| The timeless power of discovery |

|

| Please find below a special message from our advertising sponsor, Makara Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Always A Good Time For Discovery

|

|

Even in the depths of bear markets, a new gold discovery can deliver big gains for early investors.

In the current bull market, unearthing a gold deposit on one

(or both) of its two prospective gold projects could send

Makara Mining’s (MAKA.CN; MAKAF.OTC) share price due north.

|

|

In junior mining exploration, nothing pays like discovery.

|

It stands to reason. All of a sudden, a series of impressive drill hole results converts a “might-be” piece of moose pasture into a richly valuable metals deposit.

The news of discovery draws in hordes of investors and speculators who failed to position themselves beforehand, causing a spike in the company’s share price.

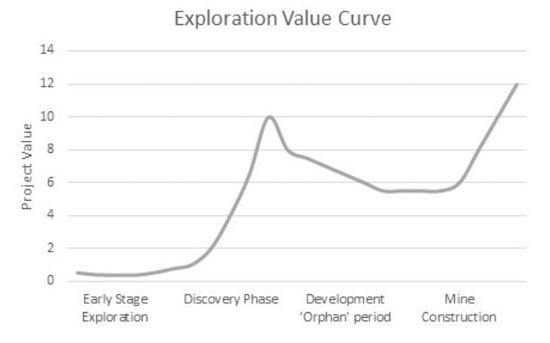

The graph below nicely illustrates the importance of getting in early to these stories.

|

| | The discovery phase is typically the most lucrative for investors |

Simply put, the steepest gains accrue to those with the foresight (and good fortune) to place successful bets on these discoveries before the drills start turning.

|

Discoveries don’t happen every day, of course, so the key is to include at least a few well-positioned, early-stage exploration stories in your portfolio to maximize your chances of success.

|

And with not one, but two, high-potential gold projects in hot gold districts, Makara Mining (MAKA.CN; MAKAF.OTC) is a compelling discovery-stage play, particularly as we enter the next phase of this bull market for the yellow metal.

|

The Second Yukon Gold Rush Continues

|

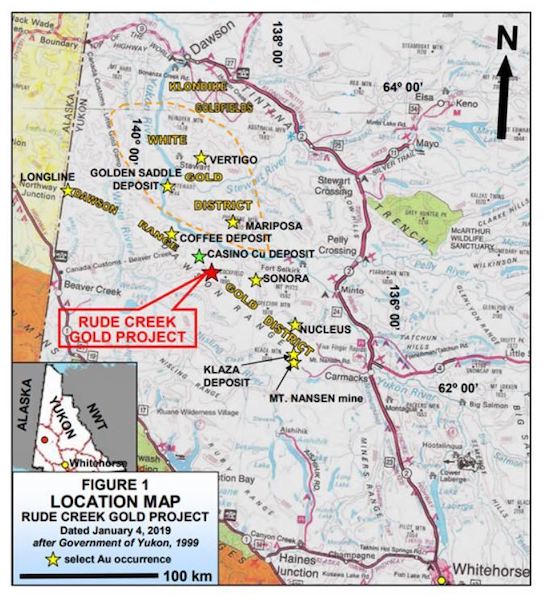

The White Gold district in the Yukon that plays host to Makara’s Rude Creek project provides a couple of excellent examples of the power of discovery.

First up, was Golden Saddle, a near-surface gold deposit in the district discovered by tiny Underworld Resources.

First outlined in the late 2000s, Underworld would eventually outline almost 1.5 million ounces of gold at Golden Saddle, put the White Gold area on the map as a gold district, and set a second gold rush in motion by other explorers in the area.

Kinross eventually bought Underworld in 2010 for about C$140 million, with the big gains from that sale going to those who got in early on the company.

The Coffee project, the second major discovery in the White Gold area, proved even more lucrative.

Attracted to the area by Underworld’s success at Golden Saddle, Kaminak Gold acquired Coffee in 2009.

By 2012, Kaminak had outlined 3.2 million ounces of gold at Coffee. By 2016, it had produced a feasibility study on the project that assumed annual production of 184,000 ounces at all-in sustaining costs of just $550/ounce.

|

The numbers from that study convinced Goldcorp to buy the company and the project for C$520 million.

|

Here’s where Makara’s Rude Creek project comes in, positioned where the White Gold district meets the Dawson Ridge district, just 45 kilometers from Coffee and 72 kilometers from Golden Saddle.

|

| | Makara Mining’s Rude Creek lies near major recent Yukon gold discoveries. |

Rude Creek shares strong geologic similarities to Coffee and has yielded significant initial assays on its Trombley zone.

In short, the project has the potential to host this section of the Yukon’s next major gold discovery.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Kenora: A Target-Rich Environment

|

Providing a strong backstop to Rude Creek is Makara’s Kenora gold project in northwest Ontario.

Both the TransCanada Highway and the Canadian Pacific Railway transect the project, as do natural gas and hydro transmission lines, meaning should Makara make a discovery here, infrastructure is more than sufficient to support building a mine.

| |

| | Great infrastructure surrounds Makara’s Kenora project in northwest Ontario (marked by red arrow on left) |

With a history of gold mineralization that goes back to 1894, more recent owners of Kenora have focused on surface work.

Trenching on the project has uncovered a target-rich environment, with highlights from recent sampling that includes:

|

• 18.0 meters of 2.0 g/t gold, including 5.0 meters of 6.8 g/t gold in the Aviator trend

• 2.7 meters of 5.0 g/t gold on the Hilly Lake trend

• 1.4 meters of 1.8 g/t gold on the Black Sturgeon trend

• 0.7 meters of 1.7 g/t gold on the Avro East target that runs parallel to Aviator

|

Follow-on sampling extended the Aviator trend (since dubbed the Ace Showing) and added other high-grade targets as well.

Given the excellent surrounding infrastructure at Kenora and the current bull market for gold, a discovery via drilling on this project could turbo-charge Makara’s share price.

|

Cashed Up To Make Market-Moving News

|

In a sign of the potential the smart money sees in Rude Creek and Kenora, Makara recently closed on an over-subscribed private placement that raised C$1.7 million.

That’s more than enough money to take exploration on its two core projects to the next level…and potentially generate the type of news that could make a big splash in the current market.

Remember that exploration chart: In good gold markets and bad, the big money gets made when the drills make a major discovery.

Of course, discoveries aren’t guaranteed, but especially in the current environment, even a strong whiff of one at Rude Creek or Kenora could propel Makara Mining (MAKA.CN; MAKAF.OTC) upward.

For those who want to speculate on that possibility, the market is providing you with a tailor-made opportunity to do so.

|

|

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |