| The calm before the storm...

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | The Calm Before The Storm

| |

Gold remains in a holding pattern as we await the Fed’s next move...but the fundamentals — including the latest numbers from the Fed itself — show that a big turning point is imminent.

| | | |

Another bank bites the dust. In fact, the second largest bank failure in U.S. history came over the weekend and, for a few moments this morning, sent the price of gold jumping.

|

But then came the April ISM manufacturing report. The index was reported at 47.1, the sixth straight month for this number to come in under 50, indicating contraction.

You would think this bad news would be good news, as it would add further encouragement for the Fed to stop hiking rates. However, it came in better than expectations and therefore did little to alter the consensus view that Powell & Co. would raise rates by another quarter point this Wednesday.

|

Gold, which had traded about $15 higher than Friday’s close before the ISM report, is now trading about $10 lower.

|

In short, we remain in a holding pattern until this week’s Fed meeting shows the path forward. My expectation agrees with the consensus, that this hike will be the last before the Fed pauses.

| | Things Are Getting Crazy

|

The collapse of First Republic Bank last week, and its bargain-basement purchase by JP Morgan (which was caught touting a 20% IRR on the “investment”), should lead the Fed to some second-guessing.

You don’t go from the easiest monetary policy in history to one of the most rapid rate-hiking regimes ever seen without breaking a few things. And while the feared banking crisis hasn’t yet become widespread, it’s obvious it hasn’t gone completely away either.

We’re likely to see more bursts in the plumbing of the financial system in the days ahead. Add in the probability of a recession, and there’s plenty to support a pause for now.

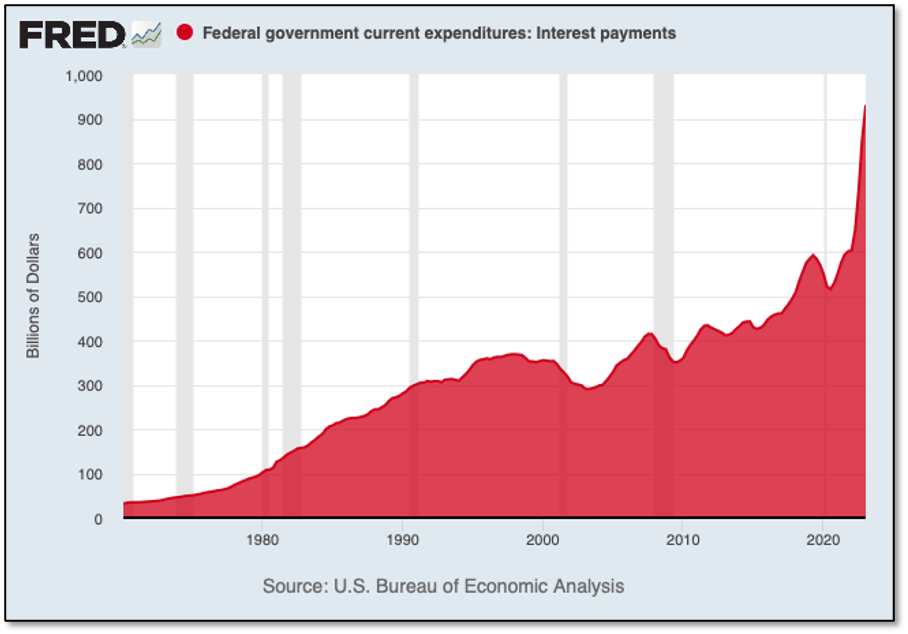

But then came the cherry on top, as the Fed just updated its estimate of the annualized cost of servicing the Federal debt:

|  | |

I tweeted this chart out over the weekend, with this caption:

| | Ya think things are getting a little out of control?

BTW, this number is likely well over $1 trillion right now on a run-rate basis. Imagine the rhetoric when the squad in Congress gets a load of that number.

|

For the record, the cost of servicing the federal debt is now $928.93 billion. That’ll have to be paid each and every year...to hedge funds, rich investors and foreign nations like China.

If nothing else, this will prevent the Fed from raising rates further.

And when the pause comes, with inflation still far above the Fed’s 2% goal, the fire will be lit once again under gold.

|

That day is inevitable...and it’s now imminent. So make sure you’re prepared.

|

I’m going into this dynamic in much more detail in our May edition of Gold Newsletter. If you’re not already a subscriber and want to get my latest predictions — as well as our top junior mining picks — CLICK HERE to subscribe now.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | | |