| Profit from the “Eureka” moment... |

|

| Please find below a special message from our advertising sponsor, Vizsla Resources. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Profiting From The “Eureka” Moment

|

|

We just saw proof that ultra-high-grade silver and gold drill results during a rollicking gold bull market can send a junior exploration company’s share price soaring.

The good news for shareholders of Vizsla Resources (VZLA.V; VIZSF.OTC) is that this looks like just the beginning.

|

|

In a gold bull market, high-grade drilling results have the ability to drive big share price increases.

|

Case in point: Vizsla Resources’ recent release of assays from drilling on the underexplored Napoleon Vein at Panuco, the company’s district-scale silver-gold project in Sinaloa State, Mexico.

Two holes drilled from the same pad on Napoleon yielded bonanza grades of both metals — and a bonanza reaction in the market.

Following a trading pause to release the news, VZLA leapt from pre-pause trading levels of C$0.44 to C$0.71 (a 60% increase in a single day!). It has largely maintained those higher levels since.

|

But this story hasn’t run its course. Not by a long-shot.

|

As you’re about to see, Vizsla has lots more targets, both along the fully two kilometers of strike outlined on the Napoleon vein...and along the 20+ other veins that have been traced on the broader Panuco property.

Investing in Vizsla now gives you a chance to ride the momentum of not only more high-grade results both from Napoleon but also from drilling on other veins on the project.

Looking further ahead, the company wants to prove up enough resources from the high-grade veins that criss-cross Panuco to put the project back into production.

|

Consolidating An Historic Mexican Silver District

|

Like a lot of Mexican mining districts, Panuco has a mining history that goes back centuries.

In Panuco’s case, however, modern production in the region primarily focused on one high-grade vein, dubbed Animas, and most of the remaining veins in the area have only been exploited by smaller-scale (and relatively shallow) operations.

More importantly, land tenure in the district has been fragmented, preventing a district-scale approach to exploration and development.

That’s where the team at Vizsla saw an opportunity. In 2019, it cut a couple of aggressive deals. The result? It was able to consolidate all of Panuco as a whole.

|

|

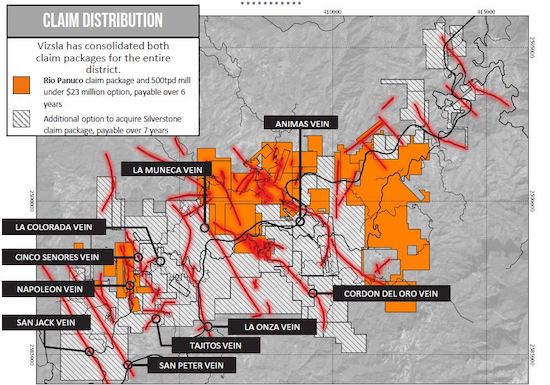

Between the Rio Panuco claims (highlighted in orange above) and the Silverstone claims (highlighted in silver), Vizsla has the option to take control of the entire district, inclusive of a 500 tonne-per-day mill, for C$43 million.

In the case of both the $23 million option for the Rio Panuco claims and the $20 million option for the Silverstone claims, Vizsla’s management has negotiated annual payments that start off small and then stair-step up in later years.

This is key, as it gives the company at least a three-year runway to establish a large, high-grade resource on the property and then make a decision about whether to take Panuco into production.

With great infrastructure, including the aforementioned mill and a four-lane highway that transects the property, a production decision here should be imminently financeable.

|

San Dimas Provides The Blueprint

|

In consolidating Panuco, Vizsla is attempting to apply modern exploration to a historic district, an approach that has worked well in other districts in Mexico, including First Majestic’s nearby San Dimas district on the Sinaloa-Durango border.

San Dimas lies just 80 kilometers to the north of Panuco and shares nearly identical geology and mineralization style.

However, in part because San Dimas has been consolidated for much longer, it has a much more storied mining history — one that has seen it produce 582 million ounces of silver and 11 million ounces of gold over the centuries.

And that production continues today, with the operation producing 6.3 million ounces of silver and 87,400 ounces of gold in 2019.

| |

|

And here’s the important part: As you can see from the maps above, both San Dimas and Panuco host large swarms of silver-gold-hosting epithermal veins.

But because Vizsla only recently consolidated the Panuco district, this area is much less advanced in terms of systematic, modern exploration and development.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

The Game Plan For Success Begins To Pay Off

|

That’s changing quickly though, now that Vizsla is working the district.

Last year, the company’s VP of Exploration began executing on a four-step plan to methodically target the known vein corridors within Panuco.

So far, the company has engaged in three of those steps — early-stage prospecting on historic workings, mapping to finalize drill targets, and drilling on those targets.

Vizsla is currently executing on step three — the recent share-price-spiking results came from a post-Covid-pause restart of its 14,500-meter drilling program on Panuco.

Given the initial grades and widths of the assays from the Napoleon vein corridor, step four (more detailed drilling to outline a resource on the vein) will likely begin shortly.

|

A Repeatable “Eureka” Moment

|

And, there’s a very good chance that the discovery holes Napoleon delivered last month will be repeated — near the initial discovery area, within other “jogs” along the Napoleon corridor and at other veins across Paunco.

Holes 2 and 3 drilled on that discovery targeted a vein system that had been exploited to about 50 meters depth by historic underground mining.

Hole 2 delivered a wide length (8.2 meters) of 1,544.2 g/t silver-equivalent (or 738.9 g/t silver and 11.1 g/t gold), and Hole 3 hit multiple high-grade intervals, including 2.5 meters of 1,133 g/t silver-equivalent and 5.1 meters of 905 g/t silver-equivalent.

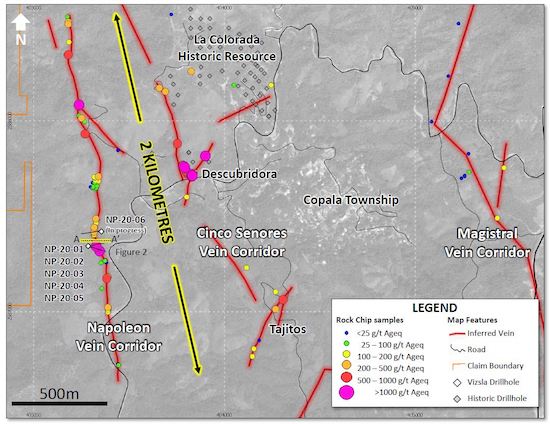

As you can see from the map below, the six holes that Vizsla has completed so far at Napoleon have focused on a northwest “jog” from the overall northerly strike of the vein.

|

|

Surface mapping has outlined other areas of high-grade to test along Napoleon, including other “jogs” along the vein system.

In other words, this discovery is providing a road-map that it can use to prove up a significant high-grade resource at Panuco.

The same surface and underground sampling that has identified this target has marked dozens and dozens of other targets across the property.

|

More Market-Moving Results Are Imminent

|

The next big newsmaker for Vizsla will be the assays from Holes 4, 5 and 6 drilled on the discovery area at Napoleon.

If you’re new to Vizsla, that’s exciting news, because it gives you a chance to jump on board this story now...before the assays from these holes hit the market.

|

Given the share price reaction to Holes 2 and 3 and the fact that visual inspection of the core from Holes 4-6 indicates that they have hit the same veining system, the odds for more market-moving results in the near future are excellent.

|

With more than C$5 million in its treasury, Vizsla is fully funded to complete the current program (and to expand it, which seems likely.)

Having hooked into a high-grade discovery so early in its exploration process, the company has every chance of proving up a large, high-grade resource at Panuco over the next few years.

If so, those who invest in Vizsla now have the chance to benefit from both the short-term price action from Hole 4-6 and the long-term potential of a consolidation play on an underexplored Mexican mining district.

As both a drill-hole speculation and a levered play on rising precious metals prices, Vizsla Resources is checking all the boxes to become the next big junior exploration winner.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |