| This gold stock gives you two ways to win |

|

| Please find below a special message from our advertising sponsor, Canarc Resource Corp. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

The emerging gold bull market is attracting hordes of new investors into the relatively tiny junior gold mining sector, and share prices are soaring.

Combining established, world-class gold resources with exploration upside, Canarc Resource Corp. (CCM.TO; CRCUF.OTC) offers two ways to capitalize on this powerful trend.

|

|

These are crazy times for gold bugs.

|

With governments and central banks across the globe racking up debt and printing money to stem the Covid fallout, gold is red hot.

The results are obvious, and not just in the huge share price increases we’ve seen among many junior gold companies since March.

The army of generalist investors and traders scouring the precious metals sector for opportunity have also been magnifying the price reaction for good news.

Juniors that might have seen a C$0.05-C$0.10 jump from a great batch of drilling assays are seeing their shares spike by three times that amount (or more) the day significant results hit the market.

Add in the re-rating of quality in-the-ground resources that’s taking place, and you have a recipe for big gains as the gold bull market gathers force.

|

These trends are what make undervalued Canarc Resource Corp. (CCM.TO; CRCUF.OTC) such an intriguing story.

|

Simply put, this is a gold-focused junior with two high-grade resources to its credit, two exploration properties about to be drilled and a story that, so far, hasn’t been on the market’s radar.

But with C$2 million in its treasury, impending drilling programs and a seasoned management team at the helm, that’s about to change for Canarc.

|

Profit Path #1:

A Market Re-Rating Of Existing, High-Grade Resources

|

The first potential catalyst for Canarc’s share price will be if the market starts to give it full credit for its more than two million ounces of high-grade gold resources.

The company’s New Polaris project in northwestern British Columbia is a key component of that gold hoard.

It contains a high-grade gold resource that measures 586,000 indicated ounces (1.6 million tonnes of 10.8 g/t) and 485,000 inferred ounces (1.4 million tonnes of 10.2 g/t). Note that those high grades are the diluted grades, which already account for 20% mining dilution.

These high grades and their potential profitability are reflected in a recent update Canarc made to its PEA for the project.

Using a US$1.00/C$1.40 exchange rate and a $1,500 gold price (more than $200 below current levels), that PEA delivers an after-tax IRR of 56% and an after-tax NPV, discounted at 5%, of C$469 million.

|

With a current market cap that’s hovering around C$25 million, that implies a value for New Polaris alone that’s almost 20 times Canarc’s current valuation.

|

Add in the million ounces of indicated and inferred gold on the company’s Fondaway Canyon project in Nevada (now optioned to Getchell Gold), and you have a stock that’s trading well below its inherent value.

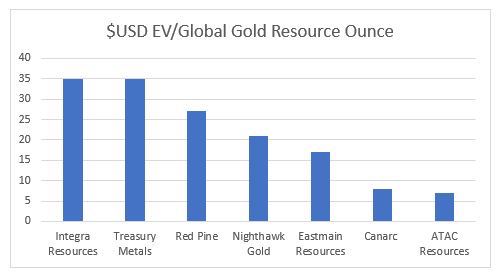

The chart below underscores the point:

|

| | Re-rating? Canarc has a low EV/global resources ratio relative to peers |

Currently, Canarc is trading at an Enterprise Value (EV) of just US$8.00 per ounce of global gold resources.

|

As the chart shows, even a move to the “middle of the pack” in terms of this valuation measure would deliver as much as a three-fold gain for Canarc shareholders.

|

And given the feeding frenzy that’s underway in this sector, such a dramatic re-rating would surprise no one.

Better still, even at those higher valuations, investors in Canarc would still be getting the company’s considerable exploration upside — essentially for free.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Profit Path #2:

Potential Exploration Success

|

And with drilling programs planned for two of its core projects, that exploration upside is going to be in play this summer and fall.

First up, Canarc plans to conduct a five-hole, 1,500-meter program on its Windfall Hills project in British Columbia.

Highlights from 2014 drilling on Windfall Hills include 28 metres of 1.5 g/t gold-equivalent (0.89 g/t gold and 39 g/t silver).

| |

| | Windfall Hills lies along the same geological belt as the 10-million-ounce Blackwater-Davidson project |

Plus, this 5,000-hecatare project lies just 90 kilometers northwest of Artemis’ Blackwater-Davidson property, home to more than 10 million ounces of gold and located within the same geological belt as Windfall Hills.

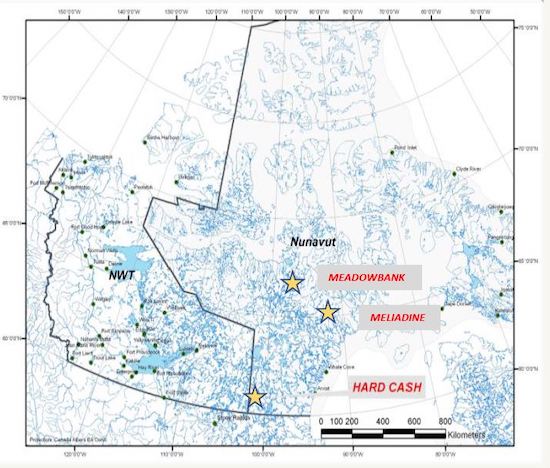

Next up will be Canarc’s Hard Cash project, a lode-gold target located on the southwest corner of Nunavut.

|

| | Canarc’s Hard Cash project in Nunavut |

Past work on Hard Cash has yielded high-grade showings, and management is currently awaiting permits to conduct a 10-hole, 1,500-meter drill program on the project later this summer.

That program will seek to duplicate the potential of Agnico-Eagle’s Meadowbank and Meliadine Mines (15.0 million ounces of collective gold deposits).

These two programs on Hard Cash and Windfall Hills have the potential to provide Canarc with market-moving assays in the back half of 2020.

|

|

Bull Market Amplifies Impact Of Good News

|

The bottom line is this: Thanks to the likelihood of negative real interest rates as far as the eye can see, a roaring gold bull market is virtually assured for years to come.

|

For evidence of that fact, one need only take a causal glance at the stock charts of so many juniors in this relatively tiny sector.

| As generalist investors have surged into this space, they’ve bid up companies anywhere from two to three times their mid-March lows.

But thanks to a relatively quiet Q1 for Canarc, the market has so far overlooked the compelling value the company offers.

|

Simply put, Canarc Resource Corp. has set itself up for big gains, as the gold market will likely force a re-rating of its existing resources…and amplify the impact of potential good news from this year’s drilling programs.

|

Given excitement that higher prices for the yellow metal are generating for the sector, Canarc likely won’t trade at current levels for very long.

If you’re looking for a compelling lever on gold, you’ll want Canarc in your portfolio before the rest of the market catches on here.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |