Sometimes the market misses the obvious.

|

That’s certainly true in the notoriously inefficient market for gold explorers and developers.

Because these companies are looking for or growing a big gold deposit (as opposed to mining one), they don’t generate the cash flows analysts like to plug into their valuation models.

|

As a result, this sector is ripe for investors to uncover overlooked gems.

|

And with a 2.47-million-ounce inferred gold resource in a great mining jurisdiction (plus a couple of lottery tickets on the Newfoundland Gold Rush), St. James Gold (TSXV.LORD; OTCQB: LRDJF) is hiding in plain sight.

|

|

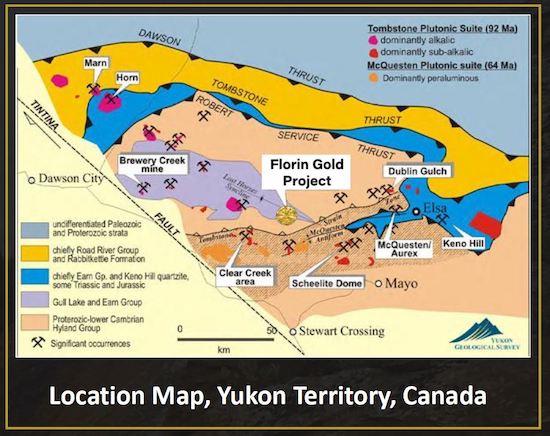

Thanks to a management team with a sharp eye for value, St. James took an option on the Florin project in the Yukon in April.

As mentioned, the project came with 2.47 million ounces of inferred gold resources.

Florin had last seen serious work in 2011, at the height of the last major gold bull market. Then the subsequent bear market left Florin underexplored over the ensuing 10 years.

|

|

| St. James Gold’s Florin project lies within one of the Yukon’s gold-rich mining districts.

|

But where the rest of the market saw a relatively low-grade, near-surface gold deposit, St. James saw the opportunity to expand the resource and evidence that it could outline some higher-grade starter zones that would allow it to boost project economics.

The company recently released the following series of videos of CEO George Drazenovic’s recent site visit to Florin.

|

| |

| |

| |

| Florin Gold Project Drill Site Overview

George Drazenovic Interview #1

George Drazenovic Interview #2

|

The clear project potential in those videos underscores why St. James was able, post-acquisition, to quickly raise the funds needed to test its theories for Florin.

Those funds came via a couple of financings that still left the company with a drum-tight share structure.

|

|

As you’ll see in a minute, that tight share structure is a key part of the investment case for St. James.

But first, take a look at this map of Florin to see why the company is so high on the project’s potential to grow from here.

|

| |

| The existing 2.47-million-ounce resources at Florin cover just 900 meters of the five kilometers of strike outlined by surface work.

|

The 2.47-million-ounce resource lies on just 900 meters of a host anomaly that has been traced for five kilometers along strike.

|

And the mineralization in this deposit is incredibly consistent: Every one of the 61 holes drilled on Florin hit mineralization.

|

This consistency suggests St. James could add significant ounces as it steps out from the resource area with its current drilling program.

Of this program, Drazenovic recently commented:

|

“We are pleased with the start-up progress on the Q3 2021 core drilling campaign at Florin, which is targeting areas adjacent to known gold mineralization with the intention of adding ounces to the existing inferred resource figure of 2.47 million ounces gold. The prospecting campaign being undertaken in tandem aims to identify new areas of mineralization which will be the target of future drill campaigns along with the West and Treadwell Zones."

|

In the short term, management sees the ability for drills to expand the resource to the southeast at Treadwell and to the northwest on the West zone, where surface work has identified the potential for those higher-grade areas of mineralization.

With assays from the current drill program at the lab as we speak, St. James and its shareholders can look forward to a fall of drill results from Florin that could well begin capturing the market’s attention, as St. James Gold looks to add ounces to their existing, 2.47-million-ounce gold resource.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Stake In The Newfoundland Gold Rush

|

Between its large size, obvious expansion potential and its location in the Yukon (a mining friendly destination if ever there was one), Florin is clearly St. James’ flagship project.

But the territory’s far north location does limit explorers’ ability to work projects year-round, which is why St. James has added a couple of highly prospective projects in Newfoundland.

|

As regular Golden Opportunities readers know, Newfoundland is in the midst of a modern-day gold rush, driven primarily by New Found Gold’s high-grade Keats discovery in the province.

|

St. James’ Grub Line property lies adjacent to the Queensway project that hosts Keats, giving it an enticing project to explore as the field season ends at Florin.

|

| |

| St. James’ recently acquired Grub property sits next to the Queensway project that hosts Keats, gold exploration’s biggest discovery in the past couple of years.

|

But the company has also optioned the Quinn Lake property in central Newfoundland, giving it ground near Marathon Gold’s Valentine Lake deposit, the province’s other big recent discovery.

Initial work is set to begin soon to test Grub Line. Combined with New Found’s ongoing drilling on Keats, this work will give St. James ample opportunity to keep making news after it reports all the drill results from Florin.

|

|

But it is those pending Florin results that add urgency to the investment case for St. James Gold.

That tight share structure (less than 23 million shares outstanding) makes St. James a rare bird in a sector where junior’s shares out often run into the hundreds of millions.

|

It also makes the company a coiled spring on the back of good news from Florin and/or a big move in gold prices.

|

With a market cap under C$100 million, St. James would appear to be getting nowhere near full credit for its 2.47 million ounces of gold, much less the resource growth potential inherent in its current drill program.

News is set to flow freely from this project in the coming weeks and will be backstopped by the year-round news-making possibilities of its Newfoundland projects.

If you’re looking for a bet on proven value turbo-charged by steady news flow from some of today’s hottest exploration districts, St. James Gold deserves your immediate attention.

|

CLICK HERE

To Learn More about St. James Gold Corp.

|