| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The latest tightening tantrum continues as stocks, bonds and crypto plummet.

This time, however, gold and silver are holding up very well.

| |

Well, maybe gold and silver are safe havens, after all.

| |

As anyone watching the markets recently, and today in particular, knows by now, the hawkish rhetoric coming from the Fed (notably still unaccompanied by any actual action by the central bank) has sent Treasury yields soaring…and markets diving.

|

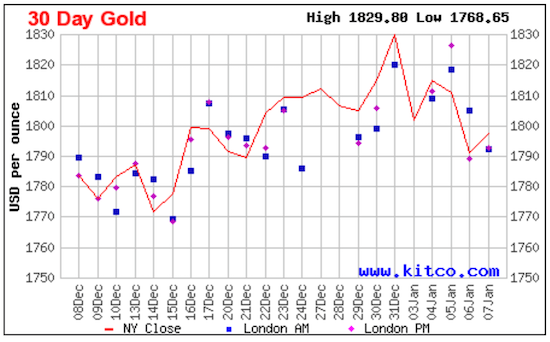

Gold was included in that number, as you can see from the chart below, as the consensus view shifted toward first rate hikes as early as March. This sentiment made a huge move last week, prompted largely by the release on January 5th of the Fed’s December meeting minutes.

|  |

Gold rebounded a bit on Friday, after a disappointing December jobs report. Today, both gold and silver are up nicely after a typical early-session sell-off.

The rest of the markets aren’t faring so well. As I write, the Dow is off well over 1%, the Nasdaq is down well over 2%, Bitcoin is down over 2.5% and bonds are in the crapper as Treasury yields continue a relentless ascent.

|

One Of Two Roadblocks For The Fed

|

What most investors don’t appreciate is the historic nature of what happened last week in the bond market.

New Orleans Conference alumnus Jim Bianco summed this up superbly in a Twitter thread, noting that “In some respects, what happened in bond markets last week was epic, something we might be talking about for many years.”

Jim went on to note:

|

“The 30-year data goes back to 1973 and last week was the worst calendar week total return in at least 49-year history!

“The long-bond lost 9.35%!! If this was a year, a 9.35% total return loss would be the 5-year worst year ever.

“Impressive for five days of work.”

|

In short, what we’re seeing right now is the markets’ hissy fit that I’ve been predicting as the Fed attempts to tighten monetary policy. It’s important to remember that this is just one of two barriers that will prevent Powell & Company from going very far down this road.

The other roadblock, as I detailed last week, is the federal debt. Unlike past circumstances when the Fed was attempting to normalize monetary policy, the debt has grown so large today that rate hikes of any consequence are simply impossible.

|

As I showed last week, a fed funds rate of even just 2.0% would imply annual debt service costs approaching $1 trillion a year. And that won’t be tolerated by the political left.

|

So what we’re seeing today are the first warning shots across the Fed’s bow. At some point, the central bank will be forced to stall or reverse its new hawkish stance...

…And gold, silver and mining stocks will soar when that happens.

We just have to endure this tumultuous transition until investors understand how the Fed is trapped.

In the meantime, today’s performance by the metals is encouraging.

| |

Cheers,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |