Why Gold?

History shows us why much higher gold prices are inevitable — and why every investor needs to have a significant position in the metal while they still can.

By Brien Lundin

I’ve covered the gold market and talked about it to investors and media for 40 years, but I’ve never recommended the metal as urgently as I am now.

There are three simple and compelling reasons: Debt…debt…and more debt.

As I’m about to show you, a trend that had its beginnings in the 1960s has now entered its endgame — the point where the level of accumulated debt has become completely unmanageable.

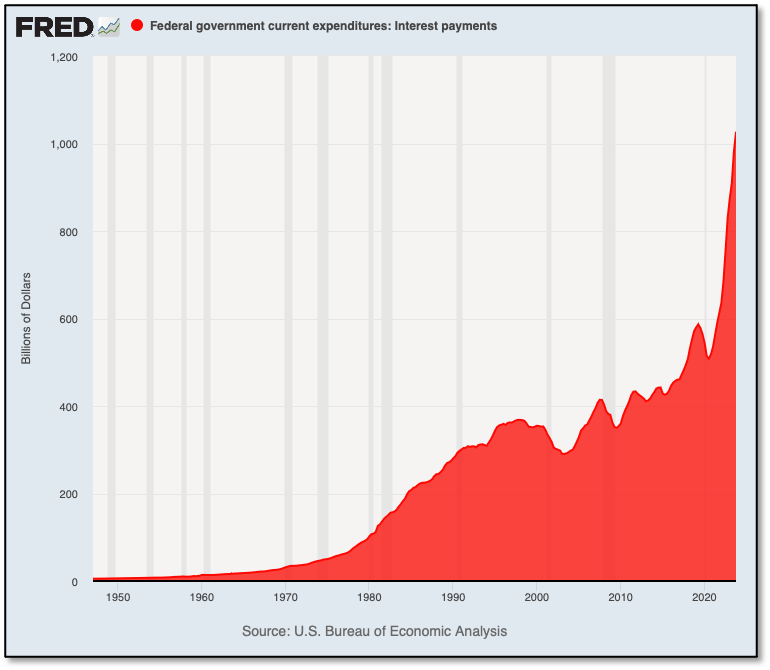

In the U.S., for example, the cost of servicing the federal debt has reached the shocking level that I’ve long predicted: over $1 trillion in interest payments.

It’s bad enough to run annual deficits of one or two trillion, but now we’re adding another trillion on top in interest. Every year.

The interest costs alone are more than any other single budget item, including national defense!

So where is all this money coming from? Thin air, created with the tap of a few keys. And each new dollar conjured into being makes every other dollar that much cheaper.

The bottom line is that the U.S. and other developed nations are now trapped in debt spirals. At this point, no degree of spending cuts, tax hikes or economic growth can save them.

Basic math tells us that the end result will be…has to be…very significant currency devaluations. And history tells us that the only sure protection will be found with gold.

To understand why, we need to look backward, as nothing we’re seeing today is new.

What’s Old Is New Again

Throughout human history, governments have always overspent their means, creating unmanageable debts.

Whether it be military campaigns, lavish lifestyles for rulers or bread and circuses for the masses, excessive debts have been a natural outgrowth of human nature and a consistent characteristic of governments from time immemorial.

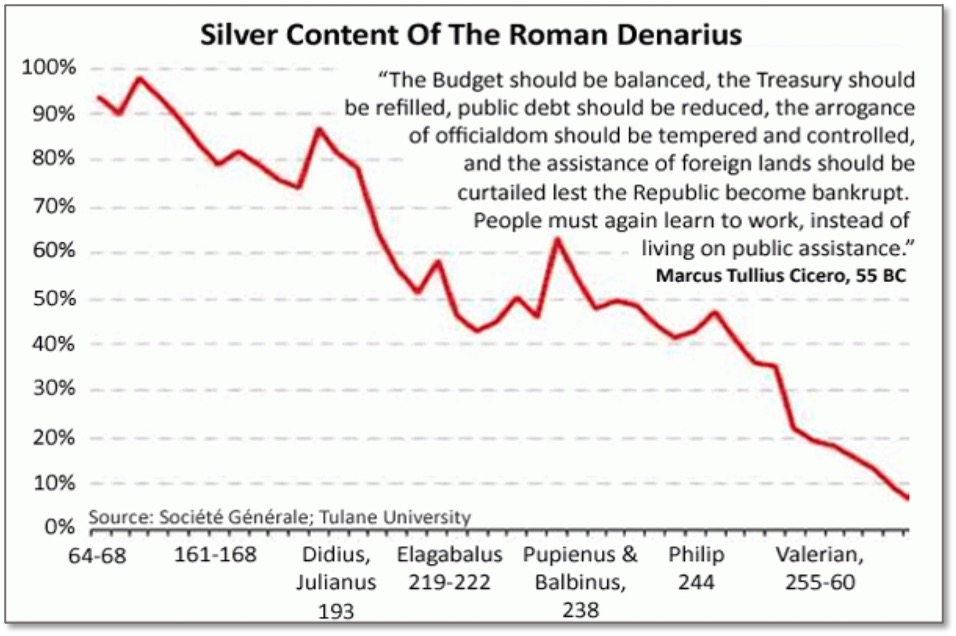

From ancient Greece and Rome to today, the solution to these debts has always been the same: to depreciate the currency.

As you can see from the chart above, the Roman denarius was devalued consistently as the empire ran up its debts. In fact, the drop in the value of the currency closely traced the decline and ultimate collapse of the Roman empire.

Ancient gold and silver coins had their edges clipped and/or their metal content debased with copper or other metals to create cheaper currency with which to pay off those debts. Later, in so-called fiat currency systems, which are not backed by gold or silver, paper currencies were simply printed up to ever-greater levels and the parties went on.

It will be the same today. After decades of deficit spending, in which new currencies have been created at an accelerating pace via computer keystrokes at treasury ministries and central banks, debt has grown to monstrously large levels in economies around the world.

Debt loads are now so large that dollars — and every other fiat currency — must be significantly depreciated, to lessen the real values and costs of those debts.

The reason is simple math: The costs of servicing these debts at normal interest rates are completely unmanageable. This is why interest rates must run consistently below the rate of inflation from this point forward.

In short, currencies must depreciate more quickly (AKA, monetary inflation) than debt service costs can rise.

The end result is that we’ll have negative real rates going forward, essentially as long as the current monetary regime is in place.

And that will be an extremely bullish environment for gold and silver, along with virtually every commodity.

This is the primary reason why we can rest assured that the prices of gold and silver, and mining stocks, will be much higher over the long term.

But there are other reasons, including the fundamental and irresistible trend of ever-easier monetary policy.

Easier And Easier Monetary Policy…

In the U.S., as a prominent example, the trend toward overspending began with the “guns and butter” policies of the 1960s. These spending programs led to significant deficit spending, which in turn led to the creation of ever-increasing amounts of dollars as the Federal Reserve monetized the debt.

Eventually, this prompted governments around the world, most notably France and Great Britain, to take advantage of the dollar’s only remaining link to gold: The gold “window” that allowed foreign central banks to exchange dollars for gold from the U.S. gold reserve.

Knowing the dollar was no longer worth a dollar, governments began sending their dollars to the U.S. Treasury in exchange for gold.

The resulting outflow of gold from Treasury vaults eventually grew so great that President Nixon was forced to “temporarily” close the gold window on August 15, 1971.

Of course, like all confiscatory government programs, that temporary closing proved to be permanent. But the most important repercussion was that it freed the Federal Reserve to pursue easy-money policies without restraint.

To paraphrase our late friend P.J. O’Rourke, giving central bankers this power was akin to “giving whiskey and car keys to teenage boys.” The rampaging inflation of the 1970s proved this metaphor, as the Fed’s governors quickly veered the U.S. economy into a figurative ditch.

Thanks to the extraordinary conviction and political will of Fed Chairman Paul Volcker, the central bank was able to get inflation under control and the economy back on track. But subsequent Fed chairs were unable to resist the temptation to move back toward easier-money policies whenever the economy began to slow.

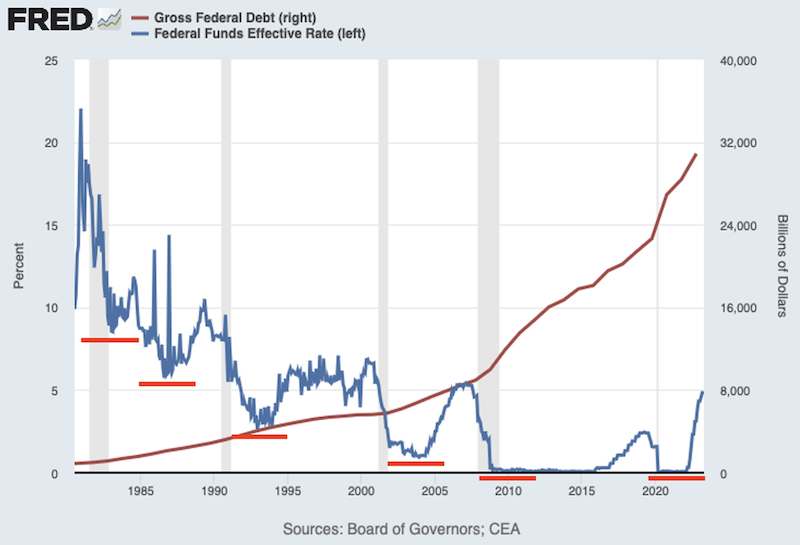

The result, as you can see in the accompanying chart, is an ever-descending staircase of interest-rate ranges.

The red lines mark the bottoms of each of the Fed’s rate-cutting cycles. Note that not only is each bottom successively lower than the previous, but the central bank was never able to “normalize” rates to anywhere near the previous levels until recently.

The central bankers themselves became addicted to manipulating interest rates (which is the cost of money, and therefore the cost of everything) ever lower in response to any hiccup in the economy.

Even worse, in the process they also addicted the financial markets to the drug of easy money.

The upshot is that the current financial markets are towering to record levels of valuations, but with that growth fueled almost exclusively by the adrenaline of easy money. In the current example, we also have massive fiscal stimulus at work via government programs like the “Inflation Reduction Act.”

The end result is that, at this point, the markets and the economy demand not just easy money, but ever-easier money.

The problem, of course, is that the descending stairs of interest rates hit the ground floor after the 2008 Great Financial Crisis. And then rates returned to zero as a result of the Covid-19 crisis. The next step, which the Fed has done everything but fully deny as a possibility, would be negative rates.

If the Fed truly isn’t considering negative rates as a possibility, it is the only central bank in the world with such conviction.

…And More Money Altogether

If ever-easier interest-rates were the only consequence of this trend, it would be bad enough. But after the 2008 crisis, the Fed took things to a new level with “quantitative easing.”

With its QE 1, 2 and 3 programs, the Federal Reserve expanding its balance sheet to previously unimaginable levels over $4.5 trillion. And while officials protested that this new-money creation was noninflationary because much of the purchasing was being “sterilized,” remember that every cent of those Treasury securities were backing government spending that had already gone into the economy, with commensurate multiplying effects.

And these new dollars were being created at a mind-boggling rate.

As before, the Fed did attempt to normalize policies after a few years, but were only able to get their balance sheet back to around $3.7 trillion and the fed funds rate just below 2.5%.

Their attempts at normalization led the U.S. stock market to throw a hissy fit, powerfully illustrating the fact that normalization would never be possible without collapsing the financial house of cards that had been built by the ever-easier monetary policies.

So the Fed quickly resorted to QE again (although they fervently denied it) in August of 2019. And then came the Covid-19 pandemic…and things got truly crazy.

Of course, the U.S. central bank escalated all previous policies to new records, almost immediately doubling the Fed’s balance sheet to nearly $7.5 trillion and setting interest rates back to zero…and all this before the major fiscal programs came in to add trillions in spending.

The price of gold soared as these rescue programs began to be implemented, because gold is a predictive mechanism: The metal looked ahead to see the inflationary consequences.

And they came as predicted, with the government’s measure of inflation (widely understood to understate the true rate) jumping to over 9%.

What was unexpected in all of this was the determination of the Federal Reserve, under the direction of Chairman Jerome Powell, in combatting the inflationary pressures with arguably the harshest rate-hiking cycle in modern history.

So what did gold do during this stringent monetary tightening? It gained over $400 an ounce.

Apparently, gold was looking ahead once again. And is continuing to do so as the price has risen to new all-time highs.

The gold market is sensing that rate cuts, as noted above, are absolutely…mathematically…necessary, as it is far too expensive to service the current levels of debt at anything resembling normalized interest rates.

Interest rates must come down, and they will. Monetary policy must return to easing, and it will. The dollar and all other fiat currencies must be depreciated, and they will.

And the price of gold will rise in those currencies, protecting those who own it.

Own Gold — For Insurance And Profit

The bottom line is that every investor who has accumulated any degree of wealth needs to protect that wealth by owning gold and silver.

The very essence of gold is its ability to insulate you from the depreciation of your currency. It represents freedom — your independence from the inevitable destruction of your wealth by government policies.

Consider gold as insurance, but not against something that might happen, but from something you know will happen.

You purchase home insurance, but you don’t truly expect your house to catch on fire. But gold protects you from something that is inevitable: the depreciation of your currency.

Moreover, gold is the only insurance in which you can pay the premium only once.

The lesson of history — and recent trends — argue that you should pay that golden insurance premium soon, if you haven’t already.

Beyond its role as insurance, there are ways you can leverage the inevitable increase in gold prices to build your wealth.

Our Investor’s Guide to Gold and Silver is a comprehensive report that covers the entire spectrum of precious metals investments, from physical bullion to rare coins to futures and options and mining stocks. And the range of options and valuable strategies are discussed within each sector.

Our flagship subscription publication, Gold Newsletter, was instrumental in the fight to legalize gold ownership in the U.S. over five decades ago, and has since evolved into one of today’s preeminent advisories on metals and the junior mining sector.

These equities are high-risk/high-potential investments, but the risks are dramatically lowered during a secular gold and silver bull market that is based on monetary fundamentals. In short, precisely the kind of investing environment we have today…and are likely to have for years to come.

Not only is the risk lowered in such a bullish environment, but the potential rewards are also raised. One junior mining stock, for example, recently soared over 55 times in value since it was recommended in a Gold Newsletter Alert. Many other picks have risen hundreds of percent in value.

But to maximize your returns and lower your risk in mining equities, you need to do your homework.

You see, the key to investing in mining stocks is to realize that it’s an inefficient market, especially so at the junior end of the spectrum. Thus, by dedicating time and money to researching the sector, you can gain a distinct advantage over those who aren’t as diligent.

That means subscribing to two, three or more of the best newsletters, and attending the best conferences that focus on the arena. Of course, we believe that Gold Newsletter and our New Orleans Investment Conference are among the best at what they do, but there are many other outstanding newsletters and events in the industry.

All of them are detailed in our Investor’s Guide, and I can’t recommend more strongly that you give it a read if you’re investing in metals and mining.

If you aren’t willing to put in such effort, you can still enjoy the protection of gold and silver, as well as some of the upside. Just buy the most recognizable bullion coins from trusted dealers and invest in the major mining-stock indices, GDX and GDXJ.

You likely won’t enjoy the same upside potential or security, but it’s better than not getting positioned at all.

Whatever you do, don’t delay. The trends I’ve discussed here are only accelerating.