| “Slowly, then all at once”...

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | “Slowly, then all at once.”

| |

The collapse of Silicon Valley Bank and the bailout (yes, it’s a bailout) of all depositors over the weekend sends gold and silver soaring.

It’s the first phase of the scenario we’ve been talking about — one that will send the metals to new record highs.

| | | |

It’s important to understand that there is nothing new under the sun.

|

What we’re seeing now with the collapse of Silicon Valley Bank over the weekend may have certain unique twists, but the tale it tells is ages old and rests on many invariable aspects of human nature.

So we can turn to pithy observations of past pundits to illustrate not only certain characteristics of the current crisis du jour, but also guide where we might be heading.

|

“History doesn’t repeat itself, but it does rhyme.”

— Mark Twain

|

Whatever they name this latest crisis, it isn’t the real estate-spawned Great Financial Crisis of 2008, nor is it the Covid-caused crisis of 2020. It has some elements of the Tech Wreck circa 2000, but many differences as well.

The primary uniting thread throughout all these crises can be illustrated by this chart:

| | |

This chart shows a four-decade and counting trend of the Federal Reserve “rescuing” the markets with ever-easier money after any recession or mere hiccup...and thereby providing the tinder for the next conflagration...which in turn forces them to lower rates again.

As I’ve been writing and saying over the past few months, today’s financial system was built upon the foundation of zeroed interest rates and the investment markets upon the promise of ever-easier monetary policy in the event of any disruption.

While I’ve had some thoughts about where the first crack in the next crisis might occur — derivatives, overseas real estate, the bond market — I’ve stressed that the one thing we could be confident in was another crisis of some sort.

Today’s financial world simply couldn’t withstand the most severe rate hikes since Paul Volcker was in charge (and when the federal debt was merely 35% of GDP, and not 125%).

|

Like a Hallmark movie, what we’re seeing now is the same plotline playing out once again, with only the names of the characters changed.

|

Granted, another difference in this script is that some pundits are credibly claiming that the government’s backstopping of depositor funds isn’t a bailout, since management and shareholders are shouldering the repercussions.

President Biden even assured us that no taxpayer funds will be used to restore the deposits.

Don’t be fooled.

This is a bailout of Silicon Valley itself, from Big Tech to start ups, from the largest VC firms to the everyday tech bros writing code for paychecks.

And Biden’s claim that none of the money covering the SVB deposits will come from taxpayers is another prime example of the economic ignorance of our political class.

Of course you and I are going to be the ultimate funders of this bailout. If all of the funds are covered by insurance premiums paid by banks, we’ll eventually end up paying for that in increased fees we’ll pay to our banks (or decreased interest paid to us by them).

And once the FDIC funds are depleted, we’re going to pay for it more directly, through taxes and/or money creation/dollar depreciation.

This is a bailout. Not exactly like the others, but one nonetheless.

|

“Slowly, then all at once.”

— Ernest Hemingway

| |

OK, that isn’t an accurate quote. Hemingway’s actual line from “The Sun Also Rises,” when the character was asked how he become bankrupt, was “Two ways. Gradually, then suddenly.”

Regardless, you get the point.

|

As the Fed began raising rates over the past year, the pressure on every market, on the very financial system itself, rose steadily.

|

Under the surface, the impact continued to spread. While we curiously observed that we had yet to see a “Lehman moment” in this cycle, there were some cracks seen here and there. The near-blowup of the British pension system was a notable one.

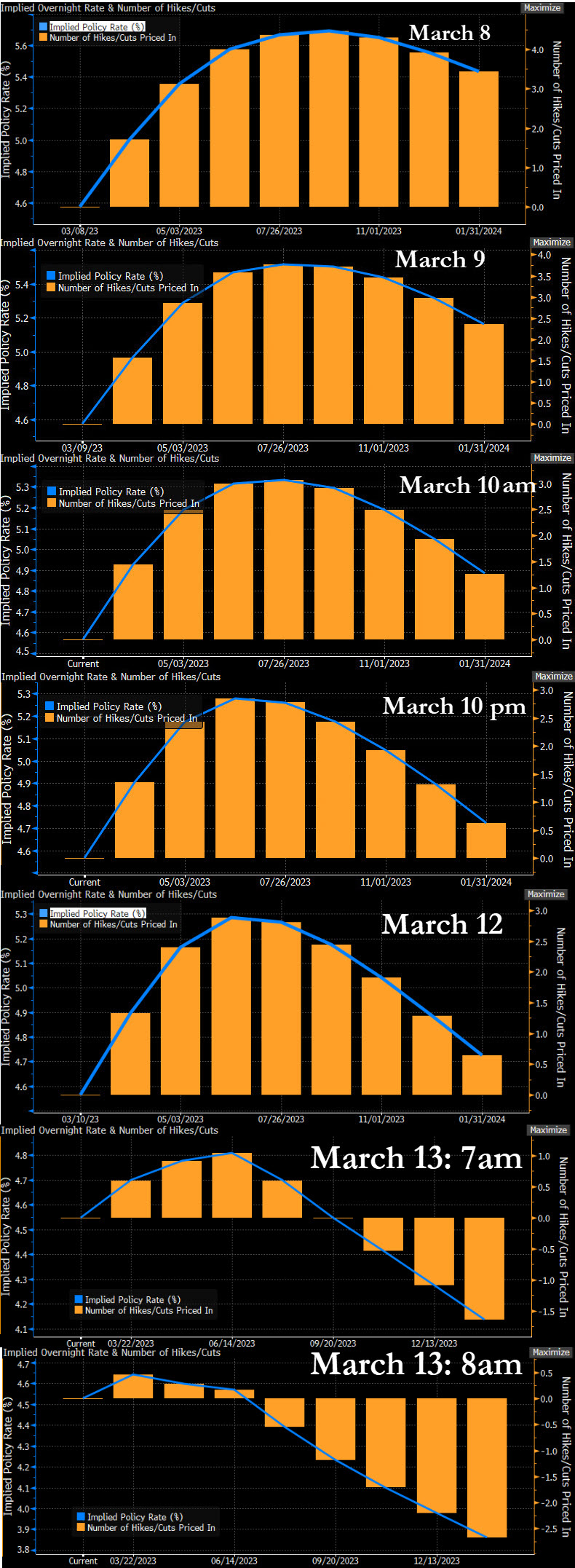

But over the past week or so, we’ve seen the process quickening. Note this graphic highlighted this morning by ZeroHedge:

|  |

As you can see, investor expectations for the fed funds rate and number of rate hikes over the next year have absolutely plummeted over just a little more than four trading sessions.

Welcome to the new reality.

The expectations for the next Fed meeting on March 22nd have gone from a 68% likelihood of a half-point hike as of last week to a 60% chance of just a quarter-point hike. And a good chance of no hike at all, especially if this crisis spreads.

Which brings me to our next guiding quote...

|

“There’s never just one cockroach”

— Warren Buffet

|

Warren Buffet is reportedly the first one to observe that “What you find is there’s never just one cockroach in the kitchen when you start looking around.” However, my friend Dennis Gartman popularized the adage in his daily letter as we passed through a number of market crises.

|

And it was always proven true. The first event...the first observed cockroach...was a sign of an infestation and a foreshadowing of what was to come.

|

In every instance, the regulators, bureaucrats and politicians stepped to the microphones and social media accounts to assure us that everything would be OK. The “full faith and credit” of the United States would stand behind the markets.

It’s worthy of note that Uncle Sam’s credit rating is being lowered with every successive crisis. Doing away with mark-to-market rules helps the government as much as it helps institutions and their shareholders.

This backing is otherwise known as the “Fed put,” and notwithstanding Fed officials’ claims of its demise over the past year, the response to SVB’s collapse show that it remains firmly in place.

Not only that, but the Fed, the Treasury and all of Washington are now backing this put. And it’s certainly not surprising in the least to see major hedgies like Bill Ackman and Dan Loeb cheerleading the Fed’s response. (I like to call this “situational ethics.”)

|

So where does this leave us?

|

We can dissect the proximal causes of SVB’s collapse ad nauseum, but the basic impetus is the same as in all the previous crises I noted above: human nature.

It’s intellectual arrogance...pure hubris...to believe that a few designated experts can manage the economy better than the aggregated decisions of individuals made in their own self interest. In other words, the free market.

Like trying to steer a slow-moving boat in a narrow bayou, every course correction tends to be an over-correction that simply leads you toward the other bank. And that results in yet another over-correction in an attempt to get you back on track.

Simply put, this is what our chart of the fed funds rate over the last four decades is showing — the cyclical over-corrections, and the creation of new crises, by the Federal Reserve.

|

We’re seeing the next furious turning of the wheel to avoid the bank, and the seeds of the next crisis being planted.

|

The valuation of Treasury holdings at par is simply another form of quantitative easing...i.e., money printing...and yet another new wrinkle in the Fed’s ever-easier monetary policies.

I’ve told you that whenever the next crisis comes, the Fed’s policy prescriptions will be a multiple of what they did in the last crisis, just as the post-Covid reaction was a multiple of the 2008 response.

So hang onto your hats — you’ll be blown away by what’s to come.

The market reactions to what’s occurred so far have been mixed in the U.S. stock market, with the major indices bouncing from well into the green to the red, as investors ponder to what degree the Fed will actually support the stock market. (Regional bank stocks are the exception here, as they plummeted before being halted.)

Elsewhere, the trends are obvious and firm: Treasury yields are nose diving; the Dollar Index, interestingly, is also dropping severely; and Bitcoin is soaring (as the rescue of SVB indicates that the Fed put is alive for crypto maxies as well).

|

And of course, gold and silver are skyrocketing.

|

As I write, spot gold is up $44.40 (2.38%) to $1,912.50 bid. Encouragingly, every bear attack is being summarily thrown aside. Also encouragingly, silver is outperforming, rising $1.29 (6.29%) at last check to $21.82.

Platinum is up 4.27% and palladium has jumped 8.50%.

Again on the positive side, the mining stocks are leveraging gold’s gains. The GDX is up 7.08%, the GDXJ is 7.45% higher, XAU has gained 5.94% and the Gold Bugs Index (HUI) has added 6.07%.

The good news is that while the junior mining stocks that we follow are also generally up nicely, the current levels remain a small fraction of where these stocks will trade in the market that I’m envisioning over the next few years.

In other words, my note last week that this window of opportunity remains open is still accurate.

More important, the scenario that I’ve been predicting — one in which the Fed is forced to pause while inflation remains persistently much higher than their target — is firmly in play.

If this continues to develop as expected, the hurdle of persistently higher inflation will make gold and silver much more attractive than stocks and bonds. And that should lead to small but very meaningful shifts in global allocations out of those assets into the relatively tiny metals markets...resulting in explosive price reactions.

So, yes, the chance to get positioned for this next big run in metals and mining stocks is still available. And I urge you to take advantage of it by subscribing to Gold Newsletter here.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |