| The silver junior built for leverage | | | Please find below a special message from our advertising sponsor, Aftermath Silver. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

With three active silver projects, Aftermath Silver (AAG.V; AAGFF.OTC) offers a potent lever on the metal that itself offers leverage to gold.

| | |

Secular precious metals bull markets don’t come around often, so when they do, you want to wring out every last drop of profits.

|

That means you need to employ leverage to maximize your gains.

It’s a step-by-step process, beginning with the fundamental, macro story.

To wit: Are governments going to continue to shower their economies with newly created currency, more and more debt and seemingly unrestrained spending?

You bet.

Will the growing mountains of debt require continued ultra-low interest rates going forward? Even negative rates after adjusting for inflation?

Absolutely.

And does this mean the price of gold will rise considerably over the coming years?

It seems assuredly so — and even more likely given gold’s recent rebound from its correction lows.

Given all that, how do you leverage this historic, multi-year gold bull market for maximum gains?

|

The easy answer is the metal that has always leveraged gold in markets like this: silver.

|

But it doesn’t end there…because you can leverage the move once again, with silver juniors.

These companies can multiply the moves in silver, which in turn leverages the moves in gold.

You get the picture. Now your job is to find the best silver junior companies.

And in this regard, one name is standing out right now: Aftermath Silver (AAG.V; AAGFF.OTC) and its three under-appreciated silver projects.

|

A Rare Bird In The Silver Space

|

It’s not hard to understand why silver naturally outperforms gold in a secular bull market.

For one thing, it trades at a fraction of gold’s price, which means the percentage gains for silver are much greater when silver prices begin to run.

Even though silver’s uses are primarily industrial, it retains its historic status in investors’ minds as a monetary metal.

Thus, when gold prices begin to run, silver typically begins to run in sympathy.

|

And when investors start scanning the space for equities that can leverage a run in silver, they will find only a small group of candidates.

|

That’s because most silver is produced as a by-product of base metal deposits, meaning projects with silver-forward mineralization are rare.

Within that already tiny universe of companies, Aftermath Silver and its millions of ounces of silver resources stand out.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

New Acquisition Fits Strategy To A Tee

|

Company President and CEO Ralph Rushton sums up the Aftermath Silver story nicely: “This is not a grassroots situation. We have built an early-stage, pure-silver play with three projects and a growth curve ahead of it.”

Those three projects began with two primary silver projects in Chile: Challocollo and Cachinal.

To those Aftermath has just added what looks to be a flagship project in Peru called Berenguela.

|

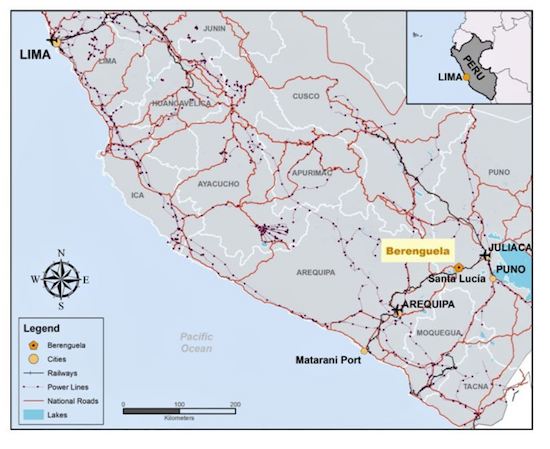

| | Aftermath’s recently acquired Berenguela project in southern Peru is situated close to key infrastructure including a port. |

Aftermath is purchasing a 100% interest in the Peruvian company that owns Berenguela from SSR Mining for US$12.7 million in cash and C$3.4 million in shares. SSR will also retain small royalties, which Aftermath can buy on a sliding pricing scale.

Because SSR’s previous optioner was an Australian company, the most recent resource estimate for Berenguela was JORC-compliant, but not compliant according to Canada’s NI 43-101 standards.

Still that Australian-compliant resource, compiled in 2018, demonstrates the potential.

|

The study posits a measured and indicated resource of 98.7 million ounces of silver and 624.5 million pounds of copper (35.9 million tonnes of 85 g/t silver and 0.79% copper). It also contains an inferred resource of 28.2 million ounces of silver and 147.2 million pounds of copper (10.0 million tonnes of 88 g/t silver and 0.67% copper).

| | The Company cautions that an independent Qualified Person (“QP”), as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Aftermath Silver to classify the Berenguela historic estimate as a current Measured, Indicated or Inferred Mineral Resource, and Aftermath Silver is not treating the historical estimate as a current Mineral Resource. Aftermath Silver will need to validate previous work to produce a mineral resource that is current for CIM purposes. | 1. For full details see Valor Resources news release dated 30 January 2018 to the Australian Stock Exchange (ASX), which summarises the results presented in report titled “Technical Report and Updated Resource Estimate on the Berenguela Project, Department of Puno – Peru, JORC – 2012 Compliance” to Valor Resources by Mr Marcelo Batelochi, independent consultant, MAusIMM Competent Person

2. JORC 2012 definitions were followed for the Historic Mineral Resources.

3. Grades are estimated by the Ordinary Kriging interpolation method using capped composite samples.

4. Bulk density has been estimated by Nearest Neighbour method and the average value is 2.82g/cm3.

5. The Historic Mineral Resources uses a copper equivalent cut off of 0.5%, copper equivalents (“CuEq”) were based on the formula CuEq (%) = Cu (%) + ((Ag (g/t) / 10000) in ounces x Ag price x silver recovery) / (Cu price x Cu recovery) + (Zn% x Zn price x Zn recovery) / (Cu price x Cu recovery). Assuming: Ag price $16.795/oz and Zn $3,150/t and recoveries of Ag 50%, Cu 85% and Zn 80%. Mn grades are not considered for CuEq calculations.

6. Numbers may not add/multiply due to rounding. |

The historic resource gives Aftermath a big head start as it begins the work to complete an NI-43 101 prefeasibility study on Berenguela, which will go a long way to establishing the economics associated with the project.

|

The Smart Money Is Betting On Aftermath

|

True kingmakers are rare in the mining sector, but Eric Sprott is certainly one of them.

In this latest run for the precious metals, Sprott has been making strategic bets on a variety of companies…and hordes of generalist investors have tended to follow his lead.

|

Bear that in mind when you consider that he participated heavily in the non-brokered private placement Aftermath Silver announced in August and closed in September.

|

Between the announcement and the closing of the deal, the placement was upsized from C$12.5 million to C$17.1 million. Sprott increased his participation in the transaction so that he remains the company’s lead shareholder, with a 19.6% interest.

Clearly, Sprott sees what other far-sighted investors see in Aftermath: a unique silver play with not one but two potentially large silver development projects led by a management team with a strong track record of delivering value for shareholders.

|

Potentially Massive Leverage To Silver

|

Leverage to silver (and gold) is one key thing to look for in a junior silver play, and given its resource, Aftermath offers that in spades.

But you also want to see upcoming catalysts to grab the market’s attention and unlock that potential.

Aftermath shines here as well, with big news on the way.

First off, with the money from its recent raise in hand, Aftermath plans to start the aforementioned prefeasibility study at Berenguela.

To do so, it will conduct infill, geotechnical and metallurgical drilling. Not only will Aftermath complete the report, they will also test several highly prospective exploration targets that could provide investors with more reasons to own Aftermath.

And even before that, at Challacollo, the company’s other major project, an NI 43-101 compliant resource is due shortly. It will be followed by a PEA to assess an open-pit mining scenario.

Indeed, both projects may be open-pittable. The mineralization at Berenguela is exposed at surface.

That makes them potential takeout targets as Aftermath moves them through the de-risking process.

Simply put, companies with silver projects this interesting are few and far between, a fact that makes Aftermath a compelling takeout target in the long term.

|

But even in the short term, this company’s silver projects make it a highly levered optionality play on rising silver prices.

|

If you like silver’s potential leveragability on gold, you’ll want to own a piece of Aftermath Silver before the next leg of the precious metals bull market kicks into gear.

| | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |