| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The markets don’t realize — yet — that the Fed is powerless to fight inflation.

| | | |

With Fed governors now saying rate hikes of 0.75% might lie ahead, the markets are fixated on a central bank intent on killing off inflation at any cost.

|

What they don’t realize is that the Fed has painted itself into a corner after decades of ever-lower rates and debt accumulation.

As a result, they are powerless to fight inflation...and will have to reverse their tightening at some point.

|

And that point could be far sooner than virtually anyone is now imagining.

| | Golden Opportunities continues below...

| | | SPONSOR:

Market Tactic

| | Bill Gates and Warren Buffett Just Changed The Future Of Clean Energy

| |

On June 2, Microsoft founder and mega-investor Bill Gates revealed a project that has been 15 years in the making.

In his June 2 announcement, Gates stated that “there is only one carbon-free energy source that can deliver large amounts of power day and night through every season almost everywhere on Earth.”

Albert Einstein was the first to discover how it could be harnessed.

And now Bill Gates says “Einstein's Energy” is going to “be a game-changer for the energy industry.”

| | His billionaire buddy Warren Buffett agrees, and is teaming up with Gates to make this Einstein energy technology a driving force in global power generation.

| | And there’s one stock with strong growth prospects that is in the business of finding the fuel for this future clean energy generation.

| | Click here to learn more about

Basin Uranium (OTC:BURCF, CNSX:NCLR).

| | |

This has been the theme of my recent conference presentations and interviews, as it has been for some time in this newsletter. A number of factors are at work here, but the bottom line is that one of two things are going to happen:

|

1) The stock market is going to tell the Fed to lay off rate hikes and pitch a hissy fit that the Powell & Co. can’t ignore, or...

2) The Fed will get to 2% or so on the Fed Funds rate, forcing interest payments on the federal debt to rise over $1 trillion. The resulting political push-back will force the Fed to retreat and throw the credibility of Treasury debt and the dollar into doubt.

|

The first scenario is easy, because it’s based on past behavior and the result of the Fed’s machinations since 2008, if not the past couple of decades. The central bank had the stated goal of propping up the financial and real estate markets, and they were more successful than they could have hoped.

But in another example of “be careful what you ask for,” the result is that these markets are now completely intertwined in today’s consumer-based economy. The stock market is the economy now, and the Fed simply can’t allow the house of cards they built to come tumbling down.

And right now, with a potential yield-curve inversion pointing toward a recession...this factor could come to a head much more quickly than even I anticipated.

The second scenario is even easier, since it’s a case of simple math.

I’ve laid the calculations out before, but once again...my research shows that the effective rate of interest on the federal debt generally settles between 2% to 4% above the fed funds rate. So if the fed funds rate is 2%, the effective interest rate is going to settle at 4% or more.

If the federal debt held by the public is $25 trillion (it’s currently $23.7 trillion and rising quickly), then simply multiply that by 4% to get $1 trillion in interest costs. Every year.

|

I don’t think the public is going to accept that quietly...not without someone asking why we’re paying so much to fat-cat investors, including China, and mortgaging our kids’ futures.

|

In other words, the addiction to easy money and debt creation is going to come due soon, in the form of doubt as to the current and future value of the dollar. Gold will soar in response.

|

Rate Hikes Are Good For Gold

|

Another little-appreciated fact is that Fed rate-hike cycles are actually bullish for gold.

It seems counter-intuitive, but the facts are clear. As you can see in this chart from the World Gold Council, gold has performed very well in previous Fed tightening campaigns.

|  | | Click image to enlarge

|

Calculating the median return over four prior Fed tightening cycles, the WGC shows that gold doesn’t do well in advance of the rate hikes, but rises significantly after they’ve begun.

This supports my theory that hedge funds and other speculators lean heavily on gold with short bets in advance of an anticipated Fed rate hike. But having bought this rumor, they then sell the news and move on once the cycle actually begins.

|

Whatever the dynamic at work, it’s a well-established pattern...and one that has been very profitable.

|

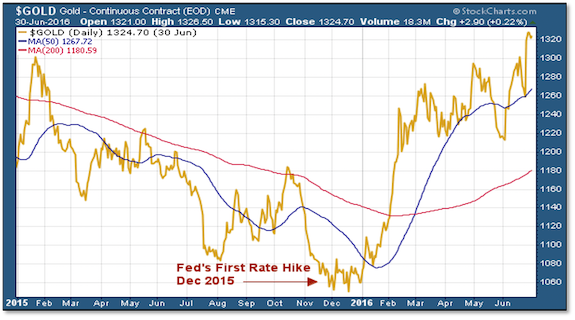

Consider this chart showing gold’s behavior before and after the Fed’s last tightening cycle.

|  |

While this initial rate hike from the Fed was widely anticipated, I’m proud to say that Gold Newsletter was the only publication to my knowledge to predict that gold was going to rally strongly as soon as the Fed made its move.

In fact, that’s precisely what happened, as gold rose over 30% over the succeeding eight months. And junior gold stocks did much better, with many of our picks doubling and some rising as much as five times in price.

|

I think we’re set up for a similar experience in the months ahead.

|

I won’t go into the other fundamental factors, including rising inflation pressures and a global move toward gold as the only reliable safe haven.

The bottom line is that, despite setbacks now and then (like we saw yesterday), the uptrend for gold is in place. Make sure you’re set to ride it.

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. We just learned that Jim Dines, a long-time friend of mine and of all investors, passed away last week. Jim was an absolutely brilliant market analyst and a true pioneer in the newsletter industry, and I’m glad that I had the opportunity to tell him so over the many years that I knew him.

He will be greatly missed.

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |