Sometimes a company’s value proposition is pretty straightforward.

|

That’s certainly the case with Barksdale Resources (BRO.V; BRKCF.OTC), whose flagship Sunnyside project in southeast Arizona lies hard against the property boundary with the Taylor zinc-lead-silver deposit within South 32’s Hermosa project.

South32 paid C$2.1 billion for that deposit in 2018.

|

Simply put, the mineralization that Hermosa’s previous owner, Arizona Mining, drilled out runs right to the edge of Barksdale’s Sunnyside property boundary.

|

And we’re about to find out if Barksdale could be the next billion-dollar winner.

|

|

|

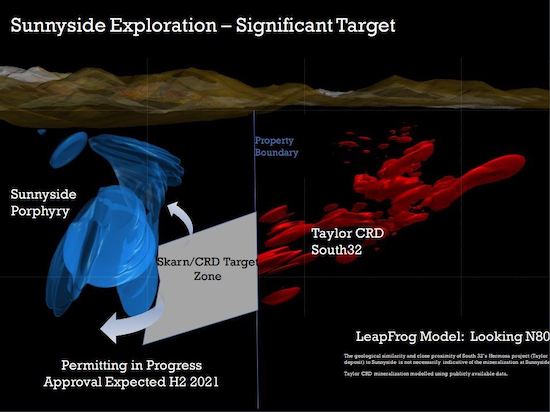

Prior work on Sunnyside indicates that the Taylor mineralization continues at depth, towards a buried porphyry that Barksdale believes provided the heat source for the entire system.

Barksdale has applied for the permits to test this concept with the drill bit and is simply awaiting government approval.

Management is targeting later this year for receipt of those permits, at which point South 32, which paid a king’s ransom to get Taylor, will have a decision to make.

|

It could either let Barksdale drill Sunnyside itself…or it could potentially buy the property or company outright and expand Taylor on its own nickel.

|

Either way, Barksdale has an opportunity here to leverage the fact that Taylor appears to trend onto its property.

|

A C$2.1 Billion Takeout Of A PEA-Level Project

|

Need proof that Taylor is a valuable deposit?

Consider this: South 32 bought Arizona Mining in 2018 for C$2.1 billion…based solely on a preliminary economic assessment done on Taylor.

Normally, takeout players wait until a project is a bit more de-risked (i.e., taken through prefeasibility or feasibility) before acquiring it.

|

That South 32 was willing to spend that amount (in an all-cash deal, no less), speaks volumes about its potential.

|

South 32’s most recent resource update on the deposit pegs Taylor’s resources at over 330 million ounces of silver, 10 billion pounds of zinc and 11 billion pounds of lead.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

The Heat Source For Taylor May Lie In Sunnyside

|

All indications from past drilling on Sunnyside indicate that this large resource extends onto the property.

You see, the discovery holes were drilled on Sunnyside back in the 1980s, but lower metals prices and the difficultly back then of securing permits for the unpatented claims slowed the process down.

|

…But not before prior owners outlined a buried porphyry that appears to be the heat pump for the mineralization at Taylor.

|

As the map below shows, the drilling Barksdale wants to do between Taylor and that buried porphyry has the potential to demonstrate it is in fact a single, world-class system.

|

|

The map underscores how the Taylor carbonate replacement deposit (CRD) shows every sign of continuing onto Sunnyside.

So why didn’t Arizona Mining try to buy Sunnyside when it saw that was the case?

It actually tried, but it couldn’t reach an agreement for it with Regal Resources, from which Barksdale is optioning up to 67.5% of the project. South 32 made an offer for Arizona and Hermosa before anything materialized.

Now, as Barksdale awaits a decision on those drill permits for Sunnyside, it is in the proverbial catbird’s seat.

A positive decision will either encourage South 32 to buy out Barksdale’s option, or Barksdale will have the opportunity to wow the market with potentially high-grade results.

The beautiful thing is, Sunnyside is only one of Barksdale’s high-potential projects, and news flow from its other ones will continue to feed the market.

|

Supporting Projects Provide Short-Term News Flow

|

In the interim, Barksdale will conduct a first-half drilling program on its highly prospective San Javier polymetallic project in Mexico.

That project was mainly assessed for lower-grade, bulk tonnage material, but Barksdale discovered that structurally-controlled high-grade mineralization was also part of its history.

|

|

|

Highlights from that historic work included 6 meters of 9.0% copper, 1.3 g/t gold and 33 g/t silver and 6 meters of 6.5% copper, 0.1 g/t gold and 5 g/t silver.

Other historic assays to chase include 9 meters of 5.2 g/t gold, 9 meters of 3.7 g/t gold and 30 meters of 1.7 g/t gold. It’s all part of the US$10 million of historical work (including 30,000 meters of drilling) that San Javier came with.

The company’s plan for project is to outline those high-grade zones, discover new zones and increase the mineralization’s overall footprint.

Pending permits, a 3,000-5,000-meter drill program will begin soon that will provide news flow to go with assays from an 8-12-hole RC program on Barksdale’s San Antonio project (located in the same Patagonia district of Arizona as Sunnyside).

|

|

The opportunity you have today is that the rest of the market has yet to catch on to the potential inflection point that Barksdale is approaching with Sunnyside.

|

Receipt of those drill permits could bring South 32 off the sidelines to potentially make a lucrative offer for Barksdale’s interest in Sunnyside.

|

And with the drills turning in the shorter-term on two of the company’s other exciting projects, Barksdale could advance considerably even before Sunnyside comes into play.

If you want to speculate on what could be the extension of a massive deposit at Taylor, you’ll want to own a piece of Barksdale Resources soon.

|