| Still bottom fishing in the metals…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

The markets swung up…and then down…today, but the metals escape largely unscathed.

| | | |

I’ve got a ball cap buried in my closet somewhere that says “The beatings will continue until morale improves!”

|

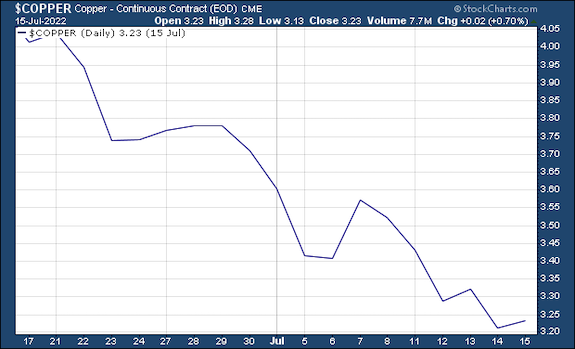

That non sequitur fits the current metals market perfectly, as the bulls in gold and silver — and might as well throw in copper and the rest — have been nowhere to be found.

| |  |  |  |

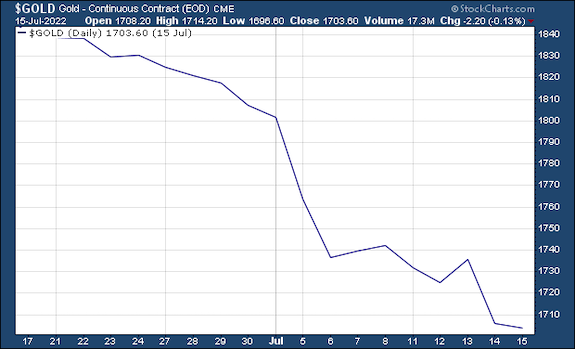

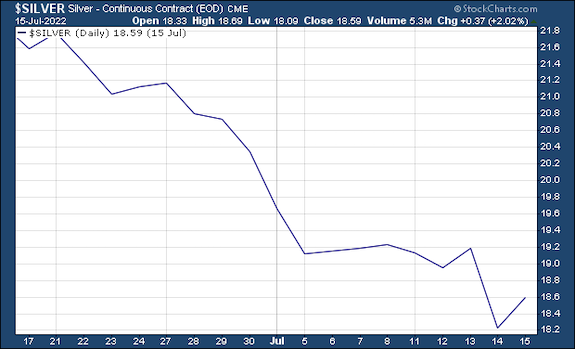

Yes, the washout in metals, both precious and base, has been vicious over the past month.

Today brought the promise of a turn-around, as not only the metals and mining stocks were up early on, but also the broader stock market. However, a report that Apple was pulling back on hiring and preparing for a recession sent the stock market reeling.

Fortunately, while gold, silver and copper gave up their gains for the day, as I write they’re essentially flat. So no more damage done.

However, as the charts above clearly show, the downtrends in the metals are still in force.

| | Golden Opportunities continues below...

| | | SPONSOR:

Safe Money Report

| | 3 Immediate Threats to Your Wealth

| | Three terrifying forces are converging to threaten your wealth.

Force #1: The destruction of decent INTEREST you earn on your savings. Force #2: The rapid erosion of your PRINCIPAL through inflation and Force #3: The gut punch to your PORTFOLIO in the crashing stock market.

I've prepared solutions to all these problems and more in my 7-step plan for 2022.

Click here for my 7-step plan for 2022.

| | | Golden Opportunities continues...

| |

For experienced hands in these markets, those of us who have experienced many downturns lasting months as well as the periodic summertime slumps over the last few decades, it certainly smells like a bottom.

But as I’ve been writing lately, and as Rick Rule and I noted in our webinar last week, there’s no telling if it’s the bottom. What we can say is that this market, especially for top-quality junior mining stocks with real, economic assets, is in an attractive buying range.

| | Timing Is Critical…And The Current Timing Is Enticing

|

If this was a typical seasonal bottom, then the correction would end sometime between right about now to mid-August.

With both the CPI and the PPI coming in with upside shocks (9.1% for the CPI and 11.3% for the PPI), the Fed has to show its determination at least one more time in next week’s meeting.

The good news is that Powell & Co. are seemingly set to raise rates by “only” 0.75%. The markets had feared a full point hike, but the latest reporting from (read: “leak to”) Wall Street Journal reporter Nick Timiraos shows they’ll go with the lower number.

Still, even a 0.75% hike will bring the Fed Funds rate effectively to the 2.0% level that I’ve been predicting would result in an eventual $1 trillion annual interest cost on the federal debt. (Interestingly, both The Economist and Bloomberg have just come out with analyses supporting the views I’ve been harping on for the last couple of years.)

The FOMC can of course overshoot this 2.0% mark, especially since it will take some time for interest expenses to adjust to the higher rates. Regardless, we are now in the range where the Fed’s monetary policies will create tremendous fiscal burdens and political blowback.

|

Add in the near certainty that the U.S. economy is now in recession, and you have powerful headwinds for the Fed’s tightening campaign.

|

If the downturn in metals and other commodities has been related to the Fed’s tightening and fears of recession — and it undoubtedly is — then I feel we’ll get some respite around late summer to early Fall, when the repercussions of the Fed’s higher rates will begin to be felt.

The bottom line is that while the timing is in question, the values in junior mining stocks aren’t. And with a number of solid juniors selling for about a fourth or less of what they would trade for in a normal market environment, there’s real opportunity for those with cash, courage and a longer-term view.

No, I’m not yet recommending a head-first dive into the junior mining pool. But I’m dipping some toes in myself, and I’d urge others to begin pecking away at some of the bargains.

Our August issue of Gold Newsletter, being published this Thursday, will cover many of today’s best values, including a couple of exciting new recommendations. If you’re not already a subscriber, CLICK HERE to make sure you get this issue hot off the press.

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |