| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

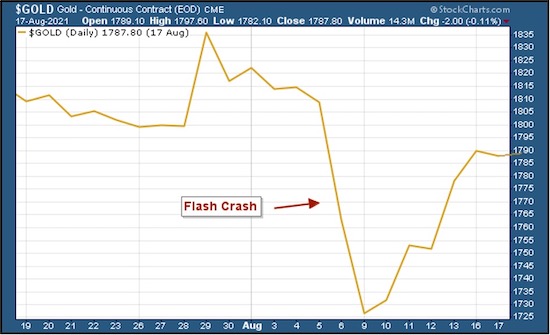

After taking a vicious beating in last week’s flash crash, gold has pulled itself off the mat and recovered everything that was lost.

I’d welcome a surprise rally, but my feeling is that it will take a bit longer still for gold to get back into fighting condition again.

| |

The most important take-away from the experience of the past dozen days is that a lot of the world wants to own gold right now, at these prices.

|

And even more so at the prices “someone” was very eager to sell it at two Sundays ago.

As I recapped last week, gold understandably sold off after the positive July jobs number was released on Friday the 6th. It wasn’t perhaps advisable, in my opinion, to sell gold, but at least the motivation of the traders was understandable.

What wasn’t explainable by any legal profit motive was the deliberate flash crash precipitated the next Sunday evening, in the thinnest of all thin-volume markets, as the early-hours Comex market opened.

|

Deliberately tripping sell-stops by flooding the market with sell orders, almost assuredly in collusion with other traders and in violation of trading limits, delivered the desired results.

|

Those high-frequency traders netted a tidy profit from their short positions, and even more if they were smart enough to go long at the bottom they created.

|  |

As you can see from the chart above, what seems like an unbroken cliff dive is actually two $40 session declines, one on Friday and the other on the following Monday. In the interim, on Sunday evening and the early hours of Monday, gold had actually traded yet another $45 lower intra-session, reaching a low of around $1,680.

The important thing to note in this chart is what’s happened since: Every bit of the losses from the manipulated flash crash have been regained, and then some.

|

That wasn’t a price level that the market was willing to accept as valid.

|

Now, we haven’t yet regained everything we lost from the original, post-jobs-number decline. But that could come in the days just ahead, with the $1,800 level being…once again…an important milestone.

| |

I could be wrong — and no one would be happier if I were — but my gut feeling is that we’ll need another few weeks to mend the technical damage from these sell-offs and to get through the Fed’s shift in messaging before gold and silver can mount a meaningful rally.

The bad news is that all the markets are having to navigate the transition in the Fed’s messaging from “we’re not even thinking about thinking about” tightening policy to “we’re probably going to announce tapering at our next meeting.”

|

The good news, as I noted last week, is that when the Fed actually does begin tightening, it usually marks a bottom in the gold price, and the metal usually begins a significant rally from there.

|

In the last such cycle, gold bottomed precisely with the Fed’s initial rate hike in December 2015. This time is a bit different, and we’ve definitely seen things happen much more quickly lately, so the question is whether Fed tapering will be enough to bring about a bottom or whether it will take actual rate hikes.

Because we’re seeing rising inflation at the same time as we’re getting so much fiscal stimulus, both of which are bullish for the metals, I think we could see prices begin to recover earlier in the process this time.

Just a setting of the tapering timeline is likely to be enough to remove the selling pressure from gold and silver.

And, frankly, I think the chances that the Fed will be able to even begin a program of rate hikes is 50/50 at best. The markets will throw a conniption fit some point, and I don’t believe Powell & Co. can afford to risk any damage to the house of cards that they’ve built.

The bottom line is that gold and silver seem to need some more time in R&R before mounting another rally. As we’ve seen before, that means the time to buy is now.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | |

P.S. I keep saying it, but the speaker line-up for this year’s New Orleans Investment Conference is one of the best in history — and it’s coming at precisely the right time.

CLICK HERE to check out our roster of top experts, and let us know if you agree.

Oh, and don’t forget to register now, as our room block is rapidly filling up…and our full, money-back guarantee means you risk nothing by locking your place in now.

| | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |