| The Single Best Report On Gold

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | The Single Best Report On Gold

| |

The annual In Gold We Trust report — the single best research report on gold — is going to be released in a few months.

In the meantime, its authors have given us a sneak peek with this remarkable “Preview Chartbook.”

| | | |

If you’re a serious investor interested in gold, May 24th is the day you need to circle on your calendar.

|

Because that’s when our friends at Incrementum AG, a highly regarded asset management firm in Liechtenstein, will release the 2023 edition of their annual In Gold We Trust report.

Simply put, this is widely regarded as the most authoritative report on gold investing in the world today. It’s worth a small fortune for anyone interested in seeing how gold fits in the global macro picture and getting a clear view on where the price will trend.

And while it’s worth a small fortune...Incrementum graciously provides it for free!

| | | A Stunning Preview

|

In Gold We Trust is the brainchild of noted market expert Ronald-Peter Stoeferle, who has been a valued presenter at our New Orleans Investment Conference. Ronni first published the report in 2007, and for the past 10 years has published it with his business partner Mark Valek.

If I haven’t made it clear yet, their work on this report over the past 16 years has been absolutely incredible — and from what I saw in a recent email from them, the next edition is going to raise the bar even further.

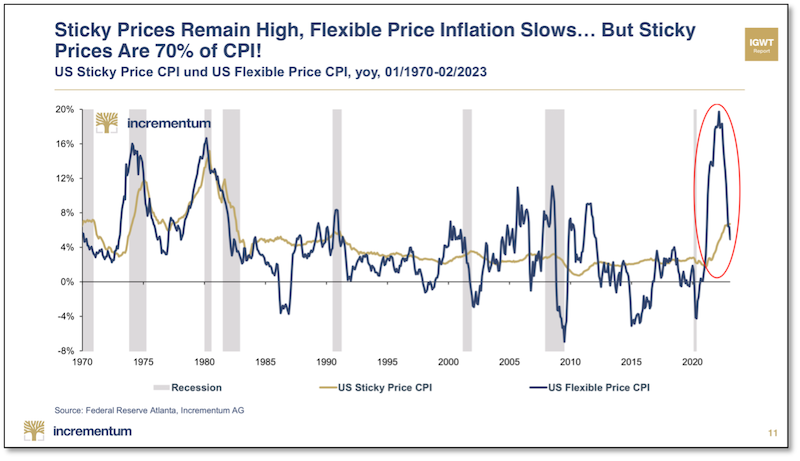

You see, while we await the May 24th issue date, Ronni and Mark and their team have just released a “Preview Chartbook” for this year’s annual report. I’ve just reviewed it, and found this first entry to be the most compelling of dozens of insightful charts:

|  |

As you can see, while “flexible” inflationary pressures are falling off as expected, the “sticky” elements are still rising precipitously.

|

And that’s important, because these sticky factors are fully 70% of the CPI calculation!

|

I explore some of the implications of this in our April issue of Gold Newsletter, being published tomorrow. In short, the precise bullish scenario that we’ve been predicting — one in which the Fed is forced to pause while inflation remains stubbornly high — is developing perfectly right now.

And gold and silver are soaring as a result.

But there’s another big surprise factor that’s been added to the mix, one that promises to make the situation even more explosive.

You can learn all about it, including three new stock picks I’ve just made to leverage the gains in gold and silver, by subscribing here.

|

But even as we celebrate and look to capitalize on these major moves in the metals, it’s important to keep the big picture in clear focus.

|

And the In Gold We Trust "Preview Chartbook" does just that, with dozens of compelling charts.

I urge you to click on the link below to review it now.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Get The "Preview Chartbook" Of The 2023 In Gold We Trust Report

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |