| The red-hot exploration story that leverages silver… |

|

| Please find below a special message from our advertising sponsor, GR Silver Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Leveraging Silver

With A Red-Hot

Exploration Play |

|

Silver offers more leverage than gold in a precious metals bull market — leverage that silver equities then multiply again.

As part of the tiny universe of companies with a silver emphasis, GR Silver Mining (GRSL.V; GRSLF.OTC) is uniquely positioned to deliver huge gains as this generational bull market rolls on.

|

|

To maximize the money you can make in a precious metals bull market, you want to focus on assets that can deliver leverage.

|

Of course, you’ll want to own some physical gold and silver.

|

But for genuine, money-multiplying leverage, you’ll want to have at least a portion of your portfolio in the exploration space.

|

Further, while gold-forward explorers have yielded big gains in the current market, there’s nothing like having a few silver-forward equities in your portfolio to really goose its returns.

That’s because, as the poor man’s gold, silver typically delivers higher percentage gains than the yellow metal once a bull market gets rolling.

And because silver is most often mined as a by-product of base metals, the universe of silver-focused equities is relatively small.

In this environment, you’d be hard-pressed to find a more high-powered silver company than GR Silver Mining (GRSL.V; GRSLF.OTC).

Because, as you’re about to see, GRSL’s dominant position in the Rosario mining district in Mexico has given it control of not one, but two flagship projects…and of an overall portfolio that could easily be divvied up into three (or four) silver companies.

|

Building A Resource At Plomosas

|

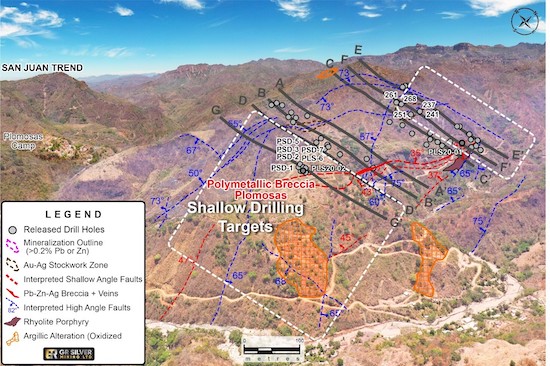

The first of those flagship projects is Plomosas, an 8,500-hectare project with at least 16 drillable targets and six areas of past drilling and underground development, including the past-producing Plomosas Mine Area.

Grupo Mexico operated the mine, primarily a lead-zinc deposit (with precious metals credits), between 1986 and 2001.

The Plomosas property then went through a series of owners and was most recently explored by primary silver producer First Majestic Silver.

Then, in 2018, First Majestic turned its attention to the San Dimas mine that it bought when it acquired Primero Mining.

|

| | Plomosas includes a past-producing mine area that still has significant upside |

Having built a relationship with key players on GR Silver’s management team on a previous deal, First Majestic chose to sell GRSL its interest in Plomosas, with the major portion of the sale price being shares that gave FM a 19.9% interest in the junior.

GRSL officially acquired the project from First Majestic this past March and proceeded to pore over the unreleased assays from more than 500 holes that Grupo Mexico and First Majestic had drilled on the project.

|

That $18 million historic databank, along with $30 million of in-place infrastructure, has given GR Silver a huge head-start on developing a resource at Plomosas.

|

Indeed, the company has already released several rounds of high-grade assays from this databank, including a batch released just last week that also included the first assays from an ongoing round of surface drilling.

That program is already hitting into new instances of near-surface mineralization. Given this early success, GR Silver is likely to expand the program and to drill underground as well, leveraging Plomosas’ wealth of historic underground development.

Simply put, this project is a target rich environment that looks very likely to produce a resource estimate by the beginning of 2021, with news flow from drilling and other exploration work all along the way.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Growing San Marcial’s 40-Million-Ounce Silver Hoard

|

And GR Silver’s allure as a silver lever only begins with Plomosas.

Its San Marcial project, located just five kilometers to the south, is already known to host a 40-million-ounce silver resource (29 million ounces indicated and 10 million ounces inferred).

Underground development and drilling are underway to expand that resource, with a focus on priority targets at shallow depth.

|

As this resource grows, GR Silver sees potential synergies with Plomosas that could shave significant time and money off both projects’ development plans.

|

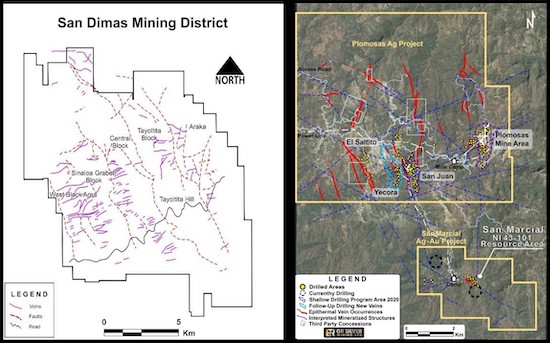

And between the myriad targets at Plomosas and those at San Marcial, this section of GR Silver’s Rosario district holdings looks for all the world like an earlier-stage version of the now-fabled San Dimas district.

|

| | Together, Plomosas and San Marcial look an awful lot like the hugely productive San Dimas district |

San Dimas has been mined for centuries and, according to First Majestic, has produced 11 million ounces of gold and 600 million ounces of silver in its history.

The Rosario district is a long way from matching those totals, but the team at GRSL is confident that it can grow its precious metals resources on these two projects by millions of ounces.

|

It’s Like Three Silver Companies In One

|

These first two projects have already made GR Silver one of the hottest plays in the junior resource sector.

But the upside doesn’t end there….

Consider this: GR Silver also controls the Rosario silver-gold project (consisting of the Yauco, El Habal and La Union 2 properties) on the west side of the district.

|

These properties are strategically adjacent to the multi-million-ounce Rosario mine controlled by Fresnillo, a major, Mexico-based mining company.

|

Not only is there a possibility that Fresnillo could add acquire one or more of these properties for itself, but there’s also a shorter-term possibility that yet another key asset — GRSL’s Placer II project — could also get some “area play” interest.

That’s because, as you’ll see from the map below, El Placer II lies close to Vizsla Resources’ Panuco project, an asset that has been a market darling in recent months.

| |

| | The value and size of GR Silver’s project portfolio make owning it like owning three (or even four) silver companies for the price of one. |

Add it all up, and just a quick glance over this map confirms that GR Silver controls at least three (and possibly four) property areas that could, each alone, make up their own, separate silver company.

|

Ongoing Drilling Means Steady News Flow

|

With the drills turning at both Plomosas and San Marcial, GRSL won’t lack for news flow in the months ahead.

That’s especially true given that GR Silver is fully cashed up, thanks to a C$9.1 million private placement, closed in June, that included further support from First Majestic and deep-pocketed resource funds.

In addition to the high-grade assays ongoing drilling could feed the market, successful drilling has the potential to grow the resource at San Marcial and, in conjunction with that 500-hole databank, to establish a new resource at Plomosas.

Longer term, the development head-start the company enjoys thanks to Plomosas’ infrastructure puts a “develop alone or sell to a major” decision on management’s radar.

And then there are the spin-off and/or sale possibilities of its other assets in the region.

|

Taken together, these assets make GR Silver one of the more compelling silver-predominant stories out there.

|

They also explain how it posted a seven-fold gain between March and August.

But there’s good news for those of you who missed that initial run — GR Silver has weakened a bit as the precious metals markets have taken a “pause that refreshes.”

That makes now the perfect time to build a position in GR Silver, in advance of what should be a busy year of news flow and a re-energized gold and silver market.

|

|

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |