| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

In anticipation of more hawkish rhetoric out of the Jackson Hole central banking confab, the markets are tumbling today.

Only two assets are bucking the trend….

| | | |

I see a figurative sea of red as I look down the list of stocks and assets on my computer screen this morning.

|

Only two “assets” are splitting this Red Sea — the U.S. dollar and U.S. Treasury yields.

|

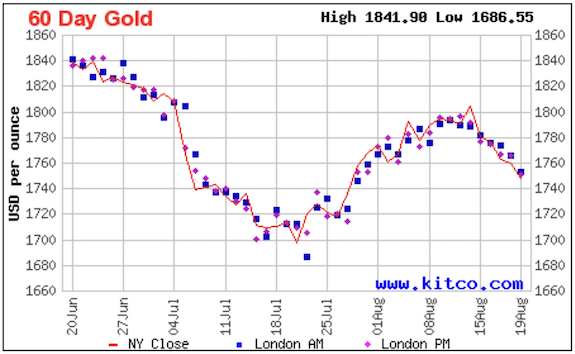

As you can no doubt imagine, gold is being hit along with the U.S. stock market and other risk-on assets like crypto. Interestingly, however, silver is essentially flat.

|

The driver of these moves lower, of course, is Fed policy. The central bank’s rhetoric and determination to continue hiking rates has been sending more shivers through the market recently, and the prospect of Jerome Powell’s Jackson Hole speech on Friday morning is turning those shakes into full-blown convulsions.

As I write, the major stock indices are down well over 1% (with the Nasdaq pushing a 2% loss), the Dollar Index has leaped over 109 and the 10-year Treasury yield has popped over 3%.

Those are not good metrics for gold, which is currently not being viewed as a safe haven by Wall Street traders. The metal is down about $10.

|  |

As you can see, this trend is putting the late-July bottom at risk. If the current market view of a Fed determined to continue tightening into a recession persists, it’s likely that gold will at least trace out a double bottom. Or worse, continue below $1,700.

I remain confident that a reckoning with the soaring cost of financing the federal debt is coming, probably sometime in October or November.

I’ll save more-detailed commentary on that subject for tomorrow, when we’re going to host an extraordinary webinar…

|  |

As I’ve noted, the Fed has a choice now of either fighting inflation or recession, and it may not be able to do either.

|

I’m excited about tomorrow’s webinar, because we’re going to explore the limited options facing the Fed and the compelling repercussions for the markets offered by each.

|

And my co-panelists will include two great friends of mine: Adam Taggart of Wealthion (and one of the best interviewers around today) and Danielle DiMartino Booth of Quill Intelligence (a veritable “Fed whisperer” thanks to her years of experience working inside the central bank).

I urge you to CLICK HERE to sign up for this invaluable webinar now.

| |

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |