| Visible gold in 4 holes and assays on the way

| | | Please find below a special message from our advertising sponsor, Opawica Explorations Inc. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| |

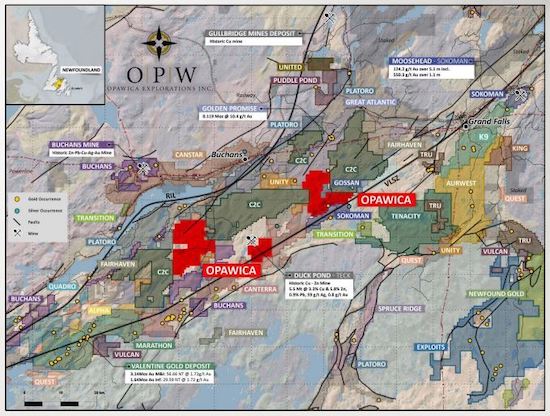

Opawica Explorations Inc. (OPW.V; OPWEF.OTC) controls an impressive portfolio: three properties on the prolific Abitibi Greenstone Belt and five in central Newfoundland, home of Canada’s newest gold rush.

With drilling now slated for two of its most exciting projects, Opawica is an exploration story with perfect timing and perfect potential.

| | | |

Some places in the world just have higher odds of success when it comes to gold discovery.

|

And with 170 million ounces of past gold production, the Abitibi Greenstone Belt that transects Quebec and Ontario is definitely one of those places.

|

As it happens, Opawica Explorations Inc. (OPW.V; OPWEF.OTC) has no less than three high-potential exploration projects along the southern end of the Abitibi near Rouyn-Noranda, Quebec.

|

Thanks to a partnership with exploration artificial intelligence (AI) company Goldspot Discoveries, Opawica has already identified multiple targets on its Bazooka and Arrowhead projects, both of which are drill ready.

Indeed, Bazooka has already seen its first 4,700 meters of drilling from Opawica — with four holes returning visible gold. Assays are pending and eagerly awaited by shareholders.

As you’re about to see, Opawica has Bazooka prepped for a second, 5,000-meter drill program, and Arrowhead is set up for its first, 5,000-meter program.

Plus, the company boasts fully five projects in red-hot Newfoundland.

Active exploration in known gold districts: It’s a recipe for success in the gold exploration game, and it’s one Opawica Explorations is following to a tee.

|

Bazooka:

On Trend With Some Of The

Abitibi’s Richest Zones

|

All three of Opawica’s Quebec properties lie along the Cadillac-Larder Lake fault zone within the Abitibi. This gives them exposure to some of the richest gold ground in the whole belt.

| | | | Opawica’s Quebec projects lie along the Cadillac-Larder Lake Break/Fault, one of the world’s most prolific gold-bearing structures.

|

Bazooka, for instance, is located next to Yamana Gold’s Wasamac gold project, home to 1.76 million ounces of proven and probable gold reserves and 2.58 million ounces of measured and indicated gold resources.

|

Past work on Bazooka has identified areas of high-grade gold. And with a just-completed, initial drill program by Opawica hitting mineralization in 22 holes and visible gold in four holes, you can understand why shareholders are excited about what’s to come when the assays are released.

|

The targets of this initial program were identified with the help of Goldspot, which in total has given Opawica 39 targets to test at Bazooka. While we wait on assays from the lab, more drilling is about to begin on this project.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Arrowhead:

As Rich Of A Target As You Could Ask For

|

And Bazooka isn’t the only project along this trend seeing drilling. Opawica is also prepping its well-positioned Arrowhead project for drilling.

How well positioned is Arrowhead? Consider this: The property boundary is entirely surrounded by ground owned by Agnico Eagle, a major producer in the Abitibi with over 875,000 ounces of gold produced in 2019.

| | | | Major Agnico Eagle’s property entirely surrounds Opawica’s Arrowhead project in Quebec.

|

Prior drilling on Arrowhead hit gold-copper on 40 separate mineralized zones. Again, as with Bazooka, Opawica has partnered with Goldspot to identify the likeliest drill targets on Arrowhead.

|

Arrowhead has a history of high-grade going back to the 1930s, when Veins A and B were defined at 3,864 tonnes of 17.2 g/t gold over 0.375 meters. That small area represented 1,940 ounces of gold.

|

These zones make for excellent targets as Opawica looks to ramp up a 5,000-meter program at Arrowhead later this month.

|

Early-Stage Potential In Newfoundland

|

The Abitibi isn’t the only high-profile district where Opawica has prime property. It also has five highly prospective projects in central Newfoundland, home of Canada’s most recent gold rush.

|  | | Opawica owns prime ground in five projects in central Newfoundland, home of Canada’s latest gold rush.

|

All five projects are at an early stage of development, but till sampling has unearthed 50 gold grains out of 121 till samples.

|

That’s a great hit rate, especially when you consider that 11 of them were pristine, meaning they likely weren’t moved far by glaciation.

|

Again, Opawica plans to work with Goldspot to identify the most attractive targets on these five properties. This is earlier-stage work, but it has the potential to give the company some blue-sky exploration to go with the more advanced stage work at Bazooka and Arrowhead.

| | |

When you’re in the discovery game, nothing provides a better catalyst for share price appreciation than drilling.

The drills are the truth-telling devices that let you know if you’ve made a big gold find.

|

Opawica Explorations has not one, but two drill programs on the way at Bazooka and Arrowhead.

...And the company also has assays on the way from the first program at Bazooka — with reported visible gold in the drill core.

|

It comes down to this: Opawica is looking in the right places for gold...it has a bead on where to drill thanks to Goldspot’s technology...and it has the financial backing of industry kingmaker Eric Sprott.

If you’re looking for a drill-hole play with big, near-term potential, you would be hard-pressed to find a better one than Opawica Explorations.

|

CLICK HERE

To Learn More about Opawica Explorations Inc.

| | | |

© Golden Opportunities, 2009 - 2022

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |