| Fed’s threats are doing the tapering for it…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| The Fed’s Threats

Are Doing The Tapering For It

| |

To taper or not to taper, that is the question. So far, the Federal Reserve’s constant talk and threats of an impending taper have performed the job better than actually doing anything.

By Adrian Day

| | | | |

Editor’s Note: My friend Adrian Day’s quarterly client reviews are true gems, in which he employs his deep experience and cutting insights to summarize the macro forces affecting all the markets.

I thought Adrian’s latest quarterly review, released just a few days ago, was particularly relevant as investors struggle to navigate the choppy waters created by the Fed’s messaging and, apparently, shift towards tightening.

I asked Adrian for permission to reprint his review for our Golden Opportunities readers, and he kindly agreed. I hope you enjoy his views below, and urge you to contact his firm here to learn more about his valuable services.

— Brien

| | |

It was a weak quarter everywhere

|

Global stocks were mostly down. The S&P was barely up, by 0.6%, while the Dow fell over 2%. But outside the U.S., markets were down, by 1.6%, and only Japan’s Nikkei among the world’s 20 largest exchanges was up at all, while several fell sharply, Germany down 4.5%, Hong Kong down 15%, and Brazil down almost 20%.

|

Gold stocks were very weak

|

Resources, as always, were mixed, with energy and many agricultural commodities up — natural gas by 64% (basis Henry Hub), which has consequences for the economy — while most metals, and other resources, fell. Base metals, on average, fell almost 5%. Gold was down just a tad, essentially flat, while the gold stocks fell sharply (the XAU index of major gold and silver stocks by over 15% in the quarter; while the GDXJ — of more junior stocks — fell over 18%).

|

Key question: When will the Fed taper?

|

There are many negative influences weighing on the markets, from stubborn covid virus to China’s credit problems. But the most important fact, we believe, is the constant threat of Federal Reserve to taper (reduce asset purchases). This is, per se, negative for bonds; while the stock market has thrown a tantrum at previous tapers, and the mere thought of tightening is deemed negative for gold. But it is not quite as simple as that, as we explain below.

The Fed has been talking about tapering for months now, but has been constantly pushing back on actually doing anything.

The story changes day by day, but two things are clear. First, they will have to cut back new purchases at some point; and second, they are extremely hesitant to actually do anything meaningful. Even after FedHead Jerome Powell said a couple of weeks ago, after the Fed’s last meeting, that they would commence tapering in December — itself not fulfilling expectations that they would begin in September — he has started walking it back, talking of “supply-side constraints holding back the economy…not getting better…the outlook is highly uncertain.”

That does not sound like a Fed chairman determined to start the tapering process soon. The Fed also fired (allowed to retire) two regional Fed chairman caught conducting personal trades. By coincidence (?), these were the two most hawkish — or rather “least dovish” — of Fed officials and can now be replaced by accommodative Biden appointees.

| | Golden Opportunities continues below... | | | SPONSOR:

Fathom Nickel (FNI:CSE)

| | The Mining Stock

With Tech-Stock Potential

| | It’s a rare opportunity to be able to invest on the basis of an unstoppable megatrend and one of the highest-grade metal deposits ever mined.

| | Like the most explosive emerging stocks of the last century, this could be one of the richest opportunities of this century.

Right up there with the explosion of online shopping stocks like Amazon...

...Tech stocks like Apple and Facebook...and even the rise of cryptocurrencies like Bitcoin.

| | | | It's so promising, nations across the globe — from China to Norway to the USA — are banding together in a rare show of unity to promote it.

| | We're talking about the electrification of the world’s automotive fleet — and how a common, everyday metal could generate big wins for keenly positioned companies.

| | And a few fortunate shareholders....

That’s because one little-known company — Fathom Nickel (FNI.CSE) — is sitting on what some believe to be one of the top prospects in the world — a former producing mine recognized as one of the highest-grade deposits ever mined.

Click below to discover why Fathom Nickel is the mining play with the potential of a break-through tech stock...

| | CLICK HERE

To Learn More About

Fathom Nickel

| | |

Let’s be clear about a couple of things. First, tapering is only reducing the pace of new purchases; it is not selling anything.

So the Fed’s balance sheet, which has continued to grow at an accelerating pace the last couple of months (24% in the last three months compared with 19% in the last 12 months) even as they discuss tapering, will still be larger a year from now than it is today. Second, as Powell himself made very clear in his Jackson Hole speech at the end of August, the Fed is separating tapering from raising interest rates. The Fed won’t be raising any time soon.

Of course, since there was no net Treasury issuance in June, July and August — the Fed bought it all — a reduction in buying from that source will of itself see market rates rise. Private investors demand more than the tiny yields on offer; the latest Treasury auctions in September all went fairly poorly. The 30-year now yields 1.91%, up over the past month, but still meaningfully below current inflation. So it carries a negative real yield. Even the most speculative-grade bonds, five out of every six, carry a negative real yield, with the average yield under 4%.

Any cut back in buying of Treasuries from the Fed, however, will have an impact. If there is a $2 trillion to $3 trillion fiscal deal, then, according to Larry Lindsay, bonds equivalent to 9% of the U.S. GDP will have to be issued next year. Who is going to buy them at today’s yields? Foreign flows turned negative last year, after years of foreign buyers cutting back new buying. Meanwhile, other traditional safe havens, like Germany and Japan, saw net foreign inflows.

|

Fed’s bark is worse than its bite

|

It is going be a while — I think at least 2023 — before the Fed increases rates, and even then, it will lag inflation.

This is why Fed jawboning has more effect than action. The Fed threatening tightening makes investors nervous. Any cut back is, per se, a negative for the bond market, but not so for gold. Once they actually start tightening, the market sees that what the Fed is doing is never sufficient, and so gold rises. (See below.)

Powell talks about supply-side constraints, but if he is looking for a reason (or excuse) to postpone tapering again, there is no shortage of those: the looming “ESG recession” in Europe; the pending Evergrande default in China; another (unexpected?) jump in new unemployment claims, as well as an economy losing some steam rapidly.

|

Economic recovery rapidly slowing

|

The strong economic rebound is tapering off, because of the new covid variant and supply chain issues, as well as a natural decline from earlier quarters’ “base” effect.

The massive government stimulus programs are also having a negative effect. The private sector in aggregate lost just 7% of income last year, yet government handouts amounted to 15%. This may help some individuals (and it has enabled many less-than-well-travelled people to take trips to Mexico, Miami Beach and Puerto Rico), but it does not generate a sustained economic recovery.

This may be one of the shortest economic recoveries ever. Economic indicators are pointing down even as inflation is moving up, not only in the U.S. but around the world. Job growth, for example, has sputtered, with new unemployment claims rising for three weeks in a row. There are currently more than 10 million job openings posted, now higher than number of people unemployed. Over half of restaurants in the U.S. were unable to pay their rent in September as higher costs offset the impact of more patrons. This spells stagflation.

|

Prices continue to move up

|

The other part of stagflation may take a while to build, given the significant deflationary trends extant at the same time. But inflation (as measured by PPI and CPI) has been steadily moving up since last August. The market — not only gold, but stocks and bonds as well — still seems to believe the Fed’s “transitory” narrative. But the Fed has a poor record of predicting the economy, and more and more people can see for themselves that prices are going up. The Fed will lose much credibility over this.

Costco's comments in a conference call last week are worth quoting. “Inflationary factors abound: higher labor costs, higher freight costs, higher transportation demand, along with container shortages and port delays, increased demand in certain product categories, various shortages of everything from computer chips to oils and chemicals, higher commodities prices. It's a lot of fun right now.”

Apartment rents are shooting up. Notwithstanding new supply from now-allowed evictions on non-paying tenants (allowed in some states, anyway), landlords have to make up for lost income and repairs, as well as making up for the inflation over the past 18 months.

Even the Fed’s favorite gauge — which underestimates inflation — is up 3.6% ex food and energy, its highest in 30 years. The Fed under Powell emphasizes data, so by its nature is backward looking. They will inevitably be behind inflation.

|

It’s the same the whole world over

|

Globally, we see much the same picture, with slowing economic recoveries, rising inflation, and for the most part central banks — and governments — without dry powder to fight any slowing.

Interest rates are low and negative in much of the world, while fiscal policies have little room to expand after widespread spending abandon during covid lockdowns. As discussed previously, many smaller banks, particularly in Eastern Europe and Latin America, are already raising rates, but the world’s major banks are hesitant to follow.

|

Europe’s Growth Slowing Due to High Energy Prices

|

Europe had a strong economic recovery from very sluggish levels, with large government deficits. But now the recovery is dramatically slowing.

