|

In March this year, Rio Tinto acquired a large portion of the Rincon salar high in the Andes of far northwestern Argentina for $825 million.

|

This is in the Lithium Triangle, which is already the source of more than 50 percent of the world’s lithium.

Concurrently, in the southeastern portion of the same salar — or salt flat — Argosy Minerals, an Australian developer, is starting production this year.

Suddenly, the Rincon salar is abuzz.

|

And now, Argentina Lithium and Energy Corp. (LIT.V; PNXLF.OTC) has announced discovery assays from its first hole in the southwestern section of the salar called Rincon West.

|

And here’s where it gets exciting: Initial results are equivalent in grade and interval to the resource estimates for both Rio Tinto and Argosy.

LIT has been drilling the next six holes at Rincon West since July with assays pending. Will the discovery confirm?

|

One great aspect of this crucial initial hit is that Argentina Lithium itself has not yet been discovered by the market and still sports a tiny market cap of just C$15 million.

|

With two aggressive neighbors — and many others nearby — news of LIT’s confirmation drilling results will travel fast.

For a sense of near-term proportion here, the average market cap of lithium companies with a qualified resource estimate — that is, in early development — is well above $100 million.

|

|

We all know by now the world needs more lithium.

Elon Musk, the No. 1 influencer and head of Tesla, stated that “lithium batteries are ‘the new oil.’”

He has exhorted entrepreneurs to invest more in the sector, stating that getting into the lithium business is “like printing money.”

|

To give just one statistical estimate, the International Energy Agency (IEA) stated in August that, as of May 2022, the price of lithium had risen seven times over since early 2021.

|

The report went on to say that 50 new average-size lithium mines are needed by 2030 to catch up to demand.

Comparing what is wanted with what is real, only four new lithium mines are projected to start production in 2022 globally.

Two of the four new mines are in Argentina — where the government means business and anxiously needs foreign exchange credits — and one of them is Argosy at the Rincon salar, directly across from Argentina Lithium’s Rincon West project.

|

The Rincon Salar Is Next Up

|

In an effort to increase its lithium production, Rio Tinto acted in March this year by acquiring the Rincon Mining concession and lithium resource at the Rincon salar in Argentina for $825 million.

That’s a serious first commitment, even for a company of Rio Tinto’s size.

|

| |

RIO’s plan is to use direct lithium extraction (DLE), rather than evaporation ponds, asserting that DLE is far better for the environment, uses less water and speeds up the process by one to two years.

The company has started a pilot plant on site with an aggressive drill program using multiple rigs.

RIO acquired a measured and indicated resource estimate from Rincon Mining of 5.8 million tonnes of lithium carbonate equivalent (LCE) grading 367 milligrams/liter lithium in brine.

|

Argosy Minerals: First Production Pending

|

Argosy Minerals is targeting production at the rate of 2,000 tonnes of lithium carbonate starting this year — first battery-grade output in October — and to use this production to earn the capital to increase output to 12,000 tonnes/year.

The company is using evaporation to concentrate the lithium, and processing directly to lithium carbonate on-site at the salar. (FYI, Argosy has 1.4 billion shares outstanding and is illiquid in North American markets.)

The company’s qualified resource estimate is 245,120 tonnes LCE at a grade of 325 mg/L lithium in brine.

They have an exploration target to more than double the size of the resource at around the same grade.

|

Argentina Lithium:

Confirming Discovery

|

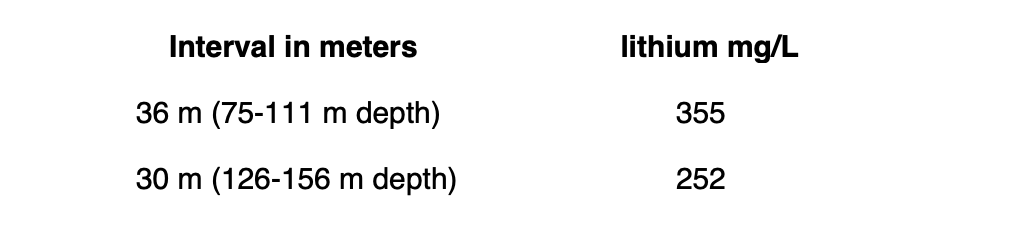

Argentina Lithium’s first drill hole — one-to-two football fields from RIO’s concession — assayed as follows:

|

|

In addition, several shorter intervals above and below the 75-meter to 156-meter depth graded 225 to 380 mg/liter.

These initial results are in line in terms of grade and interval with the resources of RIO and Argosy, with Rio at 367 mg/L, Argosy at 325 mg/L.

For sure, the upcoming confirmation assays will be a big deal.

|

| |

| Click image to enlarge.

|

With exploration of lithium brine in salars, the geophysics is of paramount importance. Higher-grade lithium brine LIGHTS UP.

To review the exciting geophysical workups for the drill holes now underway at Rincon West, visit the company’s presentation at www.argentinalithium.com.

|

|

Shortly after announcing the discovery hole at Rincon West, LIT announced acquisition of a new concession, Rinconcita II, which is adjacent to Rincon West to the east, and also joins Rio Tinto’s concession at Rincon as shown in the accompanying map.

|

| |

| Click image to enlarge.

|

Several lithium companies wonder, how did this small outfit acquire such prime locations when so many larger companies have been after them?

The same question is raised regarding LIT’s other concessions in the Lithium Triangle — as we will address, these are absolutely prime locations.

|

The short answer is that Argentina Lithium is a member of the Grosso Group.

|

The Grosso Group has been a pioneer in Argentina exploration since exploration commenced there in 1993.

The group has made networks of allies at all levels: Villages, individuals, suppliers, government officials and provincial authorities.

They maintain a strong focus on the environment, the communities and the cultures in the areas where they operate.

The Grosso Group has generated four world-class discoveries in Argentina, which are also known and appreciated:

|

• Gualcamayo gold, in production by Mineros SA

• Chinchillas silver/lead/zinc, in production by SSR Mining

• Navidad silver, controlled by Pan American Silver

• Amarillo Grande uranium, controlled by sister company Blue Sky Uranium, the largest uranium deposit in Argentina

|

|

| |

| Click image to enlarge.

|

Another Project With A Great Location

|

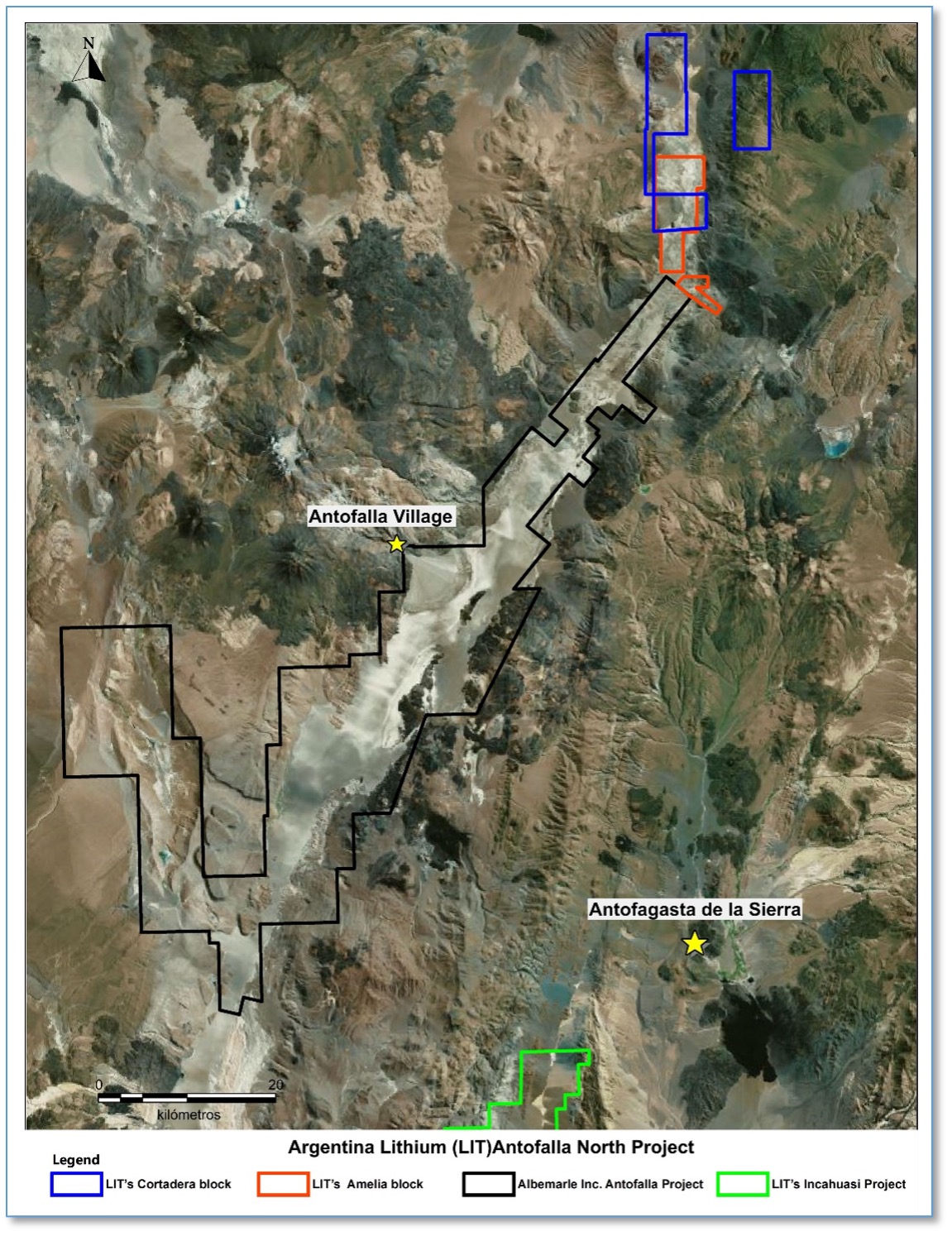

Elsewhere in Argentina, the Antofalla salar is long and narrow, located 25 kilometers west of the Hombre Muerto salar, the country’s largest lithium-producing area.

Antofalla South is controlled by Albemarle Corp., the world’s largest lithium, lithium carbonate and lithium hydroxide producer.

Albemarle has stated publicly that the company controls one of the largest lithium resources in Argentina at Antofalla South, with no further information provided, and they continue to drill with multiple rigs.

|

|

| Click image to enlarge.

|

Here, Argentina Lithium controls Antofalla North and is performing geochemical and geophysical workups in preparation for drilling next year. The geophysics is already tantalizing.

LIT also controls concessions at the Pocitos salar and the Incahuasi salar, in the basin adjacent to Lake Resources’ near-term producer, the Kachi Project.

Both areas are receiving geophysical workups in preparation for drilling to follow.

|

|

With a new discovery adjoining Rio Tinto in the productive Rincon salar in the Lithium Triangle of Argentina, Argentina Lithium is a great place to be.

|

But there’s an urgency to this investing thesis: With assays pending on the next six holes, this stock could be gone like a rabbit shortly.

|

Today, Argentina Lithium is a very low market cap opportunity in the heart of one of the world’s truly giant lithium-producing areas, and guided by a team that lives and breathes discovery.

The timing is perfect to look into Argentina Lithium & Energy.

|