| Is this gold rebound for real?

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| |

.png) | | Bottom-ing

| |

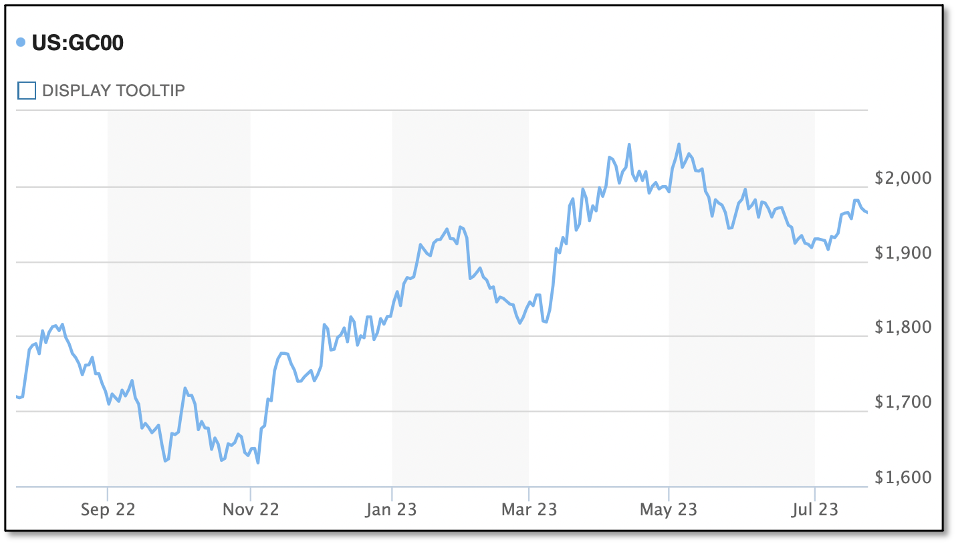

| I recently suggested that gold might have bottomed ahead of schedule. Subsequent market action has made that more questionable, but still likely.

| |

July 24, 2023

Dear Fellow Investor, | | I made a fairly bold call in this publication awhile back when I said that gold appeared to have bottomed earlier than we would’ve expected for a typical summertime slump.

| | As I guess I should’ve expected, gold took the opportunity to pull back on the throttle over the following week. A $24 jump on Tuesday, July 17th was impressive, but the metal failed to keep advancing.

The bottom line is that gold now stands right about where it started when I initially made that call.

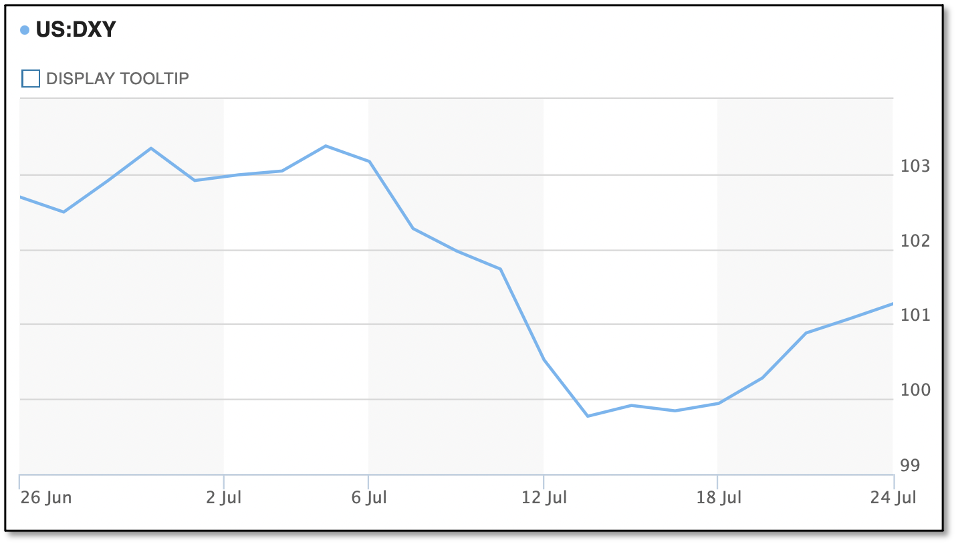

|  | | If you’re looking for a reason as to why gold paused its rally, many are looking to the dollar — and the fact that the greenback has seemingly halted its nose dive.

|  | | As you can see, the greenback’s precipitous decline ended a week or so ago, and the index has rebounded to back above the key 100 level.

Unlike most analysts, however, I don’t believe the Dollar Index influences the gold price to any great extent, but rather that both are driven by one, overriding factor.

That factor being the Fed’s monetary policy moves, or the market’s expectations thereof.

I’ll repeat what I said last week:

| | Whether the Fed raises one or two more times, this rate-hike cycle has essentially peaked...and the markets are already looking ahead toward the easing cycle.

| | When viewed from this more-lofty perspective, we can expect fluctuations in views on the timing of that big shift, and these will result in short-term reversals of the trends for gold and the dollar.

For example, it seems obvious now that the two-week rally in gold got a bit ahead of itself, as did the steep decline of the Dollar Index. But I think it’s also obvious that the next “big thing” that investors are beginning to bet on will be loosening of monetary policy.

Importantly, this forecast of a Fed pivot isn’t so much dependent upon the flow of economic data as it is a recognition of an oncoming crisis that a “higher for longer” rate policy will precipitate.

Consider this from a recent issue of Grant’s Interest Rate Observer, in which our friend Jim Grant quoted Oleg Melentyev of the Bank of America:

| | “To better appreciate the degree of challenges ahead of us, consider that the Bank for International Settlements tracks total G20 nonfinancial debt at $250 trillion, double its level since the Global Financial Crisis. Bloomberg’s Global Agg yield, the broadest measure of fixed income, is at 4%, up from just under 1% in 2021. In the meantime, average coupon on this index has only reset by 50

bps, i.e., most issuers continue to pay the old coupon and are yet to experience the full impact of higher rates. Hypothetically, if all coupons were to get reset by 320 bps to match the change in yield, the incremental interest expense of all G20 borrowers could go up by $8 trillion. This is an equivalent of Japan plus Germany GDP combined (3rd and 4th largest economies).”

| | A hat tip to another friend, Peter Boockvar, who highlighted this quote in his letter, noting “That is not what a smooth landing is made of and the dragnet of higher rates will capture more and more unless we see a dramatic, and I mean dramatic, fall in interest rates.”

| | In short, there’s big trouble ahead, my friend. Gold is rising in anticipation, while the dollar is falling in the expectation of the Fed’s inevitable prescription of easier money.

| | This is a big shift, one of the “crucial turning points” that you find investment pundits often exclaiming in their promotional copy. Unlike those, however, this one is real...and is being reflected in the markets right now.

In fact, gold is refusing to drop today, despite Wednesday’s Fed decision and a rebounding Dollar Index. That’s impressive.

If we’re going to prepare for the Fed’s next big turn in policy, one of the best ways is through the severely undervalued junior mining stock market.

| | I strongly suggest that you make sure you’re positioned — now, before this rally gains steam — in the very best junior gold and silver stocks.

| | And I would also suggest that the best way to do so would be through a subscription to our Gold Newsletter publication. (Just CLICK HERE to do so now.)

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | © Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |