| Ride the waves in this gold rally...

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

It’s important to remember that nothing goes up in a straight line, and this new gold bull market will have its own internal cycles.

The key will be to turn these to our advantage rather than being victimized by them.

| | | |

Gold soared nearly $70 on Friday as worries peaked over the state of the global banking system — and what major rescue efforts would emerge over the weekend.

|

As it turned out, the big news was that Switzerland authorities orchestrated a forced takeover of Credit Suisse by UBS, committing up to a third of the country’s GDP to rescue its banking system.

|

In response to both this move and gold’s huge run on Friday, the yellow metal has dropped about $13 today on a spot basis and, at least at the time of this writing, seems to be clawing back its losses.

|

That we’re seeing a correction in gold today is not surprising. In a Gold Newsletter Alert I dispatched to subscribers on Friday, I warned that we would probably see a pull-back early this week, but that drop should be followed by a renewed rally after the Fed’s big decision on Wednesday and as fears began to rise again going into the next weekend.

There is another important dynamic at play as well....

| | Golden Opportunities continues below...

| | | SPONSOR:

Midland Exploration

|  | | Midland targets the excellent mineral potential of the province of Quebec in Canada to make the discovery of new world-class deposits of gold and critical metals. Midland is constantly looking for partnership opportunities and is proud to count on reputable partners such

as BHP Canada Inc., Rio Tinto Exploration Canada Inc., Wallbridge Mining Company Ltd, Probe Gold Inc., Agnico Eagle Mines Limited, Osisko Development Corp., SOQUEM Inc., Brunswick Exploration Inc., Nunavik Mineral Exploration Fund, and Abcourt Mines Inc. Midland prefers to work in partnership and intends to quickly conclude additional agreements in regard to newly acquired properties. Management is currently reviewing other opportunities and projects to build up the Corporation portfolio and generate shareholder value.

| | | Listed on the TSX Venture Exchange since March 2017 as MD, the Company is led by a highly respected management and technical team with a proven mine-finding track record.

With an attractive, successful JV business model and an excellent share structure and well-funded, Midland is one of the most active prospect generators in Quebec.

For more information about Midland: midlandexploration.com

| | | Golden Opportunities continues...

| | Gold Decouples From Stocks

|

While U.S. stocks are higher today in the same corrective behavior as we’re seeing in gold, the broader stock market fell again on Friday.

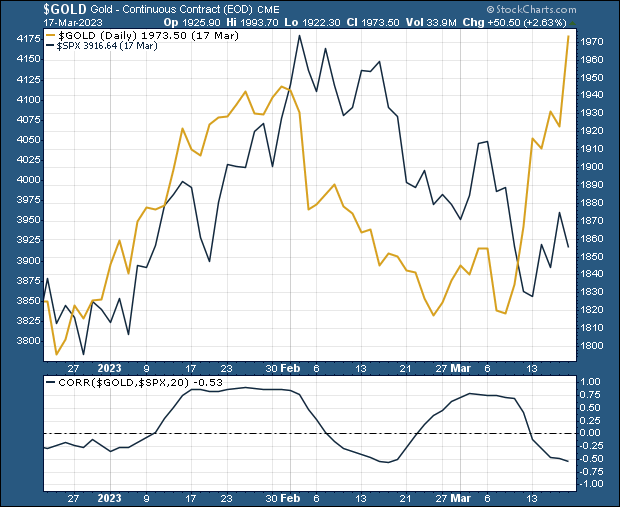

Taking a broader look, however, we see that gold has once again firmly decoupled from the stock market, and in a good way by rising while equities have fallen. Consider the following chart of gold and the S&P 500, with the 20-day correlation in the lower panel:

|  |

For years, ever since the Fed rescue efforts following the Great Financial Crisis of 2008, all the markets have been driven by the same all-powerful factor: Fed policy.

When that policy was historically easy, with zeroed interest rates and massive quantitative easing, all the markets floated higher on an ocean of central bank liquidity.

|

Asset classes that were traditionally counter-cyclical all began moving in unison. Stocks, bonds, precious metals and commodities all generally moved together, rising when policy seemed to continue easing, and falling when tightening seemed imminent.

|

Since the Fed began raising rates a year ago, this close positive correlation continued, with the only exceptions being a few short periods when stocks rose and gold fell.

But that started to change in December, as you can see from our chart, and we’ve been tracking this trend closely in Gold Newsletter.

In the lower panel of the chart, you can see that the 20-day correlation has dipped below the 0 line. This means that, rather than moving in unison, gold and stock are moving in opposite fashion. Even better: Gold has been rising while stocks have been falling.

The bottom line is that I believe the Fed will be forced eventually to pause its rate hikes while inflation remains persistently high. In fact, while I believe they’ll raise rates a quarter-point on Wednesday, that will likely be the last hike.

Once the Fed stops pummeling the markets with hikes, the markets will rejoice and they’ll all rise together.

Inflation, however, will remain elevated. And in that environment we’ll see continued shifting of portfolio allocations around the world toward gold and silver.

|

Given the tiny size of the metals markets relative to stocks and bonds, the resulting demand should send gold climbing to new record heights, and silver leveraging the move.

|

I’ve been reporting on this scenario over the past few months, and it seems like it’s beginning to play out now.

But, harkening back to my headline, it’s important to understand that this move higher will come in waves. We shouldn’t chase prices on feverish moves like we saw on Friday, but look to build positions on pull-backs.

And that’s what we’re seeing right now.

A worried market bid up the metals going into the uncertainty of the weekend, and we’re getting the natural corrective action today. Again, I expect the rally to renew after we get the Fed decision on Wednesday and as fears start to percolate anew toward the end of the week.

Last week I quoted Warren Buffet’s famous warning that “there’s never just one cockroach in the kitchen.” I’ll offer up another one of his sayings now:

|

“Only when the tide goes out do you discover who's been swimming naked.”

|

The point is, there seems little doubt that there’s much more to come in this emerging banking crisis. The risk-hedging policies of Silicon Valley Bank, or lack thereof, were likely duplicated by numerous banks in the U.S. and around the world.

You don’t raise rates at arguably the fastest pace in history, after building a financial system on the foundation of 5,000-year-lows in interest rates, without breaking something.

And probably a lot of things.

In short, there’s much more to come in this crisis, so make sure you’re ready to ride the waves higher in metals and mining stocks.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. Once again, we’re unveiling some extraordinary junior mining opportunities in Gold Newsletter. If you want to leverage the potentially record gains in gold and silver, CLICK HERE to subscribe.

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |