| A real silver squeeze now beginning…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | A Real Silver Squeeze In Progress

| |

It looks like another silver squeeze is now beginning — but unlike the previous situations, this one could truly shake up the market.

PLUS: I’m speaking at an exciting new investment event that you can join virtually…

| | | |

If recent data — and some little-noticed correspondence between the Comex futures exchange and the CFTC — are any indication, we could be in for a new silver squeeze that will finally upset the rigged “paper silver” game.

|

Allow me to explain…

Anyone who’s been active in the metals market lately knows that premiums for silver bullion are sky high. In fact, it’s hard for me to recommend buying anything at all while the price for a silver American Eagle gold coin is well over $37 with spot silver trading under $20.

|

These periodic surges in physical demand and bullion premiums actually occur with surprising regularity, and are typically reflective of lousy business practices and inventory management from government mints. (Surprising, right?)

|

I’ve also been skeptical that any sort of a “silver squeeze,” which is typically focused on smaller, retail bullion products, will have any impact on the larger supply/demand dynamic for silver...or that even the larger ETFs can have much of an impact on the Comex’s rigged paper silver game.

But something bigger may now be afoot in the silver market.

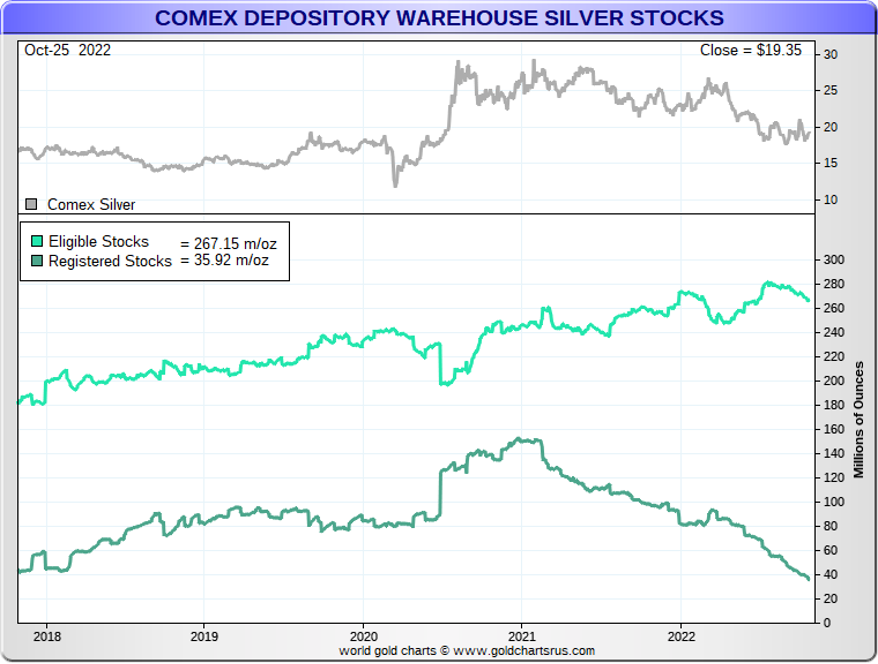

For one thing, the level of “registered” silver stocks in the Comex warehouses has been plummeting, and has recently hit historic lows.

|  |

As you can see in this chart from Nick Laird’s GoldChartsRUS.com site, while registered stocks have fallen, the “eligible” stocks have remained fairly constant or risen.

|

To clarify, registered silver is eligible to be transferred to holders of future contracts who stand for delivery, while eligible stocks are, well, ineligible to be delivered.

| |

However, any owner of eligible silver can choose to allow their holdings to be transferred to the registered category, in a quick and easy transaction. So there’s always been some doubt as to how important a decline in registered holdings may be, with such a large overhang of eligible silver still out there.

Granted, some portion of the owners of eligible silver wouldn’t agree to sell their holdings on Comex, but there’s been no way to gauge how much.

Now a remarkable report by the always outstanding analyst Ronan Manly at BullionStar.com give us a good idea of how much of that eligible silver would not come onto the market...and one of his sources is the Comex itself!

You can read the report here, but to cut to the chase, Manly quotes from a Comex report to the Commodity Futures Trading Commission of its estimate that about half of the eligible silver is owned by long-term holders who would not consent to having their silver transferred to the registered category.

|

In fact, Manly notes, a good portion of the eligible holdings are held by large silver ETFs, most notably SLV, that wouldn’t be available to be sold on Comex at all.

|

To sum it all up, the next silver squeeze could be developing at this very moment. And this one, unlike those before, could have big repercussions for silver supplies...and the price of the metal.

| | An Exciting New Investment Event — With A Unique Twist

|

I’m happy to announce that I’ll be presenting at the first annual Expat Money Summit on November 7th at 11:00a.m. (Eastern)

The event is organized by my good friend Mikkel Thorup, the host of the Expat Money Show — one of the biggest podcasts for current and future expats.

Here’s what I’ll be discussing in my session: “The Inevitability of Higher Gold Prices”

|

1. What the likely course is for gold and silver in the near future.

2. How the actions of the Fed have made much higher gold prices inevitable over the longer term.

|

This is a great way to get a “bird’s eye view” of why the Fed will soon be forced to halt its rate hikes and even begin reversing them…and what this means for precious metals.

The event also features presentations from expert speakers who are specializing in other areas of investments and the expat lifestyle, like:

|

• Crypto & De-Fi

• Real Estate and Land Investments

• Tax Optimization & Off-Shore Setups

• Visas, Residencies, and Passports

• And much more!

|

Best of all? It’s totally free to attend! Just CLICK HERE to grab your ticket.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Register For

The Expat Money Summit

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |