| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | Gold Continues To Fight Back

| |

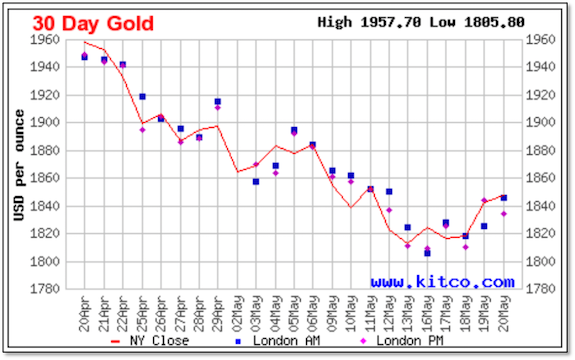

The metals are in recovery mode since the collapse in global stock markets forced selling in every other asset class, including gold and silver.

While the rebounds are encouraging, it’s still early and there’s undoubtedly more volatility to come.

| | | |

Today’s market action in gold has been encouraging, discouraging and completely unsurprising.

|

After trading as much as $20 higher in overseas trading this morning, gold was immediately sold off on the opening bell in New York and gave up most of those gains.

It’s still up about $5.00 as I write, but there’s no telling where it will end up today.

Regardless, these daily battles are less important than the impressive bottom and rebound gold has traced out over the last week of trading.

|  |

The selling in New York is, of course, not unexpected. It’s a well-established pattern.

That said, today has been marked by a further rebound in the U.S. stock market, with the Dow as I write up nearly 700 points, and another significant drop in the Dollar Index from its recent highs.

|

I’m not sure what the schizophrenic market consensus is saying with these moves, but I do know this: I’m not convinced that investors have fully accepted the new reality of high inflation, slowing economies and central banks powerless to change things.

|

In short, the U.S. stock market is going to throw more hissy fits as the Fed continues its fight against inflation, and I fear that gold will once again be victimized by “sell everything” trading days.

Yes, the bounce of the past week has been encouraging, but I want the metals to prove themselves a bit more before I start to get excited again.

The good news is that there’s a great event coming up — the Toronto Metals Investor Forum on June 10-11 — where you can talk to many of the best junior mining companies and talk to a number of newsletter writers, including me, about their favorite opportunities.

You can learn more about this event in this video.

I’d love to meet up with you at the Toronto Metals Investor Forum — just CLICK HERE to register.

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |