rounds of assays from the unreleased drilling database have generated some bonanza-grade results, led by the 0.7 meters of 6,438 g/t silver and 70.9 g/t gold (Hole 01A) drawn from the project’s San Juan area and the 1.7 meters of 26.9 g/t gold drawn from the past-producing Plomosas Mine Area.

Only one of these six areas was originally mined by Grupo Mexico as a zinc-lead operation bolstered by silver-gold credits. With its focus on base metal production, Grupo Mexico didn’t focus as heavily on the Plomosas’ precious metal potential.

And while the recent assays have included strong base metals values as well (e.g., 13.6 meters of 15.0% zinc, 15.7% lead, 1.9 g/t gold and 65 g/t silver), it’s the precious metals content that is particularly striking.

It’s looking like the precious metals mineralization lies along multiple vein systems with more of an east-west to northeast-to-southwest strike and a vertical dip.

This contrasts with the previously mined, base-metal-heavy mineralization, which was hosted on north-south, shallow-dipping fault zones.

In short, these recent results open up the possibility that GR Silver can outline a significant silver-gold resource at Plomosas simply by focusing on multiple systems parallel and oblique to the base-metal-predominant breccia on these targets.

This new style of vein-hosted, precious-metal-heavy mineralization could yield a sizable silver-gold resource just by analyzing the core left behind on San Juan and the Plomosas Mine area.

| Large Silver-Equivalent Resource Provides Base For Growth

|

Not only does the aforementioned regional exploration database include 16 additional drilling targets for future drilling, but Plomosas’ US$30 million of infrastructure includes 8,000 meters of underground development left behind by prior operators.

All this underground development gives GR Silver the ability to easily access historic targets areas and continue drilling them.

GR Silver’s management notes that this infrastructure alone would take the company a couple of years to build on its own, not to mention the time it would take to get all the permits and authorizations needed to mine in place.

Equally important, the project already has a 120-person camp, ready road access and a 33 KV power line on site. That means if GR Silver can prove out a resource at Plomosas, as looks highly likely, it will have a huge head start in developing the project.

Better still, San Marcial’s nearby, 40-million-ounce silver resource makes the potential synergies between the two projects compelling.

And, the resource at San Marcial lies within just 500 meters of the six kilometers of mineralization outlined on this property. GR Silver is currently drilling one of the eight targets on this six-kilometer trend.

Between the resource growth potential at San Marcial and the 30,000 meters of underexplored structures at Plomosas (24 potential drilling targets with indications of veins), GR Silver has an excellent shot at growing that large resource base substantially in the next 12-24 months.

And it will execute these exploration programs while following the Mexican government’s Covid-19 guidelines, employing geologists and workers who are primarily either locals or who live nearby and strictly adhering to all social distancing rules.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Assays From Plomosas, Drilling At San Marcial

|

So, with that 12-to-24-month timeframe, what’s the argument to own GR Silver now?

Only this: Plomosas’ large dataset of unreleased drilling assays and the drilling and underground development the company is conducting at San Marcial mean it will be releasing important (potentially market-moving) news on a regular basis over the weeks and months ahead. (Late-breaking update: Click here for high-grade results released on May 13th.)

Between the impressive silver and gold grades we’ve seen from Plomosas and the likelihood that further drilling will outline more resources below and in the vicinity of the San Marcial resource, GR Silver stands to increase its resources quite significantly...and quite quickly.

The analogs to Plomosas make this clear.

In a sign the smart money is lining up behind the GR Silver story, the company just last week announced a bought-deal private placement that was quickly upsized from C$6 million to C$8.1 million.

First Majestic, the company’s largest shareholder, will participate, which shows its confidence in the upside potential at Plomosas and San Marcial.

That deal will consist of 30 million units priced at C$0.27, with each unit including a warrant and a half-share redeemable on a whole-warrant basis for C$0.40 for up to 12 months from closing.

With the funding piece of the puzzle in place and news set to flow for the foreseeable future from its two flagship projects, GR Silver is primed to deliver leverage in a time of rising precious metals prices.

Given the tsunami of fiscal and monetary stimulus that’s hitting the global economy, gold and silver both are set up for multi-year bull runs.

If you have faith in those trends, you’ll want to buy GR Silver now to maximize your returns on them.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |