| The double-barreled uranium story with a lit fuse

| | | Please find below a special message from our advertising sponsor, ValOre Metals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| |

| Double The Potential

In One Mining Stock

| |

With world-class projects in both uranium and platinum-group metals, ValOre Metals (VO.V; KVLQF.OTC) presents investors with high-powered potential in not one, but two areas.

That’s been a great situation...but now it’s even better — because two recent developments have just lit a fuse under ValOre’s huge uranium resource.

| | | |

Uranium has been dominating the headlines in the junior resource market lately.

|

Now that trend is about to go into over-drive — for the entire uranium sector...and ValOre Metals (VO.V; KVLQF.OTC) in particular.

You see, ValOre already boasts a million-ounce platinum-palladium-gold resource.

|

But until very recently, relatively few investors knew that ValOre also has a big uranium story to tell as well.

|

As you’re about to see, this “hidden asset” is so valuable that it alone offers the potential to multiply the company’s share price...

...And that was before two remarkable developments that promise to significantly boost the value of ValOre’s uranium project.

|

A “Hidden” Uranium Company

|

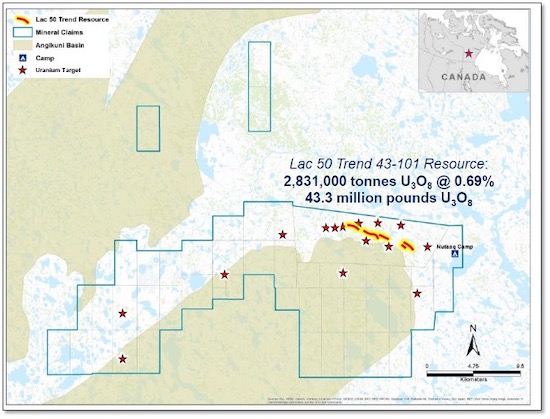

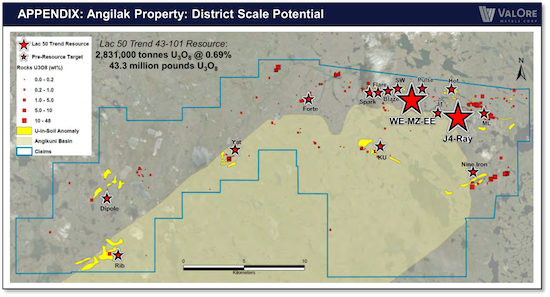

The Angilak project, located within Canada’s Nunavut territory, is the uranium kicker that holds such near-term promise for ValOre.

Angilak came to ValOre in the mid-2000s, when the company was operating as Kivalliq Energy.

During that decade’s uranium boom, companies in the sector were regularly trading at $4 to $5 per in situ pound.

|  |

It’s true: prior to even releasing its maiden resource in 2011, ValOre was valued at more than CAD$90 million – more than the company’s current market cap even with $12M in cash and 43 million pounds U3O8 on the books.

|

Then came the long bear market that followed Japan’s Fukushima disaster, and a sector teeming with hundreds of uranium plays dwindled down to just a handful.

|

And that’s part of what makes Angilak’s resource so potentially valuable.

With just a few uranium exploration and development names left and the uranium market taking off right now, Angilak’s established uranium resource should add tremendous value to ValOre as the uranium bull market continues to heat up.

How much value?

|

Consider this: A return to the more bullish valuations of the 2000s would see uranium resources valued at $4-$5/lb.

|

Do the math…multiply those valuations against its 40-million-pound resource...and it’s easy to see ValOre multiplying in value based on the Angilak resource alone.

|

Two Developments About To Pull The Trigger On ValOre’s Uranium

|

All of these factors are why ValOre has been an extraordinary, long-term investment opportunity.

Until just recently, when two developments emerged that could make this stock an even better short-term opportunity:

|

Trigger No. 1:

The Sprott Uranium Trust Goes Big

|

Last July, Sprott Asset Management bought Uranium Participation Corp, creating the Sprott Physical Uranium Trust, with a simple goal: Buy uranium and never let it go.

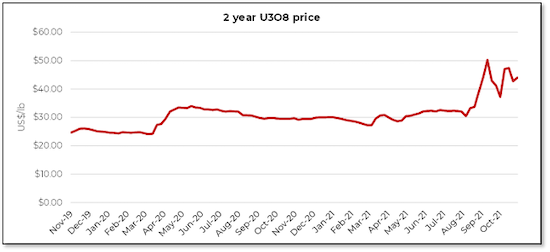

The result? A few significant price spikes in recent months (as you can see) each time the trust entered the market, and a considerably higher trading range for uranium.

|  |

Then it got better. In August, the trust had announced a US$1.3 billion financing that would allow it to dominate the uranium market and likely take the price much higher.

|

But here’s the new development: With the addition of an at-the-market component, the Sprott trust just announced that the financing will be essentially doubled...allowing it to purchase up to $3.5 billion of uranium!

|

This development all alone could transform the already drum-tight market, sending prices of uranium and uranium explorers further upward.

|

Trigger No. 2:

ValOre Goes After More Uranium

|

Just a few days ago, ValOre closed a major financing to raise funds specifically for the further exploration of its Angilak property.

|

The financing was originally announced at C$7.0 million, but the demand was so great that it was upsized to C$11.0 million.

|

As you can see from the accompanying map, the large, 43-million-pound uranium resource (noted by the two large red stars) was compiled from just a small number (5) of the identified exploration targets (smaller stars) at Anglilak.

|  |

The company is excited about the potential to significantly expand that resource with new drilling on the known targets — and now it is fully funded to do so.

The best part: ValOre will be delivering its new uranium drill assays into a market that — thanks to more buying from Sprott — is primed to get them.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

The Next Big Discovery Group Winner?

|

A big part of ValOre’s value proposition is its status as a member of Discovery Group.

This collection of explorers and mining entrepreneurs has backed some of the biggest success stories of the past few years.

| | |

Leading the way is Great Bear Resources, which is in the process of outlining a multi-multi-million-ounce gold resource on its Dixie project in Ontario.

|

Early shareholders in Great Bear have enjoyed life-changing profits, with gains as high as 60-for-one!

| |

Other winners in the Discovery Group stable include Fireweed Zinc, which controls one of the world’s largest undeveloped zinc deposits, and Bluestone Resources, which owns a high-grade gold-silver project that’s on the verge of a construction decision.

The list goes on and on, including previous M&A winners Kaminak and Northern Empire.

But now, with the PGE market gaining steam and a clear game plan in progress to significantly grow its valuable resource, ValOre Metals shows all the signs of becoming Discovery Group’s next home run.

|

A Million-Ounce PGE Resource With Big Upside

|

ValOre’s uranium assets are a company-maker all by themselves. But there’s much more to the company’s potential.

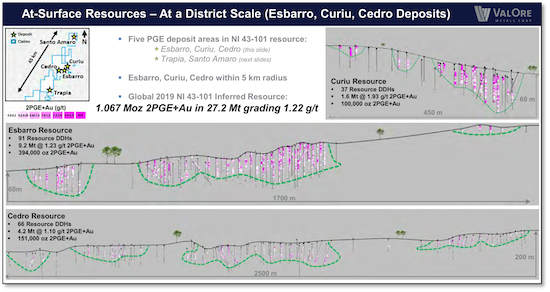

Consider that the current, million-ounce palladium-platinum-gold resource on ValOre’s Pedra Branca project puts it in a small group of PGE exploration companies that control world-class resources.

The project’s location in mining-friendly Brazil is a key selling point, as South Africa and Russia, the two biggest producers of PGEs, are both problematic jurisdictions.

Better still, ValOre has combined an analysis of past data with surface work and drilling to identify several areas where the five deposits that comprise the Pedra Branca resource could expand dramatically.

|  |

As you can see, those five deposits are all near-surface, which means they should be mineable by cost-effective open-pit methods.

Just as important, these deposits, and other key targets, are open for expansion.

At the Santo Amaro target, for example, ValOre just announced results from resource expansion drilling that cut intersections as rich as 36 meters at 2.22 g/t palladium + platinum + gold (2PGE+Au). Assays are pending from additional step-out holes.

|

As an added kicker, the company resampled historic core from past drilling and found 60% of its sample group yielded anomalous grades of rhodium, the rarest and most valuable of the PGEs.

|

With that precious metal currently trading at almost $13,000/oz., it wouldn’t take much rhodium to really juice the economics of Pedra Branca’s existing platinum-palladium resource.

|

Twice The Potential

In One Junior Mining Company

|

With drilling ongoing on ValOre’s Pedra Branca PGE project, and drilling coming up for the company’s Angilak uranium project, this is one junior resource play that truly offers double-barreled potential.

Here it is in a nutshell:

|

There are compelling reasons to invest in a world-class, overlooked uranium story.

…And there are compelling reasons to invest in a PGE growth story.

At the moment — and until the market comes to its senses — ValOre offers you the chance to do both, in a single company.

|

These kinds of opportunities don’t usually last long, and that means you need to look into ValOre now, while this rare situation lasts.

| | | | |

© Golden Opportunities, 2009 - 2021

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |