| What this gold washout means… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Gold sells off, sending the price — and sentiment — to seemingly exhaustive levels.

If this isn’t what we’ve been waiting for, it’s pretty darn close.

| |

If you’ve been following the gold market closely in recent days, you’re probably still in shell shock.

|

The metal has not only continued its correction over the last two sessions, it’s accelerated the process, dropping about $70 to just above the $1,800 level as I write.

This is just what we’ve been waiting for.

I know that sounds flippant. And to be frank, while I’ve been expecting the correction to continue through mid-December, I wasn’t expecting to see such a precipitous sell off.

But neither is it surprising, as this is just what has happened before every major gold-price rally, and is in fact a pre-requisite for such a move, to wash out the weak holders and exhaust the selling pressure.

I won’t go into much detail as to what’s precipitated this move. The “blame” can be shared widely, including everything from the impending (within hours) expiry of the December gold contract, the various shifting political and fiscal expectations, the on-going rally in Bitcoin, news of yet another vaccine and, most recently, an upside surprise in the November Purchasing Managers Index yesterday.

That last news item is what sparked, or was used as the excuse for, the immediate waterfall selling in gold, silver and mining stocks. But while the positive move in PMI sentiment bode good times ahead for the economy, it also carried a warning of the inflationary pressures that are now emerging.

To wit, the report noted that “Service providers indicated a steep rise in input costs midway through the fourth quarter, with rising supplier prices and wage growth pushing the rate of inflation to the fastest on record. Firms were able to partially pass on higher costs to clients, however, through a survey record rise in output charges.”

In other words, the inflationary pressures most have been expecting are already here. This will, eventually, be the fundamental underpinning of gold’s next bull run.

But the market technicians will tell us that analyzing these fundamentals is merely searching for excuses for what the price action has already indicated. In fact, one of today’s most accomplished market technicians told me just that last night.

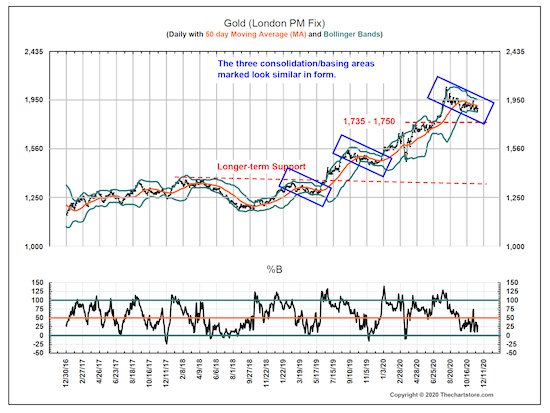

In a call with my friend Ron Griess, proprietor of TheChartStore.com, he expounded upon the uselessness of looking for fundamental reasons for the price action. More importantly, he pointed to a chart that he’d just posted on Twitter.

Here it is:

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

As you can see, Ron has noted how gold has traced out three similar consolidation/basing areas over the past two years.

So this current consolidation is nothing new. In fact, it’s a fairly common feature of a bull market in gold, or any other commodity. Again, this is a necessary function of a bull market, to remove potential sellers and clear the way for another move higher.

Importantly, if this consolidation continues to repeat the same geometry, we are nearing its end. From a rough technical standpoint, it looks like it will end within the next few weeks.

And that points, again, toward our target of mid-December.

This forces me (apologies to Ron and other technical analysts) to return to the fundamentals. From a timing standpoint, the Fed’s next meeting ends on December 16th. That would be a perfectly logical inflection point, as it has served as such in previous late-year gold rallies. (Although sometimes we’ve seen it come a few days later.)

Will history repeat? Again on fundamentals, it should. Joe Biden’s nomination of Janet Yellen as Treasury secretary pretty much locks in a policy of continued, unrestrained monetary easing, and gold will thrive under such a regime.

So hold on, because what we’re seeing right now is the construction of gold’s next launching pad.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |