|

Some junior mining companies punch above their weight.

|

Through smart property acquisitions and in-house geologic expertise, these companies acquire projects with potential out of all proportion to their market caps.

|

Such is the case with Bathurst Metals (BMV.V; BMVVF.OTC) a small (for now) junior explorer with an impressive project portfolio in Canada’s Nunavut province.

|

|

| Bathurst Metals owns 100% of five highly prospective metals projects in Nunavut.

|

Leaning on the past experience of geoscientist Lorne McLeod Warner, Bathurst has acquired five projects in Nunavut, including a potential Archean gold deposit and a platinum group metal (“PGM”) and nickel-copper prospect with world-class upside.

|

As you’re about to see, Bathurst spent the 2021 field season testing these projects with early-stage exploration techniques...and impressive returns.

|

The result is a company with a tight share structure that’s on the verge of drilling its highly promising Turner Lake gold project in the coming months and getting its McGregor Lake PGM-nickel-copper-gold project drill-ready.

|

Identified High-Grade Gold

|

If you’re going to hit a project with a grid-pattern drill plan, you need to have a good idea of where the gold lies.

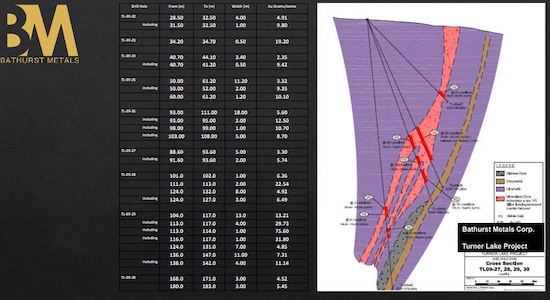

In the case of Turner Lake’s Main zone, past results make it clear that the gold is not only there, but that it also carries impressively high grades. Consider some of the historical drill results from previous operators in the late 1980s:

|

• 28.0 g/t gold over 4.75 meters

• 12.86 g/t gold over 8.87 meters

• 4.08 g/t gold over 15.27 meters

• 15.20 g/t gold over 4.00 meters

• 10.0 g/t gold over 4.00 meters

|

Note that those are historical results, and cannot be relied upon without confirmation by new drill holes.

|

But that is precisely what Bathurst is setting out to do. And results like those in today’s market would make headlines.

|

In fact, the limited drilling the project has received has turned up visible gold in most holes. Better still, the zone at Turner Lake has only been tested down to 150 meters from surface, and Archean deposits tend to run deep — kilometers deep in some cases.

|

|

| Thanks to work by past operators, Bathurst Metals can attempt to prove up a deposit at Turner Lake this year with grid-plan drilling.

|

Before Bathurst tests that depth potential, however, it has an opportunity to quickly prove up an impressive resource at Turner Lake through drilling the known zones. That’s Warner’s belief based on his past experience with the project.

The program the company has planned will be based upon the current, basic understanding of the strike, dip and plunge of the gold mineralization.

The result?

A gold target that could become a major gold deposit with this year’s drilling program.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Massive PGM-Nickel-Copper Target

|

Providing a major backstop to the value potential of Turner Lake is the outsized potential of the McGregor Lake target.

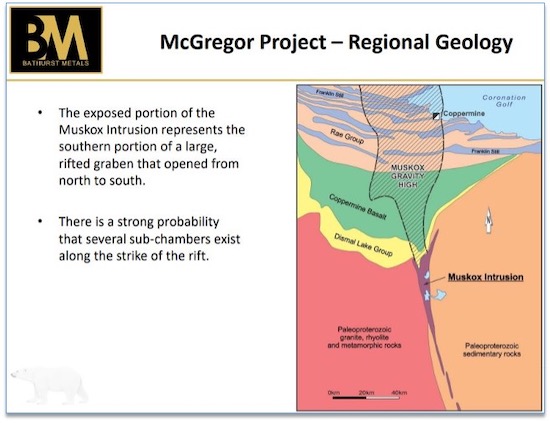

Located in far western Nunavut, McGregor Lake lies atop the southern exposure of the Layered Muskox Ultramafic Intrusive (“LMUI”).

That’s a mouthful of a mineralization type. The main thing for us as investors to understand, though, is that its capable of hosting a massive amount of PGMs, nickel, copper and gold.

|

|

| Bathurst’s McGregor project lies along a Muskox Intrusion similar to the one that hosts Russia’s massive Noril’sk Talnakh nickel-copper-palladium district.

|

A good analog is Russia’s Noril’sk-Talnakh nickel-copper-palladium district, which is worth close to a trillion dollars in terms of its in-situ value.

Obviously, we can’t compare McGregor to that or any deposit at this early stage, but Bathurst just released exploration results that were nothing short of eye-popping...

|

...Including rock samples grading as high as 5.40% copper, 5.90% nickel and 11.8 g/t palladium from one sample, and 11.50% copper, 4.06 g/t platinum and 44.5 g/t palladium in another.

|

The work on McGregor Lake is still preliminary, but based on the work of past operators, Warner is confident he can vector in on the highest-grade hotspots within this 20-kilometer-long target.

Simply put, if Bathurst can deliver a proof of concept to the market that McGregor Lake is capable of hosting a Noril’sk-level district of PGM-nickel-copper-gold, it’ll be “Katy, bar the door” for the company’s share price.

|

|

After being sidelined in 2020 due to Covid, Bathurst’s field teams were able to work its projects in earnest in 2021.

As a consequence, the company has all the data it needs to run a grid-pattern drill program at Turner Lake — and that program will go a long way toward proving up the value of that potential deposit.

|

Success on this program, all by itself, could be a major catalyst for Bathurst in 2022.

|

Add in the possibility of some good news from fieldwork on its other projects (especially McGregor Lake), and you have a company that’s ripe for appreciation.

|

|

The good news for us as potential investors in Bathurst Metals is the market’s completely asleep at the switch here.

Bathurst has quietly amassed an enviable portfolio of projects in Canada’s Far North, at least one of which has the potential to make big headlines this year.

|

So far, the company’s market cap comes nowhere close to valuing the upside potential of Turner Lake, let alone McGregor Lake.

|

If you like the metals for the long-term, you’d be well advised to take a closer look at Bathurst Metals. It could be just the discovery-driven lever you’ve been looking for.

|