| Drilling upgraded targets in Canada’s hottest gold region

| | | Please find below a special message from our advertising sponsor, Canterra Minerals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| |

Canterra Minerals (CTM.V; CTMCF.OTC) will have drill results any day from its Wilding Gold Project in the heart of Newfoundland’s red-hot gold rush.

The results could quickly delineate not just one, but multiple discoveries.

| | | |

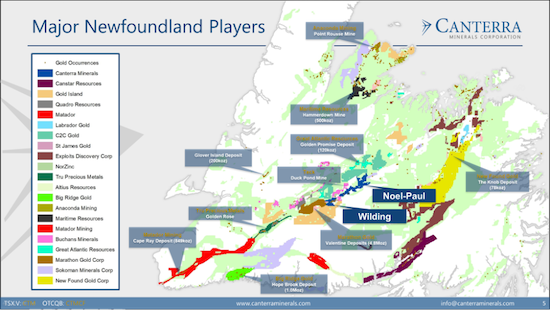

Newfoundland remains Canada’s most sought-after gold exploration district, where potential riches await for both junior exploration companies and their shareholders.

|

Success, however, starts with a robust land package.

|

And one company — Canterra Minerals (CTM.V; CTMCF.OTC) — checks that box like few others.

|

Simply put, this company’s management team has shown the ability to add accretive land positions in one of the hardest/hottest areas to get your hands on anything remotely meaningful.

Strategically, Canterra finds itself with land adjacent to both Marathon and New Found Gold — companies that have been among the highest flyers and biggest winners for shareholders.

The influx of capital deployed into the gold sector over the last two years has the market poised for new discoveries and that is good news for everyone, specifically if you find yourself invested in areas where drilling is plentiful.

Don’t sleep on Canterra Minerals (CTM.V; CTMCF.OTC), unless you are dreaming of adding this hidden gem to the mix.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Following In The Footsteps Of Newfound Success

|

Canterra’s flagship Wilding project lies directly adjacent to and northeast of Marathon Gold’s Valentine project.

If you aren’t familiar, Valentine hosts the largest undeveloped gold mineral resource in Atlantic Canada (3.14 million ounces of Measured and Indicated resources, along with an additional 1 million ounces of Inferred.)

And, this is important, these resources are economic.

But it gets better.

Marathon managed to convert Valentine from a small, 200,000-ounce resource into an economic, multi-million-ounce deposit in just a few short years. It now appears to be well on its way to becoming Atlantic Canada’s next big gold mine.

|

But that’s not all — Canterra’s Wilding project appears to host both styles of mineralization that make up the majority of the resources at Valentine.

|

As the puzzle pieces continue to align, one can draw parallels and be confident that continued drilling success will wake up a nosy neighbor to come knocking or at least peak over Canterra’s fence.

The below image depicts the activity in the area. As you can imagine, it looked nothing like this just a few years ago.

|  | | Canterra’s Wilding project is directly along strike, and shows remarkable similarities to, Marathon Gold Corp’s massive Valentine deposit.

|

Does this have your attention? Well, there’s more….

|

Smart Shareholders With Deep Pockets

|

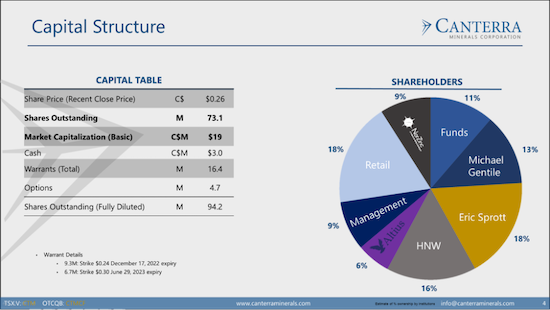

The original vender of Wilding, Altius Minerals, has an uncanny ability to spin out winning projects while retaining a significant equity shareholding. It is important to note that initial results in 2017 would likely have been received with welcomed arms if not in an unfavourable gold market. Altius therefore remains supportive (as is typical for this group).

Added to the powerful mix is Eric Sprott, the savvy mining financier who single-handedly has sparked attention in forgotten junior exploration companies over and over, and over again. He participated in Canterra’s financing just this past summer and is also awaiting results of the program he helped fund.

Sprott isn’t the only shareholder on the registry that can move a stock though. Michael Gentile, another seasoned resource investor with quite a following, can create a splash if he starts talking up Canterra. (Just look at the movement in Northisle Copper and Gold after he purchased and reviewed the company.)

|  | | For anyone looking to invest with the best, it’s hard to beat the powerful group of smart, supportive shareholders backing Canterra.

|

Access to capital is the number one reason why good projects fail, but this shouldn’t be a concern as the stars align for Canterra.

|

Well-Defined Targets – A Steady Stream Of News

|

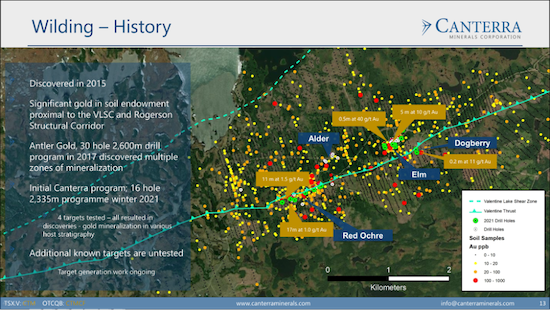

With results pending from Canterra’s year-end drill program and its 2022 campaign underway, the next releases should remind the market of both mineral events prevalent on the property.

|

These include both stacked-vein, high-grade zones and zones of more widely disseminated bulk-mineable material.

|

The pending 19 holes have combined for just over 4,000 meters of drilling at Wilding and uncovered stacked, shallow dipping quartz-pyrite veins over 30-60 meter intervals that mimic the deposit setting at Valentine, albeit in different host rocks.

Reminder: Results are pending.

So far from that program, core samples are showing that similar veins have been identified over an additional one kilometer of strike — extending the known mineralization to about 2.5 kilometers.

|

Consider this: The visual indicators are so promising…and the company is so confident…it’s moving ahead with drilling before we even see the results from these holes.

|

Obviously, with all the indications pointing to what appears to be an extension of the mineralized trends at Valentine, Wilding makes for one of the more attractive drill-hole bets on the Newfoundland staking rush.

As we anxiously await results from that program there is still time to build a position in Canterra — but not much.

The company’s “can’t stop, won’t stop” approach to drilling means it has an excellent chance of making a discovery of its own. That coupled with the area play thematic should allow Canterra to benefit from the positive results of any one of its neighbors.

|  | | The Wilding project is a classic target-rich environment…and all four targets tested so far resulted in discoveries.

|

As it’s said, “where there is smoke, there is usually fire.” And is there ever smoke at Wilding.

|

An Array Of Well-Defined Targets

|

Between soil, rock samples, geophysics and prior drilling, Canterra has used an abundance of data to outline a number of exciting target areas.

Add in their ability to design programs off the success of their neighbors, and it all puts Canterra right where they want to be — in the driver’s seat and firmly in charge of their own destiny.

Each target outlined so far has its own unique signatures and fits into a well-designed pipeline to keep the exploration team busy from top to bottom. Remember: Successful resource companies rely on every boot on the ground to play an integral role in their company’s growth.

|

As for targets, Red Ochre has been outlined as a bulk tonnage target which will likely return lower grades over larger intercepts. (Note: The company is focusing on substantially extending the strike length of the Red Ochre target, and their enthusiasm is telling.)

The Elm and Dogberry targets have now been tested for the potential to quartz veins similar to Valentine. And there are new targets being developed all the time, with some to the west, very close to Marathon, being particularly intriguing.

|

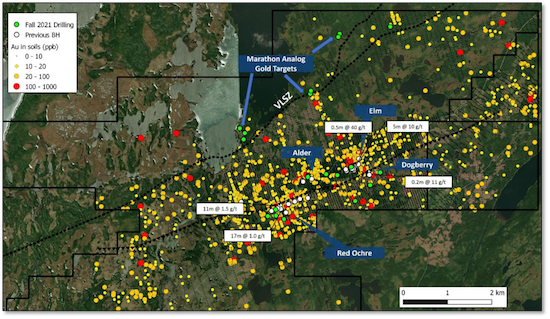

Now look closely – the image below is NOT the same as the above. It outlines the final locations of pending drill results and, yes, yet another target called VLSZ, the Valentine Lake Sheer Zone.

|  |

If any of the above outlined drilling results turns up evidence and similarities to Marathon’s Valentine, you can expect a market reaction and a potentially very lucrative road ahead for Canterra shareholders.

| |

Everything discussed so far with Canterra’s Wilding project could soon be repeated on the company’s Noel Paul property. Extending along strike from Wilding, this property encompasses some of the belt’s most prospective claims and has returned promising initial results.

| |

A first pass collection of soil samples looks to have extended the VLSZ from Wilding in a northeastward direction and onto the southern portion of Noel-Paul.

|

Soil samples were collected over broad spacing, and results returned 11 to 57 ppb gold. Not a bad start to uncovering the value of a property that is approximately three times the length of Wilding.

Needless to say, Canterra is excited to add this project to its pipeline of areas to send field crews over the next year.

| |

With proven discoveries along strike with some of the biggest discoveries in the hottest gold rush in Canada, this is seemingly a junior exploration play that’s made to order.

|

As noted, there’s still time to consider a position in Canterra before the upcoming drill results — but not much of it.

|

If you want to get a stake in this gold rush, the time to do your due diligence is now.

| | | | |

© Golden Opportunities, 2009 - 2022

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |