| The Wrath and Ramifications of Rising Rates…

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | The Wrath and Ramifications of Rising Rates

| |

Things are moving so quickly in this crazy world, it’s hard enough to get our bearings...much less figure out where we’re headed.

In this guest contribution, Russell Gray — one of today’s finest financial educators — clearly explains how we got here.

More important:

He provides powerful evidence of a “great reset” just ahead...and how we need to prepare for it.

| | | | Editor’s Note: Literally thousands of the world’s top financial minds have graced the stage at our New Orleans Conference and so many other events I’ve attended over the decades.

I’ve seen and heard them all. And one of the very best of them at explaining complex topics...perhaps the most effective financial educator I’ve ever seen...is my friend Russ Gray.

As half of the legendary Real Estate Guys duo, along with Robert Helms, Russ has taught countless entrepreneurs and investors how to understand the seemingly complex interplay of macro-economics and Main Street investing. So I’m grateful to him for providing today’s guest contribution — a clear and concise explanation of recent financial history — and why it’s pointing toward an imminent reset that we all need to prepare for.

Even more valuable: Russ explains how their annual Investor Summit can help you get ready for the volatile days ahead. I can vouch for why this event is invaluable — I attend every year, not only presenting but taking copious notes. I simply cannot recommend it any more highly.

I hope you enjoy Russ’ wonderful piece below — and urge you to click here to learn more about The Real Estate Guys upcoming Investor Summit.

— Brien

| | | | | Something’s Gotta Give:

The Wrath and Ramifications of Rising Rates

| | Are things stabilizing...or is this the calm before the storm?

By Russell Gray

| | Bank failures...persistent inflation...bankruptcies...layoffs...a run on Blackstone’s real estate fund...a global rebellion against the U.S. dollar.

If you’re not paying attention to these headlines, you probably should be. They’re the symptoms of a simmering problem many on Main Street are NOT prepared for.

| | Some think this rash of troubling headlines is the direct result of recent policy decisions...and there’s some truth to that.

Others think it can be traced all the way back to the 1913 “reset” and the creation of the Fed, income tax and IRS. Almost certainly.

Then there’s the 1971 “reset” when Nixon broke the global gold standard and unleashed the tsunami of debt the world is drowning in today. No doubt.

| | In more recent history is the 2008 Great Financial Crisis (GFC). I’ve come to believe the GFC was both a symptom of prior problems and a catalyst for the next shocking reset...which may be uncomfortably closer than many think.

Being completely asleep and ignorant of how the financial system really worked, the GFC nearly swept me into financial oblivion. But it woke me up and I started paying very close attention.

Fortunately, as co-host of The Real Estate Guys™ Radio Show and co-producer of our annual Investor Summit, I’ve developed friendships with some of the biggest macro-brains around…

| | …Peter Schiff, Robert Kiyosaki, George Gammon, Chris Martenson, G. Edward Griffin and Brien Lundin...to name a few.

I’m privileged to have been on prestigious panels with Jim Rickards, Danielle DiMartino-Booth, Doug Duncan (chief economist for Fannie Mae), Rick Rule, Grant Williams and many other REALLY smart and respected experts, including my aforementioned friends.

| | I’m not saying this to impress you, but to ENCOURAGE you.

Because if I can get my mind around all this heady stuff, so can YOU. And if you haven’t already, NOW is the time to REALLY start paying attention.

Because everything happening RIGHT NOW started slowly in 2008, and even though things are really picking up speed...there’s still time to position yourself for what’s likely coming.

Just like the children’s game, Mouse Trap, a series of cascading events triggered in 2008...almost all of it observable in the daily news…has been steadily driving towards a great reset of the financial world order.

| | Let’s take a short trip down memory lane…

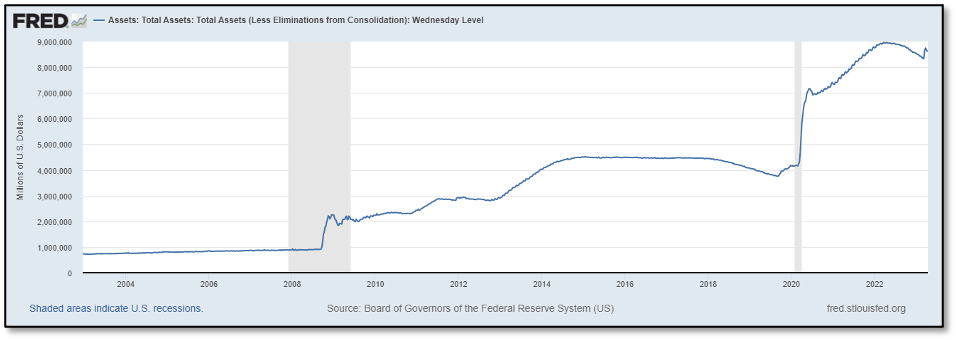

| | Prior to 2008, the Fed’s balance sheet expanded at a very steady, boring crawl...inching up a little each year to a pre-GFC level of about $800 billion. With a B. Not a T.

As you can see in the chart below, in 2009, the Fed’s balance sheet “exploded” to well over $2 trillion on its way to a post-GFC, pre-pandemic high of $4.5 trillion around 2015.

|  | | | In late 2008, I didn’t really know what this meant. I just knew it was unusual. But in March 2009, The New York Times reported…

| | “The Chinese prime minister, Wen Jiabao, spoke in unusually blunt terms...about the ‘safety’ of China’s $1 trillion investment in American government debt, the world’s largest such holding, and urged the Obama administration to offer assurances that the securities would maintain their value.”

| | Not knowing anything about the Fed, geo-politics, macro-economics, or even why the Chinese were worried, I started monitoring both China and the Fed.

Meanwhile, I began studying the bond markets and all the post-mortems on the 2008 crisis. There were several significantly important things I discovered…

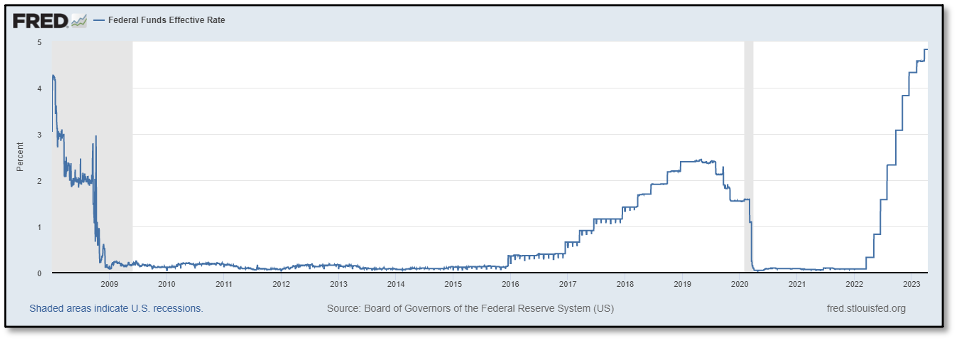

Bond values are inverse of yields. Maybe you already know that. I didn’t. But I’ve come to realize this is perhaps the single most important thing for a Main Streeter to understand about the financial plumbing.

Falling interest rates cause bond values to RISE. And decades of falling rates from 1980 to the GFC were blowing up a HUGE credit bubble.

Of course, the reverse is true. When rates rise, bond values fall. The faster rates rise, the harder bonds fall. This is the foundation of what imploded Silicon Valley Bank.

Here’s what interest rates did from 2008 to today …

|  | | Had I not been tracking China for the last 15 years I might conclude the effect of the rising rates on the highly leveraged (think derivatives) bond market is the whole story.

It’s not.

As you’ll see in a moment, China didn’t simply chastise Uncle Sam and sit idly. And as I studied the Chinese, I discovered they think long term and act with persistent patience.

Read The Art of War, The Stealth War, and The 100 Year Marathon.

| | Back to bond bubbles, the Fed, and then on to China…

| | While unrealized bond value losses littered across balance sheets throughout the global financial system is a BIG DEAL...it’s only PART of the story.

I discovered the most important player in the bond market is the Federal Reserve.

As you probably know, the Fed sets target interest rates. I learned the Fed buys and sells bonds to manipulate bond prices and therefore yields (interest rates).

If you’re not familiar, this is another important subject to understand. Now I finally understood why every financial pundit obsesses over everything the Fed says or does.

For our 2012 Investor Summit, G. Edward Griffin (The Creature from Jekyll Island) and Robert Kiyosaki (Rich Dad Poor Dad) joined us. We agreed it’s important to pay attention to the Fed.

In my presentation, I described the Fed as the elephant in the room...a beast so powerful it can easily crush you.

Motives don’t matter. Neither does skill. Whether careless, clumsy or hateful...if you’re on the wrong end of a Fed move, you’re in trouble.

| | Of course, as you can see from the chart above, Fed watching was boring for several years...until it wasn’t.

| | In our April 2013 Investor Summit, we invited Peter Schiff and PhD economists Robert Murphy and Mark Skousen...and we did a deep dive into economics.

I discovered the important differences and relationships between the economy, the financial system (banks and bonds), and the currency.

Along the way, I started watching gold as a barometer of currency strength and weakness.

Although I was only beginning to understand gold still plays a vitally important role in the global financial system, I noticed an interesting inverse correlation between gold and real estate:

| | | | There’s a lot to unpack here, but it’s a discussion for another day. Suffice it to say, when you hear talk of a housing bubble, gold might be a better place to store equity on your balance sheet.

Back to China…

In a presentation at the New Orleans Investment Conference in 2013, I chronicled a series of bi-lateral trade agreements China entered into starting in 2010.

Back then, I didn’t know what a bi-lateral trade agreement was, but I paid attention because it was China. It soon became apparent to me that China seems to be coordinating both an escape and an attack on the dollar...all the while denying it.

In early 2014, I wrote a special report chronicling news reports I’d aggregated which detailed China’s actions, accomplices, and denials. You can order a free copy here.

The theme of our 2018 Investor Summit was The Future of Money and Wealth. We talked gold, Bitcoin, energy, along with real estate, tax strategies and, of course, the dollar.

My opening presentation was an update on China’s continued assault on the dollar...and it’s growing collaboration with Russia. You can order this presentation here. Be sure to read the two reports which accompany it.

Even as recently as 2018, most Main Streeters remained unaware of moves being made by China and Russia. But it’s all happening in the open IF you’re paying attention and understood what’s being reported.

At our 2021 Investor Summit, we said it was likely inflation’s not “transitory” as claimed by policy makers, energy prices are likely to rise (they did), and the Fed is in a troubling trap with respect to interest, inflation and a financial system laden with leveraged bonds.

In last year’s Investor Summit (our 20th anniversary), I sat on a panel with Danielle DiMartino-Booth, George Gammon and Dr. Chris Martenson.

I asked Danielle point blank if the Fed would raise rates until “something broke,” and if so, what would it be?

She answered unequivocally, “Yes, the Fed will raise rates until the credit markets break.”

And so here we are…

Several major banks have failed or required saving. Inflation remains stubbornly high. Gold prices are reflecting dollar weakness. The China/Russia coalition is pulling major players...Brazil, Saudi Arabia, India…away from dollar-denominated trade.

While concerning, none of this is surprising to our seasoned Summiteers. Even better, it’s not necessarily bad news. The flip side of challenges are opportunities.

Smart investing starts with a good understanding of the macro-trends...in the economy, in the financial system...right down to the currency itself.

Based on the macro picture, a savvy investor will create an investing thesis, then refine it with the help of other smart people and qualified experts.

| | What’s next in this rapidly changing world?

| | My thesis is the Fed is faced with a difficult choice...save the financial system that their rate hikes are imploding...

…or bail everyone out by printing trillions and putting all the pressure on the dollar even as the world is de-dollarizing.

Or...perhaps...use the entire crisis to usher in an entirely new currency.

What will the Fed do?

Of course, as my friend George Gammon often says...there are no certainties, only probabilities.

| | Your ability to read and react quickly in the face of a rapidly changing landscape could be the difference between making a killing...or becoming roadkill.

| | I’ve discovered the secret to making better faster decisions is having access to a big network of smart, studious, active and informed experts and investors.

We build and expand those relationships every year during our week-long Investor Summit. The amazing presentations and panels are just the launching pad for dinner discussions, cocktail conversations and relationship-building on the beach.

We are living in historic times...perhaps on the threshold of another great reset investors and historians will be studying for decades.

What seems clear to me is that something’s gotta give.

I invite you to join me on our 2023 Investor Summit and discover what George Gammon, Chris Martenson, Ken McElroy and the rest of our stellar Summit faculty and Main Street investors are thinking and doing in these unprecedented times.

To your resilient wealth and freedom,

Russell Gray

Co-Host, The Real Estate Guys™ Radio Show

Co-Producer, The Real Estate Guys™ Investor Summit

| | CLICK HERE

To Learn More About

The Real Estate Guys Investor Summit

June 6-14 • Belize

| | For Additional Information, See:

The Real Asset Investing Report by Russell Gray

The Real Estate Guys™ Radio Show featuring Robert Helms and Russell Gray

The Real Estate Guys™ Investor Summit – June 6-14, 2023 in Belize

| | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |