| Major recession warning signal just delivered...

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

I’ve been warning that we’re on the very precipice of a recession, no matter what the talking heads on CNBC are saying.

Just this morning we got another major warning signal that, typically, most of the media are completely ignoring.

| | | |

None other than Federal Reserve Chairman Jerome Powell himself let the cat out of the bag.

|

In his post-meeting press conference early last month, he said the economy’s landing might be “softish.”

|

I interpreted that choice of words in the same way as famed investor Jeffrey Gundlach: Powell was admitting that a recession was likely.

|

I agree with Powell…but I didn’t until very recently.

You see, I’m a big believer in the innate dynamism of the U.S. Its natural state is robust growth, especially if the government can simply stay out of the way. It takes a lot to push the U.S. economy into negative growth.

On the other hand, we’re getting hit with a lot.

Most obviously, inflation right now is cancelling out a tremendous amount of growth. Even a very buoyant economy would have a lot of ground to make up just to get back to even.

|

And the economy is anything but buoyant right now.

| | Golden Opportunities continues below...

| | | SPONSOR:

StartEngine

| | The Future of Startup Financing

Crowdfunding is revolutionizing how startups raise money.

StartEngine bridges the gap between entrepreneurs and the retail crowd, democratizing venture capitalism.

- The company is led by Activision Co-founder Howard Marks and famed Shark Tank advisor Kevin O’Leary, both successful entrepreneurs.

- StartEngine has more than doubled revenue annually for three straight years. It has raised over $59 million from everyday investors.

- More than half a billion dollars has been invested on the company’s platform as the user base reaches an incredible 760,000! [1][2]

- It is on a mission to raise $10 billion by 2029.

Now is your chance to invest in this growing company!

| | Disclaimer:

Offering Circular | Related Risks

Reg. A+ offering made available through StartEngine Crowdfunding, Inc. StartEngine is not currently accepting investments from WA and TX. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

[1] Total raised includes startengine’s own raises and is inclusive of investments that have been closed on and investments that are received but not yet closed on.

[2] Number of users is determined by counting investor profiles with unique email addresses which are active and have been confirmed.

| | | Golden Opportunities continues...

|

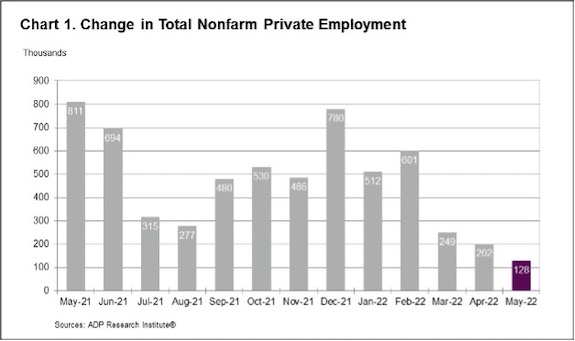

For example, last week’s ADP jobs report showed a net of just 128,000 private sector jobs created for May, a huge miss from the consensus expectation of 300,000. Not only that, but the April number was revised lower by 25,000 jobs to 202,000.

|  | | Click image to enlarge

|

This was not good news. As our friend Peter Boockvar noted, “Bottom line, the last three months has seen a marked slowdown in the pace of fresh job creation. The three-month average is 193k vs the six-month average of 412k and the 12-month average of 438k. The full year 2021 monthly average was 573k. ADP’s bottom line was this: ‘Under a backdrop of a tight labor market and elevated inflation, monthly job gains are closer to pre-pandemic levels. The job growth rate of hiring has tempered across all industries, while small businesses remain a source of concern as they struggle to keep up with larger firms that have been booming as of late.’”

Interestingly, ADP’s gloomy report was soon followed by a much brighter May Nonfarm Payrolls report, which showed a jobs gain of 390,000, against the consensus expectation of 318,000.

This was a positive surprise, boosted by a year-over-year rise in average hourly earnings of 5.2%. Remarking on this, Peter Boockvar again had the best comment, noting this “is the 7th month in the past 8 with a 5 handle. Unfortunately, however, inflation has an 8 handle.”

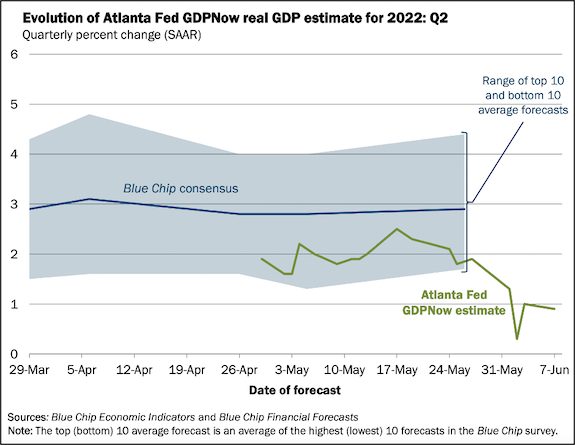

You can choose to believe the private-sector, directly reported ADP numbers or the government’s Bureau of Labor Statistics derived and adjusted report. Regardless, it’s important to note that these jobs reports have been accompanied by a flood of dour economic data in recent weeks — so much so that the Atlanta Fed’s widely-watched GDP Now model has now fallen to a second quarter GDP prediction of just 0.9%.

As you can see from the accompanying chart, the trend in this indicator has been headed solidly lower.

|  | | Click image to enlarge

| |

This is important because to meet the technical definition of a recession, the economy has to experience two successive quarters of negative growth. We’ve already had one quarter in the red, with Q1 coming in at -1.5%, so all we need is for Q2 to come in below zero.

With an average inflation rate for the quarter that’s probably hovering around 7%, whatever growth we have had is going to take a severe haircut.

|

At this point, it may be considered a surprise if we don’t slide into recession.

|

This is why I’ve been dumbfounded by all the analysts predicting a “possible” recession …occurring sometime in 2023. We may be in recession at that time but, if anything, we’re going to cross the doorway long before that.

This of course means that the Fed may be forced to relent on its monetary tightening far sooner than anyone — even me — had predicted.

I suggest that we all get prepared for this next big event in the markets.

| | And one way to do so is to sign up for this afternoon’s free “Ask Us Anything” webinar featuring me and my friend Nick Hodge.

|

As I noted on Monday, Nick’s a powerful force in the financial newsletter industry, one that I identified years ago just as he was getting started. Since then, I’ve grown to become a huge fan of his work and insights.

Given his expertise and this crucial time in the markets, it hit me that Nick would be a perfect co-host for an “Ask Us Anything” webinar, and he agreed.

|

So we’re hosting this webinar today — this afternoon at 4:00 pm Eastern/3:00 pm Central/1:00 pm Pacific.

|

Whatever you want to learn about our views on the markets — or anything else — just ask us. You’ll be able to submit your questions via the Q&A function in the webinar, but feel free to email us any questions in advance at [email protected].

This webinar is going to be both tremendously fun and tremendously valuable, and I hope you can join us.

Just CLICK HERE now to register!

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Register For

This Afternoon’s FREE

“Ask Us Anything”

Webinar

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |