| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | Waiting For The Next Spark

| |

After a dizzying rally to begin the month, the metals are consolidating the gains and awaiting the next catalyst.

That will undoubtedly come from the Fed, which continues to drive every asset class.

| | | |

It’s stupid, but completely expected at this point.

|

I know that statement could apply to any number of things these days, but the example I’m referring to is how every asset class is driven not by fundamentals, but rather by how high-frequency traders project Fed policy on a daily basis.

|

That’s what happens when the central bank comes to the rescue of the economy and financial markets on any and every recession or simple speed bump, for over 40 years.

|

What happens, as I’ve shown in numerous charts chronicling the stair-step process of ever-lowering interest rates as well as the explosion in money-printing following the 2008 Great Financial Crisis and 2020 Covid pandemic, is that these policies encourage the build-up of debt and make financial markets addicted to the ever-increasing flow of liquidity.

Which brings us to today, where the Fed and Washington’s irresponsible injection of unprecedented liquidity in the face of supply disruptions, and just as the economy was rapidly snapping back from its pandemic malaise, unleashed the highest inflation rates in 40 years.

|

And now that same Fed is trying to clean up its mess by rapidly hiking rates with little apparent regard for the consequences for markets or the economy.

| |

As I’ve recently noted, Fed Chairman Jerome Powell has indicated that they’re not worried about making a mess of anything, because they can always clean it up by easing once again.

Thus, they’ll continue to oversteer from one direction to the other, creating and busting bubbles with each turn.

The issue in regard to markets is that the Fed’s policies over the years have destroyed the historic relationships among financial assets.

Bonds do not trend higher when stocks trend lower, or vice versa. Gold does not rise in response to higher inflation, but rather falls.

This is because every market is priced on a daily, even hourly, basis by hot-money traders and their computers, and they’re setting those prices according to a very simple formula:

|

If the data or rhetoric is indicating easier money from the Fed (or in the current case, a pause), then buy everything. And if the indicators are pointing toward hawkishness, then sell everything.

|

Thus, all the previously inversely- or un-correlated assets have become positively correlated, because they’re all driven by central bank policy.

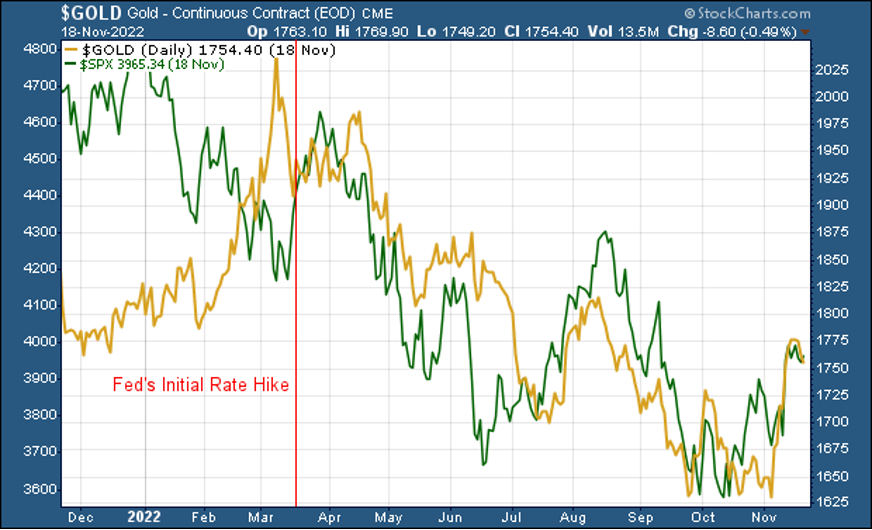

Consider this chart of gold against the S&P 500, two assets which should be negatively correlated or uncorrelated:

|  |

As you can see, the two assets have run in lock-step from the very moment of the Fed’s first rate hike this year.

The exception to all of this, of course, is the Dollar Index, which has maintained a tight inverse correlation to financial assets, as higher rates imply a stronger greenback, and vice versa.

So ignore every other fundamental factor or technical indicator — everything now depends upon what Powell & Co. do with their rate-hike campaign.

This begs the question of what happens next, with the Fed seemingly unconcerned about the damage it will wreak.

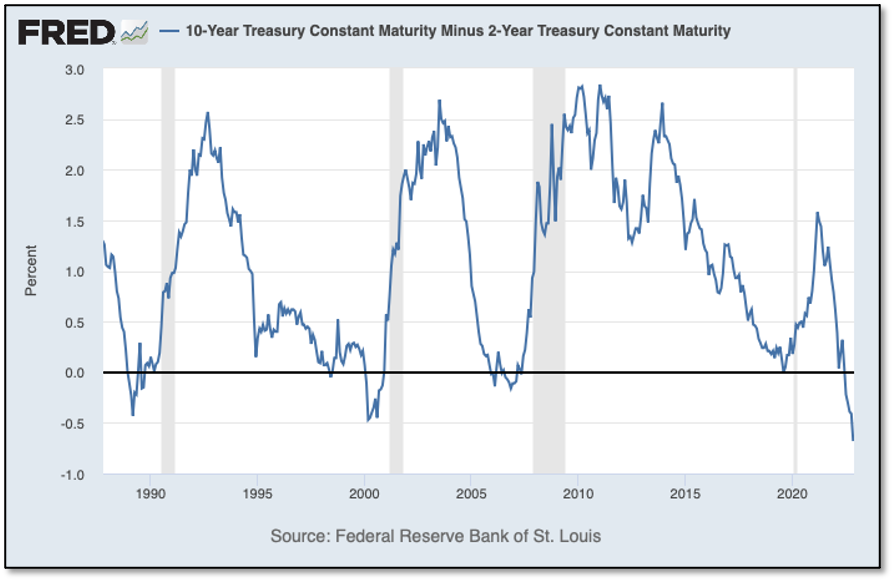

Well, we’re going to find out soon, as this chart strongly indicates:

|  |

Notice that the 10-Year/2-Year Treasury yield is not only inverted, it’s inverted to the greatest extent seen in 40 years. Notice those gray bars following every other significant inversion over that time frame?

Those are recessions.

So let’s stop arguing about whether we just had a recession with the two quarters of negative GDP growth, as there is little doubt that we are heading into another one. And this one should be much deeper and long-lasting.

|

At some point in the near future, then, Powell and his compatriots are going to have to break out their monetary mops, because there’s going to be a helluva clean up in Aisle 3.

|

Naturally, the upcoming pivot will be bullish for gold and silver, as well as most commodities and mining stocks. It will also be very helpful for equities in general.

But recent trading sessions have revealed an interesting development in gold and silver. Yes, the days after the Fed’s last meeting saw rallies in all the financial markets, but the precious metals shot upward like nothing seen in many years. Gold, in particular, posted three days within a week of near-$50 gains — an exceedingly rare event.

It was a dizzying rise, to be sure, so it’s not unexpected to see gold take a breather to consolidate those gains.

I do wish it would stop digesting that move soon, however, as the metals have spent the last week or so in a consistent price slide. Gold has dropped from a high of $1,783 to about $1,740 as I write, after losing another $14 today. Similarly, silver has fallen from $22 to around $20.70, losing another 17¢ today.

They’re not alone — all of the markets are down today, and the Dollar Index up, after hawkish comments from Fed officials over the weekend and this morning.

Regardless, I continue to believe that the Fed is close to the end of their hiking crusade. A half-point rise in December followed by a pause to reflect seems to be the market consensus, and I tend to agree with it.

Those looking for a spark to come in the Fed’s December meeting may be disappointed, though, because the Fed seems bound and determined to quash any enthusiasm on Wall Street.

In the meantime, we continue to focus on our junior mining shares, which are generally still near long-term bottoms that represent outstanding opportunities.

To learn more about these opportunities — and to make sure you receive our blockbuster, year-end edition of Gold Newsletter with extended coverage of our recent New Orleans Investment Conference, CLICK HERE.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |