Some people just have the “Midas Touch.”

|

While the junior mining industry is chock full of companies and executives who promise life-changing gains, there are a select few who consistently deliver.

|

And with a track record of shareholder wealth creation that’s second to none, Dr. Rui Feng most certainly belongs in the “those who deliver” camp.

|

His Silvercorp Metals venture is one of the biggest winners over the past two decades.

Consider that in September 2004, Silvercorp was trading at C$0.15.

By 2011, at the peak of the last precious metals bull market, the company was trading just above C$14 — a near hundred-fold gain!

Then in the late 2010s, Feng did it again with his Bolivia-based silver company New Pacific Metals.

If you’d bought into this story in 2017 and rode it through its recent peak in January 2021, you would have seen your money multiply almost eight times over.

Now, Feng is throwing his weight behind Whitehorse Gold (WHG.V; WHGDF.OTC), a company with a high-grade, past-producing Yukon gold project with huge upside.

With drills turning as we speak, this project is primed to deliver a steady diet of high-grade results to the market just as gold hits the fall season, historically its best time of the year for price gains.

Recent gold weakness has brought Whitehorse Gold down to bargain levels and created a tantalizing entry point for those looking to profit from Rui Feng’s “Next Big Thing.”

|

Near-Term Resource Growth

|

Whitehorse’s flagship project is the Skukum Gold Project, a district-scale property in the southern Yukon with a history of past production, a sizable high-grade resource and tons of room to grow.

|

Indeed, the low-lying fruit for resource expansion at Skukum was so obvious that Feng and team were able to complete a C$15.3 million financing to fund work on the project.

|

That’s an impressive raise for a newly-minted public company — Whitehorse just listed in late 2020. It’s also a strong endorsement of Skukum’s potential.

The project’s three deposit areas include the past-producing Mt. Skukum mine, the Skukum Creek deposit and the Goddell deposit. Together, these deposits host about 336,000 indicated ounces of gold-equivalent resource (at an average grade of 7.8 g/t AuEQ) and about 246,000 inferred ounces gold equivalent (at an average grade of 6.9 g/t AuEQ).

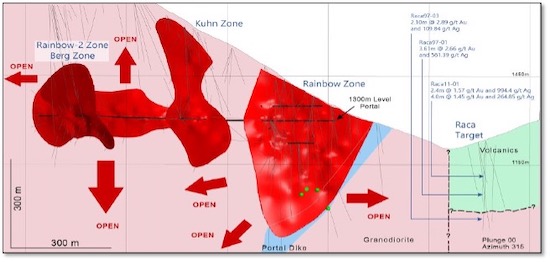

Skukum Creek hosts the bulk of that resource and, as the map below indicates, the mineralization on this target remains wide open for expansion along strike and at depth.

|

|

Drills are turning as we speak to both test Skukum Creek’s expansion potential and upgrade its existing resources. They will also test Mt. Skukum and Goddell.

Given the historic grades at Skukum Creek, odds are excellent that this program will deliver high-grade results to the market, possibly as early as next month.

|

Long-Term Discovery Potential

|

Success upgrading and expanding this resource gives Whitehorse some very real potential for a significant near-term re-rating.

And the longer-term discovery potential at the Skukum Gold Project is equally inviting.

|

The company has succeeded in consolidating this area for the first time and surface work by the Whitehorse team has identified dozens of regional targets.

|

So while the drills are turning to grow and upgrade the project’s existing resources, Whitehorse will also be evaluating this data to identify new targets to test with the drill bit in 2022.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Multi-Million-Dollar Head Start

|

Adding to the Skukum project’s allure is the presence of excellent on-site and regional infrastructure, which includes:

|

• More than six kilometers of underground development…

• A past-producing mill and on-site camp facilities…

• Over 141,000 meters of past surface and underground diamond drill core and a ton of surface data…

• All-weather road access from Whitehorse and proximity to the deepwater port at Skagway, Alaska.

|

Taken together, this supporting infrastructure gives Whitehorse a development head start worth many tens of millions of dollars all by itself.

|

| |

And in a region where many projects lie in remote parts of central and northern Yukon, Skukum’s location near the Territory’s southern border with British Columbia gives it a huge advantage in terms of access.

|

Imminent Share Price Catalysts

|

The short-term opportunity with Whitehorse Gold is clear.

Consider that the large, 18,000-20,000-meter program to grow resources at Skukum Creek and Goddell is in full swing at this moment.

|

This sets Whitehorse up to deliver a steady stream of high-grade assays to the market beginning next month and likely well through the beginning of 2022.

|

In a healthy gold market, high-grade assays generate excitement, investor interest and the potential for a share price boost.

All signs indicate that this drilling program can help Whitehorse expand the resources at Skukum in short order.

Add in the longer-term potential offered by the array of surface targets on Skukum’s district-scale land package, and all the pieces are in place for Whitehorse Gold to deliver that Rui Feng magic to those who invest at or near current levels.

|

|