| The most important factor driving gold |

|

| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

Gold’s downtrend has stopped, at least for now.

But while no one knows where the metals will head tomorrow or next week, we can be confident of where they will be months and years down the road.

Here’s why…

|

|

The stats show that it’s been a great year and quarter for gold and silver…but September was a lousy month.

|

The preliminary numbers, subject to today’s closing prices, show that gold is up about 29% for the past year and up about 5% for the quarter, but slipped about 3.5% over the last month.

Silver performed similarly, if a bit more volatile, as one would expect. It’s up about 40.5% over the past 12 months, about 28% higher for the quarter, and down more than 16% in September.

|

As you know, the sideways consolidation that had given us hope for a number of weeks was negated as the metals took a nosedive early last week.

The reason? Primarily a small uptick in real interest rates.

You see, perhaps the most important factor for gold, or at least the one with the closest correlation to its price, is the level of real yields. This is, of course, your favorite interest-rate measure minus your favorite gauge of inflation.

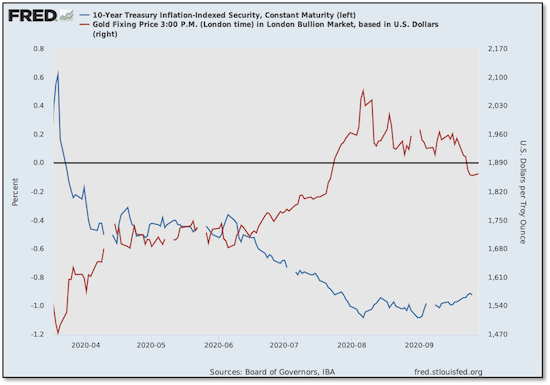

As you can see from the accompanying chart taken from the St. Louis Fed’s site, we can see this close correlation as we plot the gold price against real yields, as measured by the TIPS yield. We can see that real yields plummeted as the Fed and fiscal pandemic policy responses were being implemented in mid-March and the gold price simultaneously soared.

When real yields leveled off, the gold-price rally also took a breather — and not in reaction, but simultaneously as far as anyone could ever distinguish. Even the short-term, daily moves in real yields prompted an instantaneous and opposite reaction in gold.

|

|

In late June, real yields began to drop once again, sending the gold price on a second $300 rally. Then they both settled down into a range….

…Before real rates started a moderate, barely noticeable trend higher in late September.

Yet, with the gold price having completed another big rally, with virtually everyone on the bullish side of the boat and all this set against a very uncertain world in terms of the economy, the pandemic and political outlook, this slight uptick in real rates was all that was needed to send gold toppling.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

The lesson here is that it isn’t so much the level of real rates as their direction.

|

The gold price will rise if/when there is any degree of a trend lower in real rates. The steeper and/or longer the decline, the greater the move higher in gold. And vice-versa.

This is important for us to realize going forward, because much of the bullish argument for gold rests on the fact that we’ll be in a near-constant environment of negative real rates for years to come.

The reason: the monstrously large (and growing) levels of sovereign and corporate debt, and the accompanying service costs. Positive real rates would therefore destroy federal budgets and send corporations into bankruptcy.

As I’ve stressed over and over, because negative real rates will be around essentially forever, or as long as the current monetary regime remains in effect, the metals and other tangible assets will have a powerful tailwind.

But again, that doesn’t mean the prices of gold and silver will rise in a seamless, uninterrupted uptrend. We will see corrections along the way, whenever bullish euphoria peaks and whenever real rates temporarily trend higher and send the weak hands selling.

|

The market seems to have settled for now, but the short term for gold and silver is notoriously harder to predict than the long term.

|

|

Given the sovereign and corporate debt burdens around the world, which will necessitate ultra-easy monetary policy and negative real rates, much higher metals prices seem assured months and years down the road. It’s tomorrow and next week that are completely unpredictable.

For now, we’ve got a bit more skepticism in the gold market now, and that’s good. It’s setting up a solid launch pad for the next, inevitable rally.

I’d advise you to take advantage of this buying opportunity to get ready for it.

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. We’re only days away now from the biggest investment event of the year — and one of the most important in the 46-year history of the New Orleans Investment Conference.

That’s because this year’s virtual platform has allowed me the freedom to assemble a blockbuster speaker roster. Truly, you’ll be amazed at who we’ve gotten to grace our virtual “stage” this year.

Not only will these speakers give you live, late-breaking guidance on where to invest in metals and mining during this event, they’ll also provide insights on the geopolitical scene, the prospects for the economy in the months ahead, and coverage of every other asset class.

|

And even beyond this intensely valuable, four-day event, we’re going to keep delivering the ongoing views of these and other experts to you for months to come.

|

It’s all happening soon, the week after next, and time is growing short. Don’t put it off and risk missing out.

So CLICK HERE to get all the exciting details, many of which we’re just announcing now.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |