| High-octane silver play ready to run again | | | Please find below a special message from our advertising sponsor, Blackrock Gold. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

| High-Octane Silver Play Ready To Run Again | |

The Tonopah District in southwestern Nevada was one of the state’s most prolific silver districts, until low prices and fractured ownership put it in a state of suspended animation.

Now Blackrock Gold (BRC.V; BKRRF.OTC) appears ready to write a new chapter in the district’s history — and potentially make investors a fortune in the process.

| | |

As historic silver districts go, Nevada’s Tonopah district towers above the crowd.

|

Shortly after the fabled Comstock Lode district put Nevada on the map as a state, Tonopah was discovered.

It remains Nevada’s second most prolific silver district and the “Queen of the Silver Camps.”

|

Thirty years of commercial production at Tonopah resulted in 174 million ounces of silver and 1.8 million ounces of gold between 1900 and 1930 that averaged at over two kilograms per tonne silver equivalent.

|

Those grades made it not only one of the largest, but also one of the highest-grade silver districts in North America.

And then production plummeted — but it wasn’t for a lack of silver.

Low metals prices at the time resulted in the area essentially being forgotten for the next 90 years, with most of the old properties tied up in fractionalized private ownership.

The Tonopah district was essentially sitting there in the heart of the Nevada’s prolific Walker Lane Trend, hiding in plain sight!

Then a royalty company began pulling together those fractionalized pieces and, in early 2020, secured the final, and most crucial, piece of that puzzle.

The same day it consolidated the whole western half of the Tonopah district, it sold the Tonopah West land package to Blackrock Gold (BRC.V; BKRRF.OTC).

Tonopah West contains multiple, large historic mines, and Blackrock believes it can breathe fresh life into all of them.

The company wasted no time getting back to drilling Tonopah West, and in July of this year, released an eye-popping assay from the past-producing Victor Vein system.

That result sent its share price due north and convinced kingmaker Eric Sprott to cut a check for $5 million in Blackrock shares the very next day.

|

First Assays Send Blackrock’s Shares Parabolic

|

Victor’s first hole hit an incredibly rich intersection — 29 meters of 964.8 g/t silver-equivalent — and also found a new vein grading 2,198 g/t silver-equivalent over 3 meters, including 3,603 g/t over 1.5 meters.

By intersecting that ultra-wide interval of high-grade silver-equivalent, along with other intervals measuring as much as 3.6 kilograms per tonne material, Blackrock jogged the market’s memory about this district’s rich history.

The chart below shows you what happened as a result:

| |

| | With some intervals measured in kilograms per tonne silver-equivalent, the first assays from Blackrock Gold’s Tonopah West project lit a fire under its shares. |

Blackrock’s share price went parabolic, surging from a C$0.07 low hit in March to C$1.61 (multiplying 23 times!) after BRC released these initial assays from Victor.

As you can see, the share price has come back quite significantly since then, as the broader market has corrected lower and many early investors took substantial profits, which is a key factor in the timing of this opportunity. (More on that in moment….)

|

A Phenomenal High-Grade Hit Rate

|

First, it bears emphasizing that high-grade results have continued to stream in from drilling at Tonopah West.

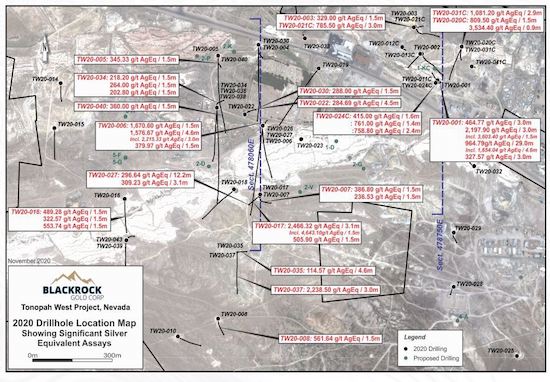

So far, the 40 drill holes released have delivered 33 intercepts with widths from 1 meter to 29 meters thick with grades ranging from 200 g/t to 4,643 g/t silver-equivalent.

That averages out to 794 g/t silver equivalent over 3.3 meters property-wide.

In fact, Blackrock’s Victor target is averaging at 1,035 g/t silver-equivalent…and BRC is still encountering new vein zones!

These are world-class numbers, but Blackrock is only halfway through its maiden drilling effort. Management believes this program has barely scratched the surface here.

|

| | Tonopah West’s drilling hit rate has been phenomenal, with 33 of 40 holes reported returning grades between 200 g/t and 4,643 g/t silver-equivalent over widths between 1 meter and 29 meters! |

Tonopah should be on any precious metals investor’s radar, and not just for silver. Drilling has generated a lot of high-grade gold too, producing at roughly 100 to 1 silver/gold ratio.

|

Blackrock encountered 26 g/t gold in the same intercept in which they also hit over 2 kg/t of pure silver. Even without the silver, that would be a great hit!

|

Company geologists see the opportunity to outline between 2.5 and 6 million tonnes grading between 1,300 g/t and 2,100 g/t silver-equivalent. If they’re right, a deposit that size would put this project in a league of its own.

If you’re looking for a comparison for a resource that’s high-grade in an uber-safe jurisdiction, SilverCrest Metals Las Chispas project in Mexico is a good candidate.

Obviously, Blackrock and West Tonopah are at a much earlier stage, and it would be an historic development if the company could approach SilverCrest’s $1 billion+ valuation.

But given the continued consistency of its high-grade drill hits (and much more in the way of drill results expected imminently), Blackrock looks like a steal at current levels.

That’s especially true given that the town of Tonopah sits halfway between Las Vegas and Reno, with a highway crossing the property and a casino within walking distance.

As infrastructure goes, it doesn’t get any better than that!

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Fast-Tracking Toward A Resource Estimate

|

Potential continues to crystallize at Tonopah West with each additional drill result.

And now, Blackrock is moving quickly to fast-track its Denver, Paymaster and Bermuda vein system, an historic producing mine on its property, to a resource estimate.

The company will likely spend 2021 feeding a resurgent gold and silver market high-grade assays.

In the process, it’s set on doing what few juniors can — go from an initial hit to a resource estimate in just 18 months.

History has shown that investing in a company building toward a significant initial resource estimate can be one of the most lucrative periods to enter a stock.

|

PLUS:

Gold Project Spinout Offers 2-for-1 Investment

|

Adding some sweetener to that possibility is the company’s Silver Cloud gold project in northern Nevada.

|

Silver Cloud lies just east of and on trend with Hollister, one of the state’s highest-grade gold mines. Just last month, Blackrock kicked off a 3,500-meter drill program to test the potential of four key targets on the project.

|

The goal is to prove up value on Silver Cloud in advance of spinning the project out into a separate company.

| |

| | Blackrock is planning to spin out its highly prospective Silver Cloud gold project into a separate company in early 2021. |

The spinout means those who invest in Blackrock Gold now will have the opportunity to own a high-grade silver-gold project on the fast track to a resource estimate and a company with a project smack in the middle of Nevada’s most productive gold region…

…And all with the same single stock purchase.

|

Market Reset Provides Tantalizing Entry Point

|

As you can see from BRC’s stock chart, a correction in the precious markets (and likely some profit taking) have brought Blackrock’s shares back from their July highs.

This fact is giving us a near-perfect entry point in BRC.

Remember, Blackrock has the wherewithal to generate a resource estimate for Tonopah West by the end of 2021 and to produce high-grade assays all along the way.

Plus, you’ll get the spin out of Silver Cloud into a separate company as a 2-for-1 bonus!

With drill results expected soon from both Tonopah West and Silver Cloud and a bullish setup emerging for precious metals, 2021 is poised to be a big year for Blackrock.

|

Take SilverCrest’s massive success story as an example of what Blackrock may be capable of from these relatively low levels.

|

With similar grades and an ideal location, West Tonopah makes Blackrock Gold a must-own as the precious metals bull market is beginning its next big run.

| | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |