| Profit from the power of high-grade gold

| | | Please find below a special message from our advertising sponsor, Canagold Resources. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | | The Power Of High-Grade Gold

| |

Large, high-grade gold deposits are rare, which is what makes Canagold Resources’ (CCM.TO; CRCUF.OTC) New Polaris deposit so unusually valuable.

And that spells opportunity, as the market is currently giving Canagold far less value than other high-grade resources.

With more drill results and a resource upgrade ahead, this market anomaly could disappear soon.

| | | |

High-grade gold is hard to find — especially more than a million ounces of it.

|

So when you find it…and find it on sale…it’s hard to go wrong with pulling the trigger as an investor.

|

That’s why Canagold Resources (CCM.TO; CRCUF.OTC) is getting attention from smart investors right now.

|

You see, thanks the vagaries of today’s markets in general and the junior gold sector in particular, the big, high-grade gold deposit Canagold has outlined at its New Polaris project in northwest British Columbia has gone “on sale.”

But with the company still churning out high-grade gold assays from a recent drilling program and an updated resource estimate due out this year, Canagold is generating the kind of news flow that will eventually get the market’s attention.

| |

New Polaris already boasts 586,000 ounces of indicated gold at a 10.8 g/t average grade and 485,000 ounces of inferred gold at 10.2 g/t.

Those are eye-popping average grades.

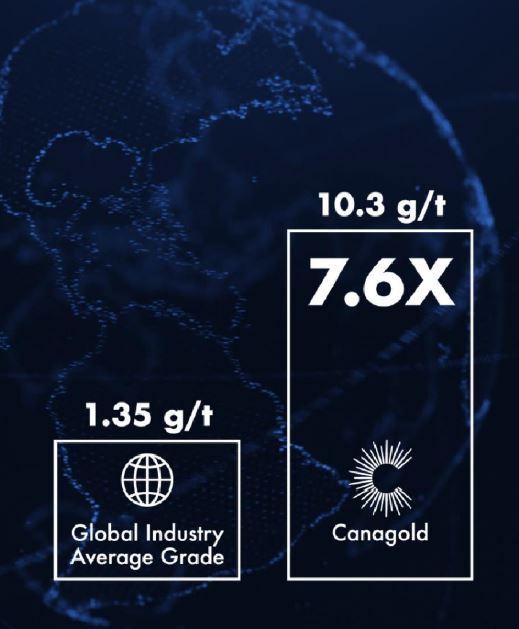

To give you a sense of how rich they are, consider that the average grade of the gold deposits getting mined today runs 1.35 g/t. That means New Polaris’ grade is more than 7.6 times the industry average.

|  |

That high grade translates into compelling economics for the project.

Consider that a 2020 preliminary economic assessment on the project, using a $1,500 gold-price assumption, projects an after-tax NPV, discounted at 5%, of C$469 million with an after-tax internal rate of return (IRR) of 56%!

The project has an estimated capital cost of US$111 million and low all-in sustaining production costs of just US$530/ounce.

According to this study, the mine would produce 80,000 ounces of gold per year in dore bars over an 8.7-year mine life.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

And Yet With Room To Grow

|

And, that mine life could improve significantly based on recent drilling. Although primarily an infill program to upgrade resources, the latest drilling program at New Polaris has had some hits that should add to the overall resource totals.

First up is the C West Main zone that hosts the deposit at New Polaris. Infill holes on this target have managed to hit high-grade gold in the gaps of the resource model.

A couple of intervals that provide a recent example of that phenomenon come from Hole 1675E1A, which returned 4.3 meters of 19.3 g/t and 2.0 meters of 42.5 g/t in areas outside the resource model.

Then there’s the C-10 vein, which lies outside the resource area completely for the C West Main zone. Canagold has gotten strong assays from that vein as well, including 17.1 g/t over 8.4 meters and 11.1 g/t over 17.8 meters. These represent massive widths compared to the average widths modeled on the deposit of three meters.

|

Management believes this vein alone could add additional ounces of gold to the resource at New Polaris.

|

Those could be significant ounces, as they would help the deposit get to the magic 10-year mine life benchmark — and the million-ounce resource that larger companies look for when considering acquiring a project.

| |

Another factor in whether a deposit gets bought is whether there’s upside potential beyond the initial mine.

And, as you can see from the diagram of mesothermal deposits below, that upside potential is very much there at New Polaris.

| | | | Click image to enlarge

|

Although mesothermal resources aren’t that common in British Columbia, they are in eastern Canada, where some of the richest gold deposits in the world lie.

The diagram makes clear that these types of deposits go deep, sometimes as deep as two kilometers and more.

In British Columbia, the historic Bralorne mine was mined to depths of 1.9 kilometers for 4.2 million ounces of gold. Coeur Mining’s Kensington mine, which is just west of New Polaris in the Alaska panhandle is a mesothermal deposit currently producing 120,000 ounces of gold per year.

By comparison, New Polaris has only been drilled extensively down to 600 meters…and there’s every indication that the mineralization continues at depth.

Drilling off a resource with 1,000-meter holes isn’t cost effective, but it isn’t hard to see a possibility where the deposit gets developed with resources defined to the 600-meter level and underground drilling during operations shows potential to expand the resource at depth.

| |

The 2020 PEA’s opex costs at New Polaris are in the lowest quartile of the industry with a high-grade resource practically begging to get mined.

The head grade in the PEA is 10.3 g/t gold — and that includes a 20% mining dilution (waste) already factored in at New Polaris. This makes Canagold Resources one of the more compelling levers on rising gold prices.

|

The company is currently trading for just US$22 of enterprise value per global resource ounce. That’s less than half of its peers with similar sized resources.

|

So just to get back to the average value of its peers on this metric, the company would have to double in price.

And Canagold could capture the market’s attention and get that re-rating in the near future: Canagold still has assay results left to release to the market and a resource update due by the end of the year.

In a gold market that should eventually soar higher off sky-high inflation, Canagold Resources has the value and the news flow to be one of the biggest winners in the days ahead.

| | | |

© Golden Opportunities, 2009 - 2022

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |