| Trillions upon trillions… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

If you were concerned about the effects of the most accommodating monetary policies in world history and the largest economic stimulus spending in U.S. history…

…Get ready, because you haven’t seen anything like what’s coming up.

| |

I’m old enough to remember when the word “trillion” was one of those fantasy words — like “gazillion” — that was used so infrequently one wondered if it was a real term at all.

|

Now it seems to be used more than “billion” when talking about government spending.

Remember way back, late last year, when Congress finally forced through a fiscal stimulus plan? It was seemingly priced at just $900 billion precisely to avoid the stigma of a trillion-dollar price tag.

Now any such restraint is long in the past. Once in office and in control, the Biden administration and Congress teamed up to pass a massive, $1.9 trillion package that had little to do with Covid and much more to do with paying off key voting demographics.

While the legislation was passed along party-line votes, don’t think that the Republicans would have done much less. Politicians of all stripes have been behind the massive surge in government spending not only since the emergence of the Covid pandemic, and not only since the 2008 Great Financial Crisis, but over the preceding decades as well.

A recent Wall Street Journal column traces the spending spree back to Lyndon Johnson’s Great Society of the 1960s, and notes how Johnson’s fiscal policies, as well as those of his successor Richard Nixon, sent the inflation rate spiraling higher.

The parallels to today’s situation are apparent, with the last two Covid stimulus bills, all $2.8 trillion worth, being merely a down payment on the upcoming spending plans.

I’ve talked before about the Biden’s administrations plans for as much as $2 trillion in infrastructure spending. That was soon upsized to $3 trillion in recent weeks.

But that same Journal column reports that the president’s advisors are now pushing for him to “go big” with $4 trillion and even $5 trillion spending programs.

|

And just today, the New York Times is reporting that the administration is talking about yet another multi-trillion-dollar stimulus plan, this one aimed at “green” initiatives.

|

It’s obvious that whatever tenuous connection to reality that may have existed as recently as late last year has now been completely severed.

|

|

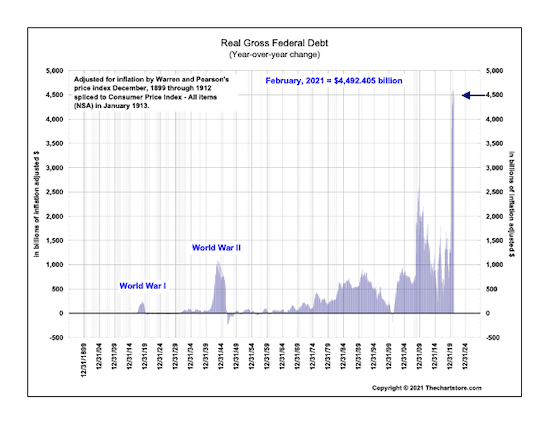

The accompanying chart from our friend Ron Griess of TheChartStore.com is taken from his weekly (and highly recommended) Chart Blog. It clearly shows that — before the latest approved and proposed spending — the year-over-year change in the Federal debt had grown exponentially.

It significantly dwarfs anything deemed necessary in either world war or since. And before you consider the difference in today’s dollars versus those of yore, note that Ron’s chart shows real, constant-dollar changes in the Federal debt.

Again, this is before the latest approved or projected spending. With those included, that exponential increase is more than doubled.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Impossible To Get Your Head Around These Numbers

|

It boggles the mind — more so if you try to imagine what a trillion of anything actually is.

A trillion is a million million, a number followed by no less than 12 zeroes. I know that doesn’t help to get your mind around it, so let’s try a few visualizations.

If a trillion one-dollar bills were stacked, the resulting pile would extend 63,100 miles high. If you laid those dollar bills side-by-side, they would cover the earth…23 times over. If you saved $50,000 a year, it would take you 20 million years to save a trillion dollars.

While we’re talking about time, consider that a million seconds equates to about 11 and a half days. A billion seconds, in comparison, is about 32 years. A trillion seconds? That’s 32,000 years.

|

Combining both time and money, if you were somehow able to spend a million dollars a day, beginning on the day of Christ’s birth…you would not yet have reached a trillion dollars.

|

I could go on and on, but you get the point. It’s impossible to get your mind around a trillion of anything, much less dollars. And perhaps that’s a big part of why, once you start tossing these numbers around, you lose all touch with what they are, in reality.

And it’s why supposedly serious advisors are now pushing for multi-trillion-dollar spending programs, even as the global economy is rebounding from the pandemic.

The chances seem miniscule that all this new currency creation will not lead to an extraordinary increase in inflation.

In fact, considering that price inflation is synonymous with the depreciation of the dollar, much higher rates of inflation are actually necessary to reduce the burden of these debts.

It’s coming. And if you want to be prepared, you need to buy gold, buy silver…and keep reading this newsletter.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |