| Ignore gold’s big jump today | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Gold’s leaping higher today.

Here’s why you should ignore it.

| |

Yes, gold’s surging higher today.

|

As I write, it’s up about $15 and silver is doing even better. The mining stocks are also powering ahead.

And I’m here to tell you that you should ignore it all.

| |

The fact is, gold’s gains today are merely erasing its losses of yesterday. And I expect more of this short-term volatility as we navigate the thinly traded year-end markets.

These low-volume days are the manipulators’ playground. They often take advantage of distracted traders to move the markets to their will, with gold and silver often being victimized.

So don’t concern yourself with whatever happens, good or bad, in the metals and mining stocks over the next few days.

Because all the evidence — both fundamental and technical — has confirmed that a major new rally has already begun.

|

A Fundamental Freight Train

| |

The macro story remains the same for gold and all the assets associated with it: Debt, more debt and markets addicted to ever-easier money.

As macro trends go, these are irresistible juggernauts, unlikely to change without a fundamental reset of the global financial system. (And such an event would multiply the prices of gold and silver.)

But nearer-term developments have also been supportive.

One example: the downward trend in the Dollar Index. This has been bullish for gold over the past few weeks, and the sell-offs in gold over the past couple of days were largely due to a brief rebound in the greenback.

That rebound reversed today, as the Dollar Index has resumed its nosedive.

In addition, some credit for gold’s recent decline must also be assigned to the passage of the latest Covid stimulus bill, as the “buy the rumor, sell the news” effect kicked in. The size of the bill, which at $900 billion was much lower than the original proposals ranging as high as $3 trillion, temporarily dampened enthusiasm for gold.

But those who are expecting a big dollar rally or a sudden return to fiscal prudency in Washington should be cautioned by the following chart, featured by our friend Peter Boockvar yesterday in one of his morning missives.

| |

|

As Peter noted, “Imagine being thrown a 5,600-page document and told you only have a few hours to read it and then vote on it. Welcome to Congress, but that's business as usual and we know what the meat of the pages say. There is plenty of pork in there though and while cheap credit helps to facilitate all this spending, I still believe the exploding US deficits are being reflected in the weak dollar this year. Here again is a 20-year chart of the DXY vs the budget deficit as a percent of GDP. While we’re likely due for a dollar bounce or pause in its decline, I do expect to see further weakness in 2021, along with higher long rates with a 10-year yield going above 1% to something closer to 1.5%-2% as inflation picks up.”

Peter’s chart confirms that the relative value of the greenback, as assigned by traders and investors the world over, has largely correlated with the size of the U.S. deficit as a percentage of GDP.

The exponential growth in the former while the latter has fallen or stagnated post-Covid has been the proximal factor in the dollar’s decline versus its trade currencies, and the prospects for this factor don’t look any better as the incoming Biden administration promises much more spending to come.

According to a Bloomberg report:

“Biden on Sunday said he applauds Congress’s bipartisan agreement, but he described the package as providing ‘temporary relief.’

“‘This action in the lame duck session is just the beginning. Our work is far from over,’ Biden said in a statement including other actions his administration plans to take. ‘Immediately, starting in the new year, Congress will need to get to work on support for our COVID-19 plan, for support to struggling families, and investments in jobs and economic recovery.’”

So even with Monday's passage of $900 billion in pandemic relief — which coupled with the $1.4 trillion in federal spending also passed sends a total of $2.3 trillion in new deficit spending into the economy — what we’re seeing is merely a down payment on what’s to come.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A New Bull Market, Technically Speaking

|

So, while the markets will fluctuate from day to day, it’s readily apparent that gold is in a fundamentally bullish environment for months and even years to come.

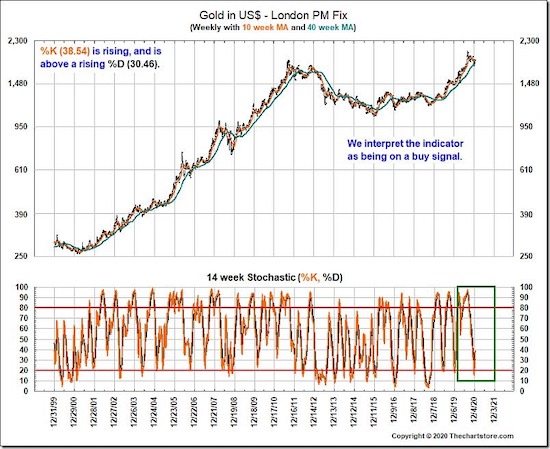

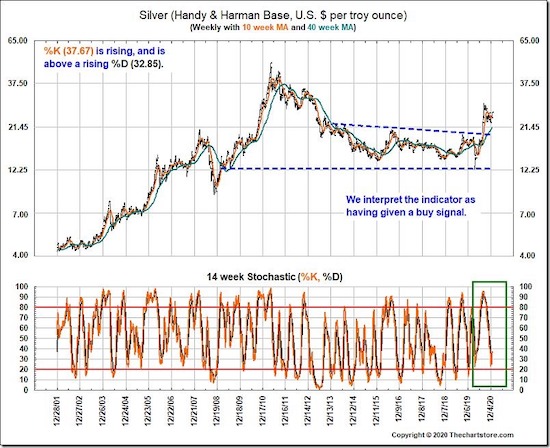

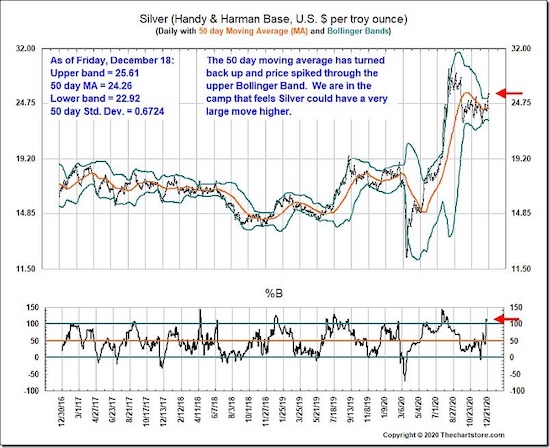

It’s also apparent from the technicals. As the following charts from our friend Ron Griess of TheChartStore.com show, both gold and silver have now officially begun new rallies.

|

|

As you can see from this chart of gold with its 14-day stochastic, the stochastic has posted a very sharp rebound from its low below the key 20 level. The rebound is so sharp, in fact, that it’s barely distinguishable from the previous downtrend.

This is precisely the kind of sharp reversal from the downside momentum that we want to see, and which characterizes a major bull-market environment.

We see a very similar pattern in silver.

|

|

Here, silver’s stochastic never quite reaches the 20 level before the downside momentum suddenly reverses. Contrast this to the patterns shown during the 2011-2015 bear market.

The metal obviously has no patience today for sustained downward momentum.

|

|

Finally, Ron’s chart of silver with its 50-day moving average and Bollinger Bands shows (to my eye, at least) a significant narrowing of the bands and the expected, subsequent breakout. Fortunately, that breakout has been to the upside.

Taken altogether, along with the fundamental evidence of a more-freely spending (If you can imagine that) administration moving into the White House, it seems the new bull run in gold and silver is in place.

In other words, our predictions of a late-year bottom have come to pass, albeit a little earlier than we’d expected. As we’ve noted in recent issues, it seems that gold bottomed on November 24th, when it hit the 50% retracement of this year’s big post-Covid rally.

And the rally since then has gone largely unnoticed by many. Consider that, with little fanfare, the yellow metal has risen more than $100 from its levels of just a few weeks ago.

And it seems that there’s more to come in the new year.

| | We’re about to turn the calendar and say goodbye to one of the craziest years in recorded history.

Good riddance.

But for investors, part of saying goodbye should mean preparing for what’s to come. And while no one can predict the future (as 2020 showed us!), we can be confident that it will feature much higher prices for gold, silver and mining stocks.

So we need to make sure we’re prepared for that.

Throughout this crazy year, we’ve tried to help you navigate the craziness and reap the rewards of a powerful bull run in metals and miners. We’re going to continue to do our best in this regard throughout 2021.

It’s going to be interesting…and profitable. Of that I’m sure.

In the meantime, I and all of our team deeply appreciate your support throughout 2020. We wish the very best for you and yours through this holiday season and into the New Year.

There are exciting days ahead, and we look forward to experiencing them with you.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

| | | |