|

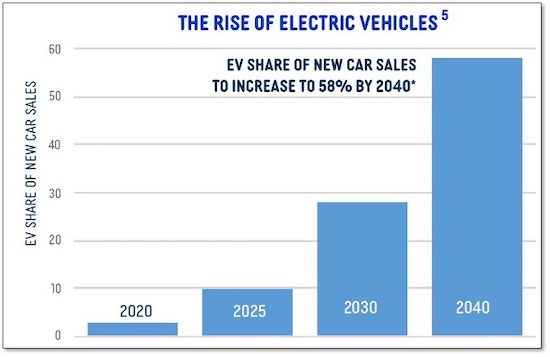

Just a quick glance at the chart below tells you all you need to know about the electrification trend.

|

|

| With electric vehicle sales expected to take a 58% share of new car sales by 2040, the electrification trend appears unstoppable.

|

By 2040, it’s anticipated that EVs will account for a remarkable 58% share of new car sales.

Not even considering the demand required by battery storage for commercial power and other uses, the EV boom is going to send prices soaring for the battery metals in the decades ahead.

|

It’s a secular trend with real staying power, and it’s one you can make a diversified bet on with one company: Electric Royalties (ELEC.V; ELECF.OTC).

|

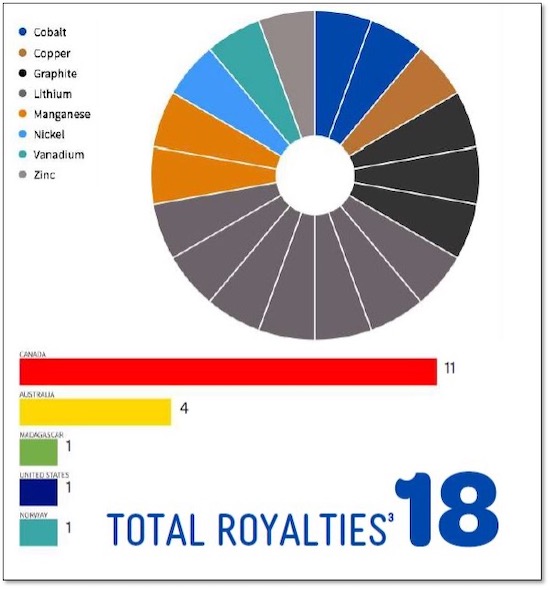

Electric Royalties boasts 18 royalties and counting, spread across a variety of the key metals in the electrification boom. Importantly, it provides all the powerful advantages royalty companies typically offer over explorers and producers.

As you’ll soon see, the company is firmly on the path of cash flow growth, one that makes it perhaps the perfect way to maximize your leverage on the battery metals boom.

|

The Power Of Diversification

|

You’ll read it in all the finance textbooks: Diversification is a crucial tool for managing risk.

If you’re too overloaded in a sector or commodity, you expose yourself to the risk that attends that sector or commodity.

But if you spread your bets, you benefit from the fact that markets rarely move in lockstep fashion. Diversification protects your downside while giving you exposure to the sectors that are moving upward.

As you can see from the charts below, Electric Royalties’ 18 royalties are spread across a wide variety of metals critical to electrification, including lithium, cobalt, graphite and manganese, as well as copper, zinc and nickel.

|

|

| Electric Royalties offers diversification across just about all of the major battery metals, and geographic diversification as well.

|

As you can see, these royalties also offer geographic diversity, with claims to future cash flows from projects on no less than four continents.

|

|

A key metric for royalty companies is cash flow, and that’s something that Electric Royalties already has going for it.

It’s sliding scale gross revenue royalty on production from the Middle Tennessee zinc mine has been kicking off cash since Electric bought it last August.

In 2022, it looks likely that the Graphmada graphite mine in Madagascar will come off care and maintenance and start generating cash flow through Electric’s 2.5% Net Smelter Royalty. Electric acquired Graphmada from Vox Royalty as part of an ongoing strategic partnership.

And Electric has another graphite project (Bissett Creek) past the feasibility stage and a lithium project (Authier) undergoing engineering studies.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

The Royalty Company Advantage

|

On top of that, Electric Royalties has six royalty projects in advanced stages of exploration and millions due to be spent on exploration in 2022.

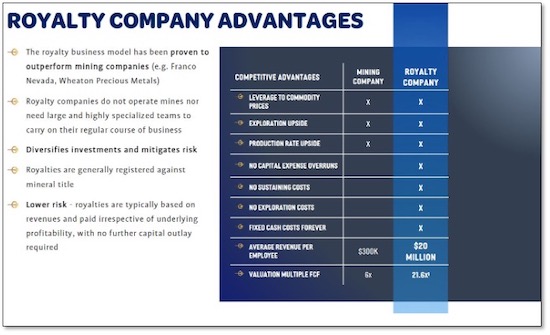

That points to the myriad advantages of royalty companies.

|

|

| Royalty companies offer myriad advantages over investing in miners and explorers.

|

They tend to be the first names off the shelf when generalist investors rotate into a sector, which means they often outperform explorers and producers.

They offer exposure to the upside on exploration and development projects while spreading the downside risk across a variety of different projects.

|

Plus, because royalty companies don’t own or run the projects they offer exposure to, they aren’t subject to capital expense overruns, production costs or exploration costs.

|

With royalty companies like Electric Royalties, you get all the leverage to commodity prices of a junior explorer or producer, but with considerably less downside risk.

|

|

So far, the market has yet to fully appreciate what Electric Royalties has already accomplished.

|

• It has a robust, 18-project portfolio of royalties leveraged to the exciting electrification mega-trend.

• It has spread its royalty bets across the entire suite of battery metals.

• It has solid exposure to lithium after lithium prices increased more than 300% in 2021.

• It is already generating cash flow — and looks likely to generate more soon.

• Its operating partners raised more than $150 million in 2021, most of which is earmarked for 2022. That should lead to catalysts galore for Electric this year.

|

Even if Electric Royalties were to stand pat on its portfolio in 2022, growth appears baked into the cake.

|

In a global economy that’s pushing the electrification trend at breakneck speed, Electric Royalties stands ready to leverage that trend as only a well-positioned royalty company can.

|

Note that this overlooked story is starting to get noticed, and its share price has begun to move higher in recent days.

So if you’re looking for a “one-stop shop” play in the battery metals boom, look no further than Electric Royalties…and start looking now.

|