| Yellow metals in the green

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Yellow Metals

In The Green

| |

Gold is continuing its post-Fed advance today, while uranium has also been deservedly getting investor attention.

| | | |

As the major U.S. stock indices are seemingly more often in the red than not these days, more and more investors are moving into two yellow metals that are spending more time in the green.

|

I was set about to write up some brief comments on gold today, but just as I was beginning I looked up to see our New Orleans Conference alumnus Jon Najarian on CNBC recommending Cameco as a uranium play.

“Aha!” I thought, there’s another yellow metal that I haven’t talked much about lately.

Before I get into that, just a quick note on gold….

|

The Fed Continues To Boost Gold

|

It was an interesting turn-around in the markets this morning as, almost in unison, U.S. stock indices turned down, the 10-year Treasury yield popped higher, oil jumped $5 and gold shot up about $12.

That would be a recipe for some negative news from Ukraine, but apparently geopolitics were only tangentially responsible for some of these developments.

As it turns out, a prepared speech by Fed Chairman Jerome Powell, in which he assured us that the Fed was ready to hike rates at a half-point clip at any time, was behind the dive in stocks, the rise in the 10-year yield and, counter-intuitively, the pop in gold.

The EU making noise about potentially banning Russian oil imports was apparently the catalyst for the jump in oil, and probably had a bit to do with gold as well.

The broader point is that the post-Fed-rate-hike rally we’ve been predicting in gold remains intact.

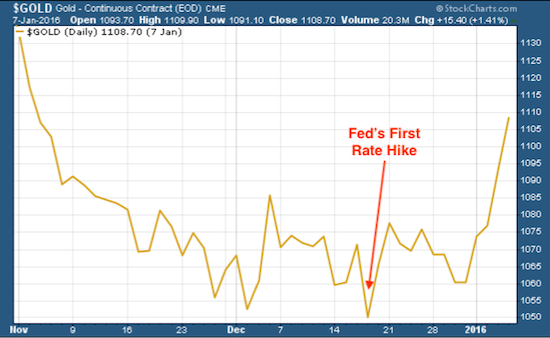

That’s not to say that we won’t see a step or two backward along the way. Consider this chart of gold immediately preceding the Fed’s initial rate hike on December 16, 2015 and the days shortly thereafter.

|  |

As you can see, that post-hike uptrend began in fits and starts. Similarly, while we had a nice bump right after the Fed’s hike last Wednesday, we had a down day on Friday.

In short, everything’s going according to plan…so far.

Of course, the major development that could temporarily knock the rally down would be a resolution in the Russia-Ukraine crisis. But the operative word is “temporarily,” as the monetary fundamentals are powerfully in gold’s favor.

Which brings us to the other yellow metal….

|

Uranium Continues To Heat Up

|

Like gold, the price of uranium had been in a nice uptrend before Russia invaded Ukraine.

With uranium, however, the rally had begun earlier — last summer — and saw the spot price rise about 50%, from $30 to over $45, from mid-summer to the end of November.

It stayed around those levels until Russia invaded Ukraine, sending the price considerably higher. Over the last week, for instance, spot uranium jumped about $5 to $59 a pound.

Very simply put, the crisis in Ukraine, combined with some previous political turmoil in Kazakhstan, has the world (and utilities) worried about the security of uranium supply from these troubled regimes going forward.

Perhaps even more importantly, it seems that soaring natural gas prices are forcing the EU and other nations to reconsider their classification of nuclear power as anti-green. Instead, they are recognizing it as not only carbon-neutral, but also the only reliable supply of their baseload energy needs.

There were already strong fundamental reasons for the price of uranium to rise, but these have either been highlighted or added to by the crisis in Ukraine.

|

Getting A Portfolio In The Green Through Yellow Metals

|

OK, that’s my last colorful pun for this issue, I promise.

My point is, gold and uranium are two metals beginning uptrends that I feel will last for years. If you’re not positioned in both of them, you need to look into rectifying that soon.

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. Coincidentally, our Gold Newsletter Uranium Report has just been updated with the latest developments in the sector as well as reviews of some of the higher-potential stock plays.

CLICK HERE to get it now.

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |