| Dear Fellow Investor,

|

| They say that records are made to be broken.

|

| That’s something to remember as silver is poised to make a new bull run...and smart investors are scrambling to pick up the most undervalued and highly-levered junior silver stocks.

|

| Tops on that list may be Blackrock Silver (BRC.V; BKRRF) — a company that was the darling of the industry in silver’s last big move...and one that has the potential to spin out far greater gains this time around.

|

| The interest in Blackrock and other silver juniors is understandable. Silver historically outperforms gold in a bull market, and silver mining companies usually outperform silver itself.

Smaller silver exploration/development companies can outperform even the miners...so by investing in this high-powered sector an investor could layer leverage on top of leverage on top of leverage.

The gains can be extraordinary.

|

| Consider what Blackrock Silver did in the last big metals bull market of 2020: Within the span of just three months, it multiplied over seven times in price following their initial discovery.

|

|

| Powerful Leverage: When silver rose about 40% from June 2020 to August 2020, Blackrock Silver’s share price soared more than seven times over

|

| What could be better than that? The answer may be in what lies just ahead.

Because gold and silver are perking up at this moment, and seem poised for another bull move. But this time, Blackrock Silver is a far better company than ever before...and even than it was just days ago.

|

| Big News From Blackrock...

|

| Blackrock Silver was a tremendous opportunity a month ago.

Trading at just under $1.00 per ounce of silver in the ground (enterprise value/ounces of silver-equivalent), its ounces commanded the highest valuation of any silver exploration and development company in the industry as it offered a combination of powerful advantages that no other company could match:

|

| • An enviable location in Nevada (where abundant infrastructure and skilled labor drives down operating costs)...

• Exploration ground on private land (making permitting much easier and quicker)...

• One of the highest-grade, large silver resources in the world...

• Tremendous exploration potential.

|

| Add it all up, and it’s not surprising to see why so many investors rushed to buy this company when silver started to climb in 2020. And it’s why it was still a great opportunity a few weeks ago.

But then, earlier this month, Blackrock stunned the market with an amazing announcement:

|

| A new inferred resource estimate showing 100 million ounces of silver-equivalent — more than double the initial resource estimate — at an even higher grade than before.

|

| All of a sudden, Blackrock was easily twice the company it was before...twice the value...and twice the opportunity as the silver price starts to rise.

The good news: It looks like there’s much more to come.

|

| “The First 100 Million Ounces Is The Hardest”

|

| The mantra of Blackrock’s exploration team is that “the first 100 million ounces is the hardest.”

Their point is not just that few companies ever achieve this goal, but also that they now have a great idea of where to find much more silver.

You see, perhaps their biggest discovery since announcing their initial resource estimate of 42.6 million ounces in May of last year is that they’re just scratching the surface on their Tonopah West property.

|

| As they’ve continued to drill and explore their land position, they have gained a much better idea of what controls the rich silver mineralization and where it’s trending.

|

| Drill results and geological mapping have now clearly established that the mineralization is following the inside rim of an ancient caldera. So, instead of trending directly to the west as everyone had always assumed, the silver veins turn, to trend to the northwest.

This discovery has allowed Blackrock’s geologists to predict where to drill to find the high-grade silver-gold mineralization that characterizes this historic district.

Even better, this newly discovered trend brings the projected mineralization back onto Blackrock’s property, with potentially kilometers of undrilled strike length now available.

|

|

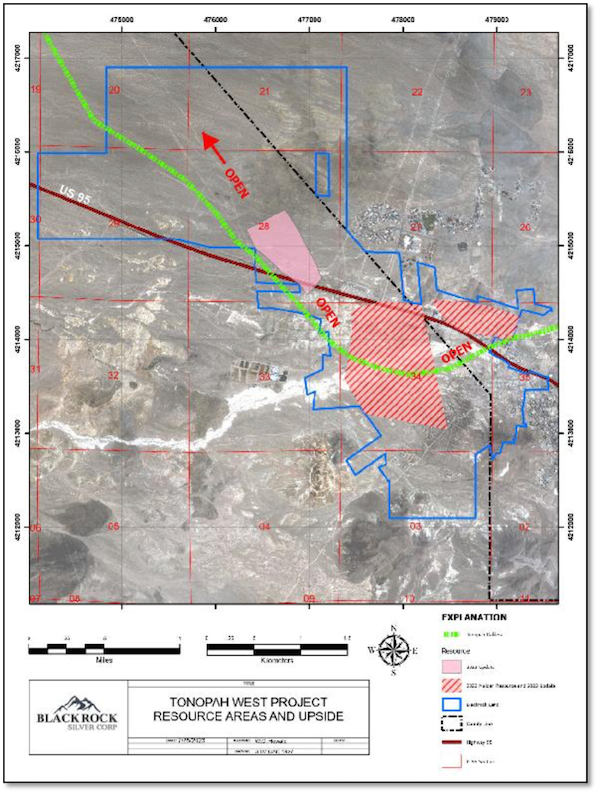

| Click image to enlarge

|

| In the map above, the red-hatched area is the previous resource, while the solid pink area represents the added high-grade resource. The green line is the mapped outline of the caldera.

|

| As you can see, the drill-defined system has been tracked across three kilometers and yet remains open to the south, northwest and at depth.

|

| It’s readily apparent why Blackrock’s geological team is excited about how much silver and gold remains on their property...and how much easier it will now be to find.

As they say, this first 100 million ounces of silver was the hard part. Now it’s going to get a lot easier.

The best news for investors, though, is that the market is largely ignoring this huge resource!

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

| At These Prices, Is This Today’s Most Levered Silver Stock?

|

| The typical summer doldrums in metals and mining were expected to go away once the more-favorable fall season came around.

But then came harsh rhetoric from Federal Reserve officials, along with spiking interest rates, sending gold and silver prices reeling...and putting mining stocks right back on the bargain rack.

Of course, that’s all changed recently, as geopolitical issues have joined with fundamentals to spark a major new rally in silver and gold.

Here’s where it gets interesting...

|

| Blackrock Silver announced its huge new resource — 100 million ounces of silver-equivalent at an eye-popping average grade of 508.5 silver-equivalent grams per tonne — before silver and gold took off to the upside.

|

| The result is that the big news had little impact on the company’s share price.

More important: It makes Blackrock perhaps the most undervalued...and high potential...silver stock around. Consider that it’s now trading for only about $0.48 per ounce of silver-equivalent resource.

You’d be hard pressed to find another high-grade silver resource selling for twice that price. And certainly not one in infrastructure-rich Nevada. Valuation gaps like this don’t tend to last long.

So what was once one of the best silver opportunities has only gotten better.

|

| Even More Silver...And Lithium...Potential

|

| Remarkably, Blackrock Silver’s story doesn’t end with the large and growing resource at Tonopah West. The company also gives shareholders two additional high-potential projects:

|

- The Silver Cloud project: A large, 45 square-kilometer land package in the midst of the richest gold mining area in North America, Silver Cloud is centered on the Northern Nevada Rift, adjacent to Hecla’s huge Hollister mine.

A recent bonanza drill hole hitting 70 g/t gold and 606 g/t silver over 1.5 meters added to a drill-defined structure extending 425 meters so far. With more drilling ahead, this is the one project that could actually steal headlines from Tonopah West.

- The Tonopah North Lithium discovery: Lithium is so hot that Blackrock was able to strike a rich joint venture deal on its highly prospective ground to the north. By spending US$15 million, Tearlach Resources can earn 70%.

That deal is already reaping rewards, as an 11-hole drill program confirmed rich lithium grades of up to 1,660 ppm across a 7.2-square-mile area.

|

| Either one — or both — of these projects could end up justifying Blackrock’s current market cap all by themselves.

|

| This Silver Rocket Is Back On The Launch Pad

|

| With a track record of quickly multiplying seven times in price over just three months, Blackrock Silver offers the kind of leverage that investors are looking for in a red-hot silver market.

But what about just a normal market?

The record also shows that high-grade silver resources were recently valued at $2.50/ounce in the ground. With Blackrock’s resource now trading around $0.48/ounce, just a return to the previous range implies tremendous potential gains.

And that’s not factoring in the clear potential for finding much more silver at Tonopah West.

|

| With the silver price taking off now, it won’t take long for investors to discover Blackrock Silver’s large, high-grade resource...its obvious room for growth...and its current deep undervaluation.

|

| You can discover all this before they do, by clicking on the link below.

|

| CLICK HERE

To Learn More about Blackrock Silver

|