| How To Profit From The Offshore Property Rush

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | How To Profit From The Offshore Property Rush

| |

The convergence of demographics and scarcity is creating unique wealth opportunities in real estate. Here’s how you can get on board...

| | |

Dear Fellow Investor,

Wow — this year’s New Orleans Investment Conference was a smashing success...and an absolute whirlwind. While I’m still compiling my notes to share with you, please enjoy this summary of the booming offshore real estate market from our good friends at ECI Development.

— Brien Lundin

| | | How To Profit From A Real-Life Time Machine

| | By Michael Cobb

Chairman and CEO

ECI Development

| | | If we could actually see what was going to happen in the future, we could develop products and services that everyone would want and need. And then, of course, we’d do very well for ourselves.

You’d certainly make better investment decisions, wouldn’t you?

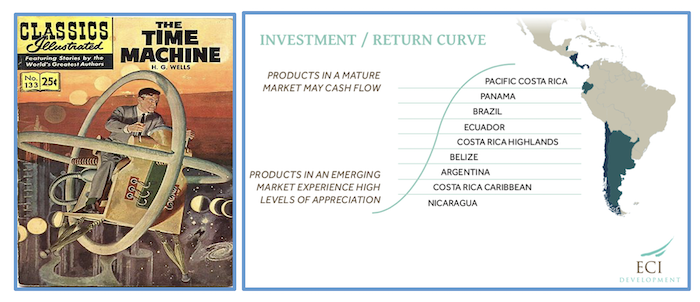

|  | | A fantasy time machine versus Latin America – a real-life time machine.

| | While we can’t go forward in time for a sneak peek, we can, in a way, travel back in time and let the future we already know catch up to us.

Here’s how.

Investing in developing countries is like time travel because we can position ourselves in the “path of progress.” We already know how things developed in North America. This is like seeing the future because development patterns generally repeat. It is possible to predict what likely comes next.

| | Investing in the developing world is really like being able to go back in time. With knowledge from our North American “future,” we can predict and provide the next product or service coming down the road. This is real investment power.

| | But it gets better. A lot better. A great shift came about with the COVID pandemic and how various governments around the world handled the situation. Suddenly all kinds of people from a variety of industries can work from home (or anywhere!). People are now recognizing and realizing the freedom they seek all over the globe. This is the Remote Revolution.

Millions of North Americans are already living overseas. For a lot of reasons detailed below, more and more will. Get ready. There is going to be a lot of money made by somebody. Why not you?

| | It Happened Before And I Was Lucky To Be A Part Of It

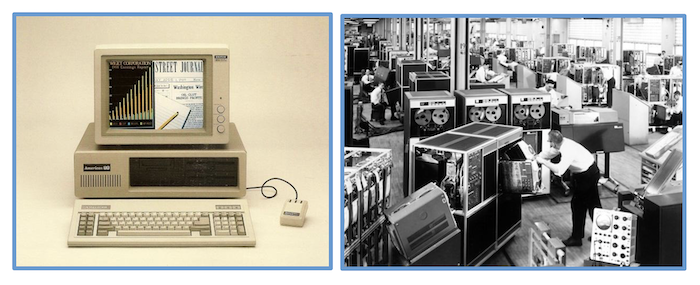

| | I was among those fortunate enough to be a part of the early personal computer wave of the late 1980s and early ’90s. Now the truth be told, it wasn’t foresight that put me there…just plain luck. But I was there and it was a great time to be in the computer business.

|  | | A race for supremacy in the marketplace.

| | The principle reasons the tech sector performed so well financially when it did was because of the union of two major factors, demographics and scarcity. It was the powerful convergence of these two factors that led to the great adoption of PCs, their massive, widespread use and the incredible wealth created for savvy investors who could see the future.

Millionaires and billionaires were minted with the convergence of demographics, demand and scarcity.

The first factor was demographic. Baby Boomers began moving into management positions in industry during the 1980s. They embraced change and the wonder of a computer they could use personally and not remain completely dependent on a bunch of smart guys down in the basement. The PC delivered significant useful value for individuals open and welcome to change.

The second factor was scarcity. Supply could not keep up with demand. More people wanted PCs than were available for a significant period of years. It produced huge opportunities for investors and entrepreneurs. We know the famous names of the billionaires. Gates, Allen, Dell, Case, Jobs and many others. Thousands of millionaires were created too.

The success of the PC and the fortunes made are a great example of the convergence of demographics and scarcity. Investors reading the tea leaves wisely, saw the trends. Many invested in these companies and did well too.

| | It’s Happening Again Now…

| | The convergence of demographics and scarcity is happening again.

This time it’s in response to a post COVID world and one that values freedom, quality of life, affordability, great weather and an abundance of exceptional recreational activities.

Numerous sectors like health care are poised to do well, but much of that future success has already been priced into the market. To really profit from this convergence, one must “look under different sand,” as my friend Steve Sjuggerud says.

|  | | Look where others aren’t to find the best opportunities.

| | Find the opportunities others are overlooking. This is where the real prize awaits. And one tremendous opportunity is under our noses right now.

| | Latin America:

The Data Is Powerful And Compelling

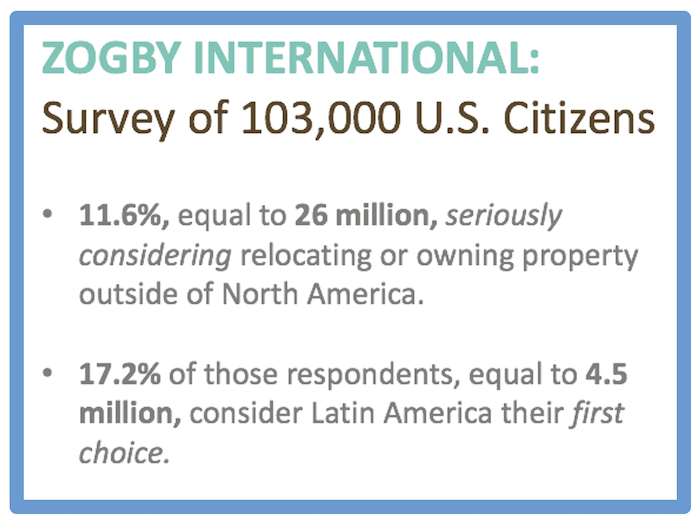

| | Zogby surveyed 103,000 Americans and discovered that 11.6% — equivalent to more than 26 million people nationwide — have a desire to move or own property outside the United States. Of those, the equivalent of 4.5 million listed Latin America as their first choice as a relocation destination.

|  | | Why Latin America?

The most important reasons people are looking at Latin America are the “soft” factors like proximity to the U.S., Canada, family and friends. Flying in a north/south direction limits the time zones crossed to two or three, making travel and communications back home simple and easy. Safety, stability and services are important base lines, but convenience is perhaps just as, or more important, in the end for consumer satisfaction.

Latin America is growing by leaps and bounds. Innovative policies on the part of the countries themselves have become fundamental in attracting foreigners and hence their capital, to the region. More than a million North Americans reside in Mexico part or full time, over 40,000 Americans have homes in Costa Rica and more than 20,000 call Panama home part or all of the year.

Each country in the region has its own attractions and incentives that draw tourists and permanent residents alike and they are all competing to provide excellent retirement packages.

| | Capitalizing On A Crisis Of Supply

| | There are plenty of houses in Latin America. So where’s the shortage? It is only when one examines the supply of high-quality homes in the region that one quickly sees the impending shortage.

If one considers the amount of residential product with world-class infrastructure and amenities, the shortage is magnified immensely. Knowing why there is a shortage of supply is critical to understanding why investment in the region makes so much sense.

Most developers in the region sell a speculative type of product. It has also been called “cut and run.” This literally means that a developer buys a large tract of land, adds the minimum infrastructure like dirt roads and electric poles, then sells the lots to speculation buyers. Many homes in the region are built to a standard we would not accept and enjoy. For example, cold water only plumbing to showers is common in the region. I don’t know about you, but I love a hot shower.

A survey by Christopher Kelsey & David Norden clearly points to the growing consumer demand for products with high levels of infrastructure, amenities and “reality.” Developers agreed by 92% that consumers will want to see the infrastructure and amenities completed before purchase; 85% see an increased trend by consumers to purchase completed homes and condominiums rather than vacant lots and pre-sales opportunities.

|  | | | High-quality construction and North American standards.

| | Yet very little of this product exists in Latin America designed to serve North Americans. Hence the shortage and incredible opportunity to fill a huge and growing need in the marketplace. Consumers who are now in the market to invest overseas want and need something different, as the Norden survey and other research data suggests.

This next wave of property buyers in Latin America want a product that they are familiar with and one that meets their standards and expectations. ECI is one company that delivers what these clients expect. You may want to look at what we are doing and how you can participate. Click Here to see how.

| | The “Time Machine” opportunities right now are dramatic and timely. The “Path of Progress” is always moving.

| | We don’t often get the chance to spot trends early with vehicles in place to ride the wave. Seize the moment. The timing is great and exploring the options simple, easy, quite likely very profitable. Learn more. You’ll be glad you did.

| | For more information about international real estate, retirement opportunities abroad, tourism destinations and investment opportunities click here.

| | Note: If you are an accredited investor and would like to how you can participate and capitalize on this major demographic shift, send us a note and we’ll e-mail you a short summary of an exciting private equity opportunity.

| | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |