|

Every year, the equivalent of 20 million barrels of oil go straight to the landfill.

|

That’s a direct result of waste asphalt shingles from old roofs — this shingle waste typically can take 300 years or more to decay.

|

But one pre-IPO company, Sky Quarry Inc., has developed a patented process to recover the bitumen and heavy oil from those shingles.

|

|

| Every year, the U.S. sends approximately 20 million barrels of oil per year to the landfill in the form of waste asphalt shingles.

|

And, because governments and municipalities are willing to pay to have Sky Quarry take this waste stream off their hands, its business model promises to serve up tidy profits as well.

It’s a classic example of “doing well by doing good.”

Better still, it’s a model that is imminently scalable, which means Sky Quarry’s current plant to extract heavy oil and other by-products from waste asphalt shingles could provide the proof of concept needed to fund the construction of dozens of similar plants across the U.S.

|

A Clean Tech Solution

To A Big Problem

|

At the center of that model is Sky Quarry’s patent-protected technology for extracting up to 95% of the oil from the shingles.

And, along with that oil, the company also has plans to create multiple revenue streams by generating other salable products from the shingles, including:

|

• Asphalt tack coat — for use in the paving industry to help bind together layers of asphalt.

• Asphalt granules — for re-use by shingle manufacturers in production of new shingles.

• Limestone powder — for use by shingle and carpet manufacturers.

• Environmentally sourced heavy oil — used primarily for road asphalt mixes.

• Reclaimed bitumen — for re-use by shingle manufacturers in production of new shingles.

• Asphalt road product — for use in building and repairing roadways.

|

Depending on the season and the price of oil, Sky Quarry will be able to toggle between selling oil when its price spikes and selling other products like asphalt when oil prices are low.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Scalable, Highly Profitable

Business Model

|

With governments willing to pay a tipping fee of between $15 and $60 a ton to take waste asphalt shingles out of the waste stream, the processing costs could be essentially paid for, even before you factor in streams from by-products other than oil.

Last year, to establish the viability of its business model, Sky Quarry purchased an oil sands extraction plant in Utah.

That plant proved easily convertible into a plant that uses the company’s proprietary technology to separate waste asphalt shingles into salable products.

|

Because Sky Quarry is saving this slow-to-biodegrade waste from the landfill, it is essentially getting paid to produce revenue-generating commodities.

|

As a result, most of the money they’ll make on selling oil, asphalt and other by-products from its plants will go straight to their bottom line.

|

|

| Sky Quarry’s proprietary technology to recycle oil and other products from waste asphalt shingles is imminently scalable, making it a company that offers both compelling margins and high growth.

|

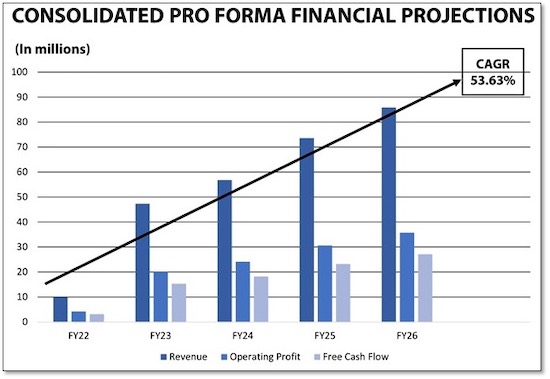

Better still, this is a business model that’s very scalable, as the chart above of Sky Quarry’s revenue and profit projections for the next several years indicates.

That scalability comes from the company’s ability to quickly and cost-effectively build other plants that use its patented technology to process waste asphalt shingles all over the country.

|

Cashing In On

“Build Back Better”

|

And with the hard infrastructure bill providing a rare instance of bipartisan consensus, it seems likely that at least that part of President Biden’s Build Back Better platform will get passed.

Regardless of where you stand on this bill, it’s a fact that this plan, if passed, will open wide the taps of government spending on roads, highways and bridges.

|

|

| President Biden and Senator Mitch McConnell agree on little, but both have lined up behind a “hard infrastructure” bill that could provide a ready-made (and possibly subsidized) market for some of Sky Quarry’s end products.

|

That will create huge demand for the kind of asphalt products Sky Quarry can produce, and it will provide an obvious way for the company to generate revenue if oil prices crater for some reason.

|

Plus, even though Sky Quarry’s current business model shows it making good money without any subsidies from the government, the Biden administration’s green bent means Sky Quarry’s environmentally friendly solution could well garner subsidies anyway.

|

The bottom line is that Sky Quarry is set up to win in the current political environment, and it offers investors a potential way to cash in on Build Back Better.

|

Get In On The Ground Floor

|

It’s always best when you can get in on the ground floor of a high-potential opportunity like the one Sky Quarry presents.

|

And you very much have such an entry point right now, thanks to a unique, pre-IPO arrangement that allows you to buy a piece of Sky Quarry before it goes public.

|

For a company with a business model this potentially profitable and scalable, Sky Quarry is an opportunity you definitely want to do your homework on.

|