|

With oil prices surging to multi-year highs — and apparently heading considerably higher — many investors feel they’re too late to leverage this trend.

|

What most don’t realize is that there is a company that’s producing oil and capitalizing on the high prices right now...but also has a transformational event coming up that could turbocharge that leverage.

And that story is about to get out.

|

It’s a confluence of events that could richly reward shareholders of Hemisphere Energy (HME.V; HMENF.OTC).

|

As you’re about to see, Hemisphere’s Atlee Buffalo project in southeast Alberta is a cash-flowing asset with a growing production profile.

And yet this company also offers one of the most compelling valuation mismatches in the sector...and an under-appreciated factor that’s about to kick in and potentially boost yields considerably.

Consider this remarkable story....

|

The Cash Is Flowing & Growing

|

One of the benefits of the “survival of the fittest” dynamic in the explorer-developer end of the oil and gas space is that the surviving companies tend to be cash-flow positive.

That’s certainly the case with Hemisphere Energy.

The heavy oil pools it is tapping at Atlee Buffalo are set to produce C$19 million in adjusted funds flow from operations in 2021 — and C$30 million in 2022.

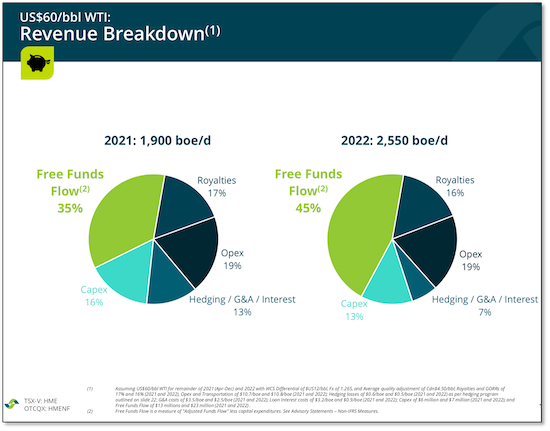

As the chart below shows, an increase in free funds flow will coincide with an increase in average annual production from 1,900 boe/day to 2,550 boe/day.

|

|

| (click image to enlarge)

Hemisphere’s already robust free funds flow percentage is set to grow.

|

In 2022, free funds flow as a percentage of overall revenues will improve to 45%, from 35% this year.

At that cash flow growth rate, management expects to exit 2021 with its net debt cut in half, and they expect to exit 2022 with a C$9 million net cash position.

|

About To Kick In:

A Flood To Turbocharge Yields

|

Hemisphere has built its production and cash flow growth forecasts on the ability of “polymer flooding” to increase the yield of Atlee Buffalo’s oil pools.

This process involves injecting a polymer roughly the viscosity of olive oil into horizontal wells within the reservoir. The pressure from the resulting polymer wall helps push more oil to the surface.

|

| |

| (click image to enlarge)

Polymer flooding project promises to significantly increase Hemisphere’s oil pool yields in the days just ahead.

|

This is a proven technology used by heavy oil producers globally, and with only 5% recovery made of the project’s reserves to date, a soon-to-complete polymer flood conversion on its G pool reservoir should accelerate both recoveries and production.

|

It’s a low-risk, high-reward enhanced oil recovery method that promises to improve production on the G pool in the short term and with an option to implement the same techniques on another pool (F pool) in the future.

|

It also has the virtue of keeping Atlee Buffalo’s environmental footprint small, an important selling point for local stakeholders.

Now, here’s the kicker....

Hemisphere began its polymer flood program in mid-summer, and all 10 injection wells in the pool have now been converted over to polymer flooding. So most investors are aware of this program, but few have noticed this key statement in the company’s last news release:

|

“Response from the flood is expected by early 2022.”

|

In short, the expected increase to yields is coming up very soon, potentially providing a dramatic and widely unappreciated increase to production.

Moreover, the company just announced three new wells into the Atlee Buffalo G pool that are now coming online.

This means not only profitable production and leverage to rising oil prices...but also a potentially very significant increase in production that the market is completely ignoring.

That dynamic is made clear by this next surprising fact:

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Severely Undervalued Relative To Peers

|

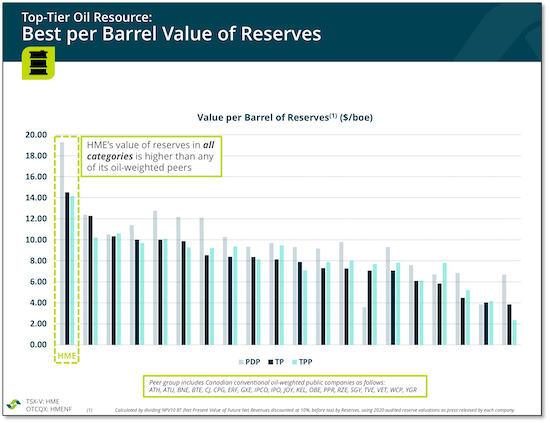

Just as important from our perspective as investors is the valuation disconnect currently occurring with Hemisphere Energy’s market cap.

This is a company currently trading at around C$80 million.

This is true despite the fact that, as the chart below shows, HME stands head and shoulders above its oil-weighted peers in terms of the value of Atlee Buffalo’s reserves.

|

|

| (click image to enlarge)

HME’s reserve value stands head-and-shoulders above its peers…

|

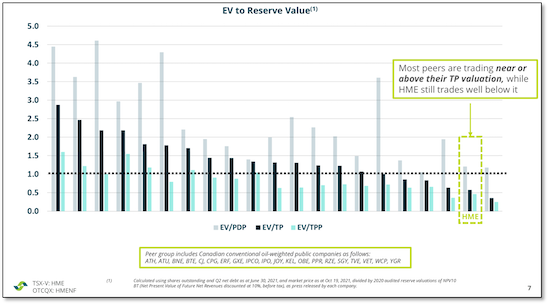

Yet, amazingly, per this next chart comparing its enterprise value to reserve value ratio, Hemisphere boasts a valuation mismatch that’s practically begging to be corrected.

|

|

| (click image to enlarge)

…and yet HME remains severely undervalued on an EV-to-RV basis.

|

Even a modest move to the middle of the pack on this valuation metric would give those who build a position HME at current levels an easy double on their investment.

|

A Nearly Uncapped Upside…

But Your Window Of Opportunity Is Closing

|

And that’s just the table stakes.

|

Consider that the third-party auditor that generated the 2020 estimates of Atlee Buffalo’s reserves values its proved reserves at C$170 million and its proved and probable reserves at C$211 million.

|

You read that right.

In the hot oil market that seems likely around the corner, Hemisphere Energy could easily see its value shift towards these more optimistic estimates.

It’s a possibility that could see the company’s market cap increase much, much more from current levels — and that’s without considering a boost in production yields from polymer flooding.

And that potential big boost in yields lies just ahead.

|

This degree of leverage simply isn’t possible when you invest in oil and gas multinationals…and it’s what makes Hemisphere Energy such an intriguing, smart-money consideration right now.

|

With an upside that’s nearly uncapped and broader market trends moving very much in its direction, Hemisphere Energy is a name you’ll want to look at now to maximize your gains as oil prices continue to rise.

|