|

Here’s a shocking stat: Clinical depression afflicts 264 million people every year.

|

One result of this situation is a health segment that has made a mint for Big Pharma — even though the current classes of anti-depressant medications have an uneven track record treating depression and come with a host of side effects.

|

Now, psilocybin, a Schedule 1 drug that’s the active ingredient in magic mushrooms, is showing promise in clinical studies as a long-lasting treatment for depression and other mental health disorders.

|

And as psilocybin and other psychedelics are having their moment as a potential disruptor to Big Pharma’s mental health med oligopoly, tiny Cybin (NYSE: CYBN) already has a drug in clinical trials that’s part of its three-pronged strategy to generate big gains for shareholders.

This is a story that has the attention of major retail and institutional investors, and as you’re about to see, it has the potential to help turn traditional treatments for depression on their heads.

|

Playing In Big Pharma’s Backyard

|

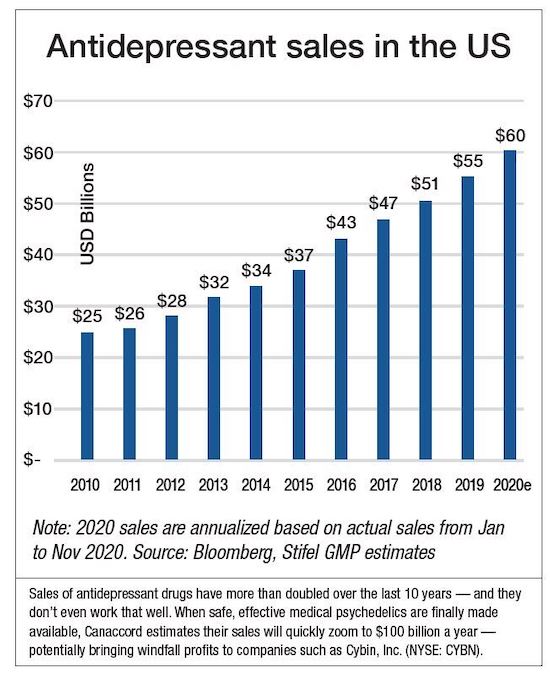

As the chart below makes clear, antidepressants are a cash cow for Big Pharma.

|

|

Sales have more than doubled in the past 10 years to more than $60 billion.

And yet this has occurred as the current class of antidepressants come with a host of unwanted side effects and, worse still, have shown only uneven effectiveness in treating depression.

That’s what makes the potential of psychedelic treatments like psilocybin so promising.

|

Administered in controlled, clinician-monitored doses, these drugs have been shown to have a sometimes dramatic impact on depression and with little to no side-effects.

|

Simply put, if Cybin can get one of its current drug formulations approved, it could end up taking a big and lucrative chunk out of Big Pharma’s monopoly on depression meds.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Medicine’s Heavy Hitters Are Spearheading

Psychedelic Research

|

The push to assess the effectiveness of controlled dosing of psychedelics to treat depression, anxiety, PTSD, addiction and other mental health disorders isn’t some fly-by-night research effort.

Some of the world’s most prestigious institutions are studying their effectiveness in treating mental health disorders. They include:

|

• Johns Hopkins University

• The Yale School of Medicine

• New York’s Mt. Sinai School of Medicine

• NYU Langone Medical Center

• London’s Imperial College of Science Technology and Medicine

|

A recent study by Langone Medical Center had patients who got fast and long-lasting relief from depressive episodes with controlled, monitored doses of psychedelics.

Another study by Dr. Robin Carhart-Harris at London’s Imperial College showed 67% of patients with treatment resistant depression experienced significant relief within a week of psilocybin treatment.

|

Psilocybin Has Shark Tank’s

Kevin O’Leary On Board

|

It’s studies like these that have successful investor and Shark Tank co-star Kevin O’Leary on board the psilocybin train, a fact which may seem curious to those familiar with his views on marijuana companies.

O’Leary has shied away from marijuana investments because pot is still a Schedule 1 drug at the federal level, which means its still a federal crime to sell and possess it. That status makes institutional investors reluctant to invest in the space.

|

|

Even though psilocybin is also a Schedule 1 drug, there’s no corresponding push to legalize its recreational use. Instead, psychedelics companies are focused on developing a product that can be administered in a controlled way by a clinician, with FDA approval to boot.

To O’Leary, that distinction will make all the difference in terms of attracting institutional money to the space and it explains why he’s a “big investor in psychedelic stocks."

|

DEA Approval For A Schedule 1

Manufacturing License

|

In a move in seeming perfect sympathy with O’Leary’s thoughts on psilocybin, Cybin just announced it has received U.S. Drug Enforcement Agency (“DEA”) approval for a Schedule 1 manufacturing license.

This is a big deal for Cybin, as it will allow it to bring all the research it currently has farmed out to third parties in house. The market has yet to recognize what a long-term advantage this license will bring to the company, but it’s a great example of how the Cybin management team is staying at the forefront of the psychedelics industry.

|

|

And with a promising, psilocybin-based treatment for clinical depression already approaching phase 2 trials, Cybin’s development approach has three pillars.

|

Pillar #1: Developing a novel drug discovery platform. This pillar is focused on increasing the effect of psychedelics without decreasing their therapeutic value.

Pillar #2: Creating proprietary drug delivery formulation approaches like inhalation, sublingual, ODT and extended-release formulations.

Pillar #3: Developing a novel treatment regimen to help clinicians improve outcomes. This includes a software-based platform to assist therapy integration and state-of-the-art neuroimaging technology.

|

Cybin currently has 13 patent filings and a discovery pipeline of nearly 50 molecules.

|

|

With clinical trials already underway for one of Cybin’s drugs, the company is in great position to deliver a big win in this space.

|

That potential is why Roth Capital Partners recently put a $10 buy target on Cybin, a target that would represent almost a five-fold gain from current trading levels.

|

The report cited psilocybin’s effectiveness in treating depression in the Imperial College study as a key reason for its buy recommendation.

Though just one study, the sterling results for psilocybin suggest a game-changing drug to treat depression could be just around the corner.

In a post-Covid world fairly crying out for remedies for mental health afflictions, Cybin looks well positioned to leverage biotech’s next big thing into big gains for early shareholders.

|