Europe is heading into what analyst Larry McDonald calls an “ESG recession”, sparked by widespread “clean energy” policies (the ban on fracking in the U.K., for example, despite the discovery of large natural gas reservoirs). These policies have consequences, even if most politicians don’t look beyond the latest opinion polls while the intellectual class applauds.

If energy prices are going up dramatically, with shortages throughout Europe (most notably in the U.K. and Germany, where gas prices have soared 170% this year), it’s obviously something to do with those nasty Ruskies — and Boris is clearly to blame as well because of Brexit. No-one thinks of the ESG restrictions on traditional energy sources, nor the massive money printing that leads to all prices going up.

Inflation is also picking up across Europe; for the Eurozone, September CPI was up 0.5% month-on-month, and it was not an anomalous month.

|

China slowing while emerging markets stronger

| |

China is also slowing, though from a higher sustained rate of growth, as the real estate market is cooling, and exports are beginning to slow. The largest real estate developer, Evergrande, has now missed two scheduled debt payments and may fail; it has only kept going for a year or so by infusions of new money. An Evergrande failure will hurt Chinese real estate and may spread to the whole economy by causing cautious banks to reduce lending.

Chinese banks — generally — are undercapitalized after years of expansion, and frequent forgiveness of interest on loans, adding amounts to principal and thus exaggerating the loan to capital ratio. In response, the People’s Bank may actually cut rates again, even though growth is still the highest of any major economy in the world. Though Evergrande’s failure would be a major event, so far it appears that banks in Europe and North America have little exposure to Evergrande and other at-risk Chinese developers, though some in Asia do.

Emerging markets on the other hand have already been raising rates. For the most part, emerging markets did their fiscal adjusting a decade ago and are now rebounding. Commodity exporters have strong current account surpluses and balance sheets, and virtually no dollar debt, having learned a hard lesson in the Asia crisis of the late 1990s.

Some however are still struggling with covid, while commodity prices have different effects, depending on whether the country is an exporter or importer. In Brazil, to take an example, the economy is rebounding but inflation is also increasing. The central bank has increased rates from 2% to 5.5% over the past six months to get in front of inflation, and more increases are expected.

Overall, however, in most countries, growth is slowing at the same time that price inflation is picking up. The combination — stagflation — is the worst of both worlds for the economy, positive for gold (vide 1970s), and possibly positive for stocks depending on whether the central banks fight the “stag” with easy money or the “flation” with higher interest rates.

|

Overvalued U.S. equities heading for fall?

|

U.S. stocks are losing their momentum, both relatively and in absolute terms, with the market down in September on a mini-taper tantrum.

Valuations are at extreme levels, higher than at the height of the dotcom mania in 2000 by some metrics. Then, a few stocks were far more expensive, but today the median valuations are higher. The median p/e on the S&P now stands at 34 times, while in 2000 it was “only” 22 times. Only by comparison with bonds do equities look cheap, but bonds are in a bubble because of central bank buying.

But the market remains complacent and indications of speculative excess abound. Short interest, for example, stands at 1.5%, the lowest in 30 years (the same as in 2000 on the eve of the dotcom bust) and down from over 3.5% a decade ago. Margin levels remain elevated.

There are signs of a looming tumble, however. The market is seeing lower volume on up days (whereas strong bull markets have had high volume on up days). Market breadth is deteriorating, as the number of stocks above their 200-day moving averages is dropping even as indices were moving up; half of the S&P 500 are already down 10% or more, and just four stocks — Microsoft, Apple, Google, and Tesla — accounted for about half the performance of the S&P over the past three months.

U.S. assets have been a very crowded investment for many years, and they are overvalued relative to other markets. Smart money has been shifting to both value and cyclicals, and especially in foreign markets. Unfortunately, with the slowdown in Europe, stocks there now appear expensive as well.

|

Chinese stocks fall on regulatory crackdowns

|

In China, the continuing regulatory net has been cast broadly (tech, ride sharing, private education), and certainly broader than national security concerns (the original rational). The market is down 16% in the last seven months, and they are threatened from both sides in an increasing war of words with the U.S.

In addition to the Chinese crackdown, there are fears of U.S. restrictions on listings, with the SEC insisting Chinese companies open their books to U.S. auditors. Many ADRs do not represent actual ownership in the companies but are more like tracking stocks, and these so-called Variable Interest Equities (VIE) are particularly in the crosshairs. However, most of the bad news is already reflected in stock prices, though extreme care and selectivity is required.

In sum, major markets around the world are expensive and the risk of a near-term pullback has increased. At the same time, there is a shift from the U.S. and from high-growth to value and global markets, particularly in emerging markets; value has outperformed growth in these markets nearly 80% of the time. We are cautious but always looking for good companies at reasonable valuations.

|

Resources: Corrections from previous moves continue

|

There have been significant corrections in many resources after recent market moves. Lumber is down 72% from its May peak; iron ore is down almost 50% in the past two months. Other than aluminum, up 14%, most metals were down this past quarter, on average nearly 5%. China buys about 50% of most commodities, so a slowing Chinese economy, particularly the property market, will hurt resources.

Energy prices have been the leaders in the past quarter, and year, with U.K. natural gas up 324% year to date, while oil is up over 50% YTD, and coal anywhere from 34% to 238%, depending on the type and location. Restrictions on production of traditional energy sources was always going to have a result; someone (I forget who) commented a few years ago that “we will run out of supply before we run out of demand” and that is happening sooner than expected.

Tight supplies mean continued high prices, though as we have discussed before, there is no shortage of spare capacity in oil from places that are not trying to eliminate carbon fuels (Russia and Saudi Arabia, for example), so oil prices in particular may retreat, particularly if the Chinese and global economies slow. And there are plentiful gas shales in many countries available if fracking is permitted.

|

Cautious on uranium for now

|

Nuclear power is clearly essential if economies are to produce sufficient power without emissions, and more people are realizing this after the frenzy to ban nuclear power a decade ago. As with oil, there is no shortage of potential supply, at least in the near term; both Kazakhstan, the largest producing country, and Cameco, the largest private producer, have deliberately withheld supplies to boost the price. This is what has made me cautious on uranium.

The demand has also been artificial: some uranium developers have been raising equity and using the proceeds to buy uranium in the market, while the largest impact on demand in recent months has been the new Sprott Physical Uranium Trust with its “At The Market” equity raise feature. This means that whenever the trust is trading at a premium, Sprott can sell new units in the market and use the proceeds to buy physical uranium.

This they have been doing aggressively, raising the size of the program two weeks ago by $1 billion to $1.3 billion. (For context, the market cap of the Trust ahead of the announcement was less than $1 billion.) Uranium prices jumped 40% in the past month, the result of this buying. In the last week, however, the Trust has been less active in issuing stock and buying uranium, and the uranium price has plunged, by the largest weekly decline since January 2008. been slipping.

This demonstrates clearly how much the near-term price of the mineral is dependent on the Trust’s buying. Like all similar attempts to boost prices, whether short squeezes or attempts to corner markets, this makes me nervous. The optimistic view is that the recent price surge will push utilities towards making long-term contracts.

Longer term, the outlook for uranium is very bullish as China continues its nuclear power build, and countries from Japan to Germany realize, a decade after Fukushima, that they need nuclear power as a solution to this summer’s power problems. For now, however, we are standing aside.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Why has not gold responded more?

|

The big question on gold investors’ minds, for good reason, is why gold is not higher given the unprecedented money printing and rising inflation. The second question is when will it change?

To some extent, gold has simply been in a long consolidation after the extraordinary move early last year, when gold jumped over 30% from its end-March low to early-August high. That kind of move — in four months — is extraordinary for an asset that is intended as a hedge and as insurance. Gold is not supposed to do that. Bitcoin…Tesla…perhaps, but not gold! It has been a long consolidation, as month-by-month more and more people give up, while natural gold buyers feel there is no rush to invest.

Gold is down nearly 8% year to date, and down again in September, which is disheartening. But we should put that in context: gold was up 25% last year, so the pullback is less than one-third of the previous year’s move up. The current gold bull market started at the end of 2015, when gold hit $1,051. Gold cycles, both up and down, tend to be long; indeed the shortest have been the last two, in the 1970s and from 2001 to 2011. And it is not unusual for gold to have mid-cycle corrections, often caused by an extraneous shock. In the 1970s, gold dropped over 40% in a correction lasting 20 months. In 2008’s credit crisis, it fell nearly 30% in eight months.

So far, this pullback has taken 15% off gold’s peak price — a piker by historical standards — and has lasted just 13 months, well within norms for mid-cycle corrections. I would suggest that gold bottomed in March at $1,685, meaning the correction lasted less than seven months.

|

What is holding back gold?

|

There have been fundamental factors holding back gold, and three are most important. One is the dollar, which has moved up over the past several months as the “cleanest shirt in the laundry basket.” However low U.S. interest rates might be, they remain meaningfully higher than those offered by other major world currencies.

The second factor is that the stock market and other assets — including until recently cryptocurrencies — have been doing well. So long as the stock market moves up, investors believe that gold investments can wait.

The third major factor holding back gold is the Federal Reserve’s constant threat to start tapering. The Fed has a history of talking more than doing, and, for reasons beyond me, the institution still has credibility. It is not only gold that has not responded to money printing and inflation, but other assets such as TIPs, bonds, commodities; none is acting the way one might expect, all seem to buy the Fed’s narrative.

|

Fed talk hurts more than the walk

|

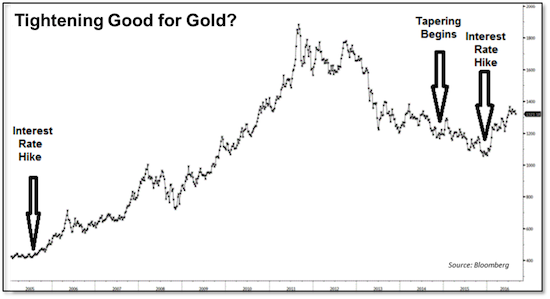

The fact is that many times in the past gold moved down in advance of Federal Reserve tightening, responding to growing talk, but turned when it actually started to tighten. This is “buy the rumor, sell the news,” only in reverse. Gold acts this way because all-too-often when the Fed does actually start to act, it is too little too late.

The Fed starting raising rates in August 2005, and again in December 2015, after months of discussion. In both cases, gold bottomed the same month rates started being hiked. Similarly in May 2013, when the Fed started talking about tapering, gold slid for the next several months. It was just before Christmas that we saw the first rate hike, and gold bottomed almost to the day.

|  |

The recent action has been frustratingly modest and volatile. However, the longer gold meanders in its current trading range, the faster and stronger the eventual move will be. In the meantime, gold investors can accumulate at prices that will appear very good in a few years’ time. They should not wait too long.

|

Gold stocks at historical lows

|

The major miners (per the XAU) jumped 65% in the end-March to early-August period last year, so they too have experienced a long consolidation. The stocks are now extraordinarily inexpensive, with the senior and intermediate gold companies trading in the lowest 25 percentile of their historical valuations, and more-or-less the lowest price-to-free cash flow ever.

Given the price of gold…given the strong cash flows…given the improved balance sheets (the XAU is net cash positive today)…given the improved discipline among top mining companies, today’s low valuations are a gift.

We all know that gold stocks are volatile. It can be discouraging when a new stock you buy falls 10% in the first week you own it. But that volatility works both ways, and once gold starts to move up convincingly, then the gold stocks will respond very strongly. It is worth noting that flows into gold ETFs and other investment vehicles are very procyclical, so we can expect flows to increase as the gold price moves up.

|

Seniors and juniors inexpensive

|

Although the major miners will be the first to move when gold turns, as well as the more certain to move, the exploration stocks are now at very low levels; we may yet see lower levels if tax-loss selling continues into year end. This period will prove, I believe, to be an extraordinary buying opportunity for the juniors and explorers as well.

Silver has been far weaker than gold over the past couple of months. Part of this is due to seasonal weakness as electronic and jewelry manufacturers — which combined account for about half of 2021 demand — take a summer break. The resurgence we frequently see in September, as jewelers buy gold and silver for the upcoming holidays, has not happened. In addition, we have seen investors who bought into the “silver squeeze” story get exhausted and sell as the price has continued to decline.

We believe gold and silver both represent very strong buying opportunities and gold in particular has the best risk-reward profile. We also are buying selective resources, notably copper and agriculture, where the supply side of the equation is as compelling as the demand, but are near-term cautious as China’s economy slows, particularly of specific resources where the near-term supply situation is not as strong.

| | Overall, we are increasingly concerned about the possibility of a near-term pullback in global equities markets, particularly given the overvaluation, as the Federal Reserve and other major central banks move, hesitatingly, towards some form of tightening. The global economy and debt situation are not secure enough to withstand too much tightening. This is temporary, and we are confident that they, and particularly the Fed, will start easing again within a year or so, favoring combatting economic weakness over fighting inflation. This will be very positive for gold and silver, which we believe are close to strong moves up.

|

To learn more about Adrian Day Asset Management

and to sign up for Adrian’s Market Insights

CLICK HERE

| | | | |

© Golden Opportunities, 2009 - 2021

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |