| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | Gold Is Breaking Its Chains

| |

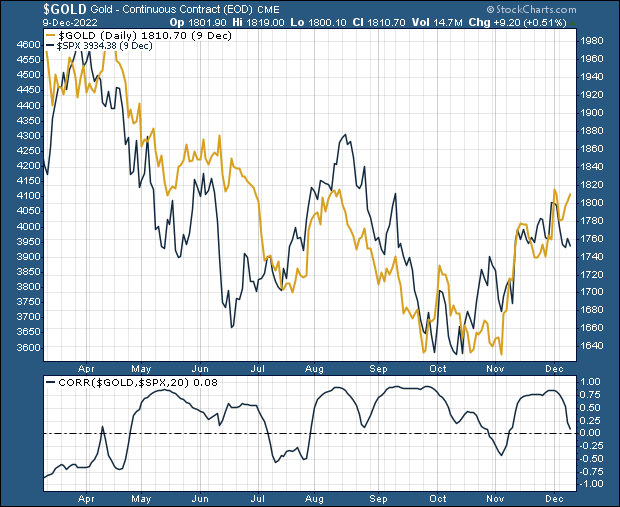

Gold and silver are continuing to decouple from the stock market declines. While it’s still early, this could be an important development.

| | | |

I’ve been writing recently how the metals were showing early signs of severing their bonds with other asset classes.

|

Ever since the Fed launched its rate hike campaign in March, gold has traded in a very close positive correlation with the U.S. stock market, with both rising or falling in line with the then-current interpretation of Powell & Co.’s intentions.

You can see that close correlation in the upper panel of the following chart of gold vs the S&P 500.

|  |

Not long after the Fed began raising rates in mid-March, gold and equities started trading in lock-step. Similarly, but in an inverse correlation, gold and the Dollar Index also locked up.

But also notice the lower panel in this chart, which shows the rolling 20-day correlation between gold and the S&P. During the vast majority of this time frame, that correlation was at the upper range, close to “1,” which would mark a perfect correlation wherein gold and stocks rose and fell in unison.

The only exceptions were times when gold dropped while stocks rose — mid-summer and most of October.

Now look at the end of that correlation trendline and notice how it’s now dropping precipitously from the most recent peak.

When I first wrote about this trend-change a couple of weeks ago, that 20-day correlation line was just beginning to dip. Now it’s falling like a rock.

|

Importantly, it’s doing that for the right reason: Gold is trending higher while stocks are trending lower.

| |

This is an important sea change, and one I’m about to explore in the most valuable investment newsletter of the year….

| | Our Massive Year-End Edition

Of Gold Newsletter

|

If this trend continues — if gold rallies while stocks fall off — it will support my potential scenario wherein the Fed is forced to pause, or perhaps even pivot, before getting inflation close to its target range.

If that happens, the environment would no longer be bullish for equities or bonds, despite the Fed’s more-dovish policy, because inflation would eat away at asset values. But such a development would be very bullish for gold and silver.

And if that attracts even a small percentage shift in the massive global asset allocations toward the metals, the resulting price gains could be explosive.

I’m going to delve much more deeply into this potential breakout in our traditional expanded, year-end edition of Gold Newsletter that will be published this Thursday.

If you’re not familiar with it, this issue is eagerly awaited every year for the astounding value it delivers.

|

Not only do readers get my usual take on the macro situation and the metals markets, as well as detailed coverage on dozens of today’s most exciting junior mining companies…

…They also get comprehensive coverage of our recent New Orleans Investment Conference, with excerpts from the presentations of many of the world’s top experts.

|

Readers are going to get extensive highlights from presentations by all of these speakers:

|

Peter Boockvar...Danielle DiMartino Booth...Dave Collum...Tavi Costa...Dominic Frisby...George Gammon...James Grant...Jim Iuorio...Brent Johnson...Lawrence Lepard...Brien Lundin...Robert Prechter...James Rickards...Rick Rule...James Stack…and The Real Estate Guys.

|

Plus, they’ll enjoy excerpts from these scintillating panels:

|

• Booms, Busts & Bubbles Panel: Albert Lu (MC), Peter Boockvar, Dave Collum, Jim Iuorio, James Stack

• The Economy Panel: Adrian Day (MC), James Grant, Brent Johnson, Mark Skousen

• The Future Of Money Panel: Adam Taggart (MC), Danielle DiMartino Booth, George Gammon, Russell Gray

• The Geopolitical Panel: Gary Alexander (MC), Dominic Frisby, George Gammon, James Rickards

• The Mining Share Panel: Rick Rule (MC), Brent Cook, Tavi Costa, Lawrence Lepard, Brien Lundin

• The Precious Metals Panel: Thom Calandra (MC), Omar Ayales, Rich Checkan, Dana Samuelson, Lobo Tiggre

• Open-Mic Attendee Q&A: Albert Lu (MC), Dominic Frisby, George Gammon, Byron King, James Stack

|

It’s all included in this blockbuster issue extending well over 80 pages in length.

Renowned as the greatest value in investing, you can get this special edition on Thursday — plus a full year of Gold Newsletter — at a special 30% discount if you can act now.

Just CLICK HERE to make sure you don’t miss it!

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |