| Fed debt costs are soaring and nobody’s noticing…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

With very little of the Fed’s rate hikes yet factoring in, the costs of servicing the federal debt are already rocketing higher.

Most surprisingly, no one is noticing.

| | | |

This is one of the most amazing developments I’ve ever seen.

|

As you know, I’ve been predicting that the rising costs of servicing the Federal debt will eventually force the Federal Reserve to not only stop its rate hikes, but completely reverse course.

I’ve been predicting that federal interest payments would soar and force the Fed’s hand sometime this fall.

Now it looks like it could come far sooner.

| | A Shocking Chart

|

Yesterday I was trying to catch up on the markets, and some sleep, after a grueling 24 hours of travel back home from Ireland. At some point as I was perusing Twitter in a daze, it hit me that I hadn’t checked in on how the Fed’s rate hikes, begun in mid- March with a mere quarter-point hike, had affected federal interest payments.

These are quarterly reports, so I wouldn’t have expected the Fed’s hikes to have had much of an impact yet.

Boy was I surprised.

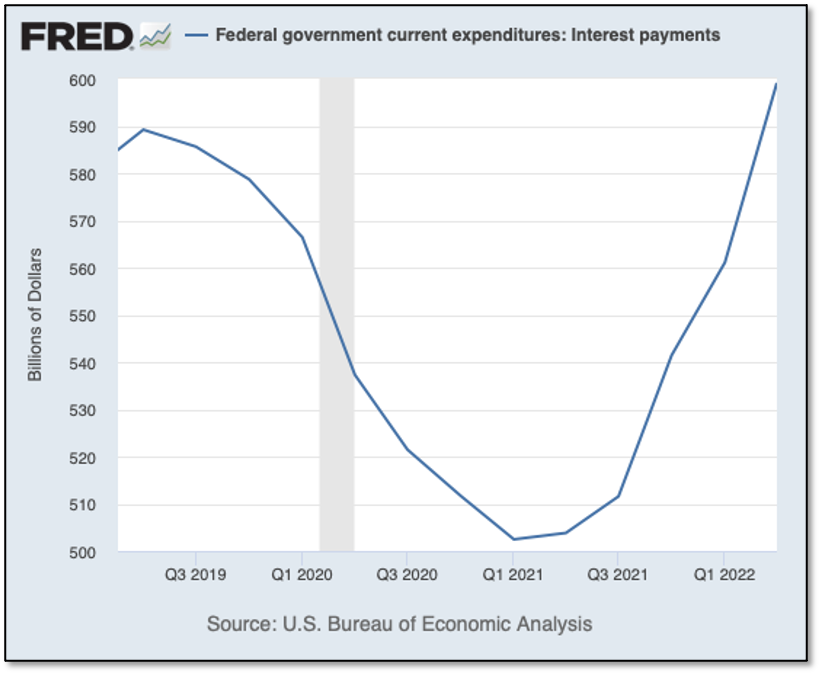

In fact, debt-service costs have already soared past pre-pandemic levels and are headed straight up. Consider this chart:

|  | |

Federal interest payments are already running at a $600 billion annual clip, even though these numbers are likely only reflecting the Fed’s initial quarter-point rate increase.

Can you imagine where there’ll be once the FOMC’s multiple three-quarter-point hikes start to hit in the weeks just ahead?

I can imagine it. In fact, I’ve been predicting that these costs will soon exceed $1 trillion per year...and that this will be a political flash point that spark talk of debt default.

Still, even I was amazed at how these costs have responded so quickly. The reason, of course, is that interest payments are tremendously sensitive to interest rates...and also because the federal debt itself has soared.

Now consider this chart:

|  |

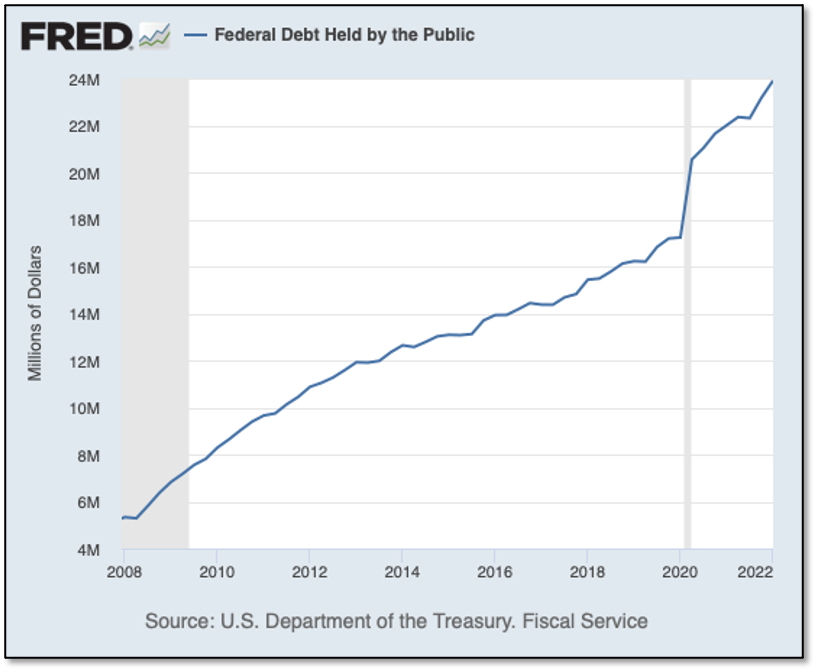

As you can see, federal debt held by the public is a vast multiple of what it was at the time of the last financial crisis in 2008.

So even small increases in interest rates will have an outsized effect when the debt is this large.

The bad news is that we’re not getting small rate increases — the rate hikes now in the pipeline are much higher than we’ve seen at any time since Paul Volcker. Moreover, they’ve come over weeks, not years as in the Fed’s last crisis response.

|

No one is yet talking about this factor, but it won’t be long before it starts to make headlines.

|

Take advantage of your head start — make sure you’re positioned in gold, silver and mining stocks...and that you’re registered for this year’s exciting New Orleans Investment Conference (CLICK HERE to learn more and register.)

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. We’re hosting a blockbuster webinar with Danielle DiMartino Booth, Adam Taggart and yours truly. The Fed: Stuck Between A Rock And A Hard Place will explore the ramifications of the Fed’s continued tightening into a recession, and what investors need to do to prepare for these consequences. The webinar is next Tuesday, August 23rd at 4:30 pm Eastern, and you’ll need to register now if you’d like to attend.

CLICK HERE to reserve your place.

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |