January 8, 2023

Dear Fellow Investor, |

| It doesn’t matter how wealthy or sophisticated you are. What I’m about to reveal is the sort of thing that will get your pulse quickening.

|

| I’m talking about the chance for profits that would be life-changing, regardless of how wealthy you may already be.

|

| In fact — as I’m about to show you — we are facing a generational opportunity in metals and mining stocks...a nearly perfect analog to what we saw in the early 2000s.

I know that may sound like hyperbole. But as the writer and publisher of Gold Newsletter, the world’s oldest precious metals advisory, I can assure you that it’s the cold, hard truth.

You see, over the 52-year history of this publication, our strategy has produced winners that multiplied 10, 20 or more times in price, again and again.

|

| In fact, one of our most recent big recommendations — Great Bear Resources — recently closed out as a 45-for-1 winner for our readers.

That means a $10,000 investment could have netted nearly a half a million dollars!

|

| And I’m writing you now because I’ve got no less than 10 candidates that could duplicate that remarkable return….

|

| Here’s Why Gold Is Going Much Higher

|

| As you probably know, gold recently hit an all-time high.

That’s great for gold investments...but make no mistake, the 10 junior mining companies I’ve pinpointed could soar no matter what happens with gold, silver or any other metal.

That’s because they’re on the trail of huge discoveries or are developing rich projects with the promise of multiplying their market values.

|

| But get this: Their potential is even greater now because gold, silver and other metals are going much, much higher. And it’s the Federal Reserve itself that’s going to send them there.

|

| Why? Because the Fed’s rate hikes have ironically provided the very roadblock to their plans to fight inflation.

You see, the massive $34 trillion federal debt — fully four times its size in 2008 — is now completely unmanageable.

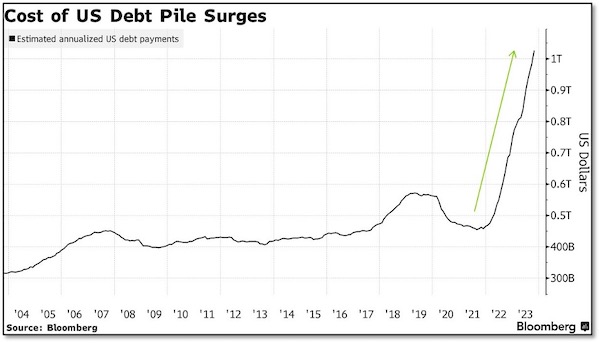

But don’t take my word for it: Bloomberg just reported that the annual cost of financing the U.S. debt has soared to over $1 trillion per year.

As Bloomberg notes, “Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month, Bloomberg analysis shows. That projected amount has doubled in the past 19 months from the equivalent figure forecast around the time.”

|

|

| This chart shows how quickly interest costs have escalated as not only the debt has grown at a frightening pace, but also as interest rates have soared. The result is a mind-boggling increase in the bottom-line interest expense.

|

| And it’s going to get much worse in the months just ahead, as a significant percentage of Treasury debt — most of which was placed in short-term paper even when rates were near zero — is reset at today’s far-higher rates.

|

| But none of this is news to my readers of Gold Newsletter. I’ve been warning of this precise event...and the resulting political repercussions when interest costs ran past the “big number” of $1 trillion...for years now.

I’ve been harping on this inevitable event because it would trigger doubts over U.S. credit worthiness and lead to calls from left-wing politicians to repudiate the debt and redirect payments toward more entitlement spending.

...And that kind of talk would spark a crisis in the dollar.

Bloomberg agrees: “The worsening metrics may reignite debate about the US fiscal path amid heavy borrowing from Washington. That dynamic has already helped drive up bond yields, threatened the return of the so-called bond vigilantes and led Fitch Ratings to downgrade US government debt....”

The process is gaining steam now: Moody’s just joined Fitch in downgrading U.S. debt from stable to negative...

...And now even the New York Times is recognizing what’s happening, publishing an exposé under the subject line “The debt matters again.”

|

| Because of these spiraling costs, the Fed itself is now projecting that it will cut rates three times this year. The market expects five rate cuts.

|

| This doesn’t surprise me at all, because the cost of the federal debt alone — even if we ignore all the other factors and potential crises — means they’ll simply have to start cutting rates dramatically.

|

| But Here’s What Does Surprise Me...

|

| The most amazing thing about the markets today is this: We can still buy the best, highest-potential mining stocks at near record low prices.

We know that gold and silver are going much higher once the Fed starts its rate-cutting cycle. And we know that mining stocks will leverage the gains in the metals.

|

| Yet we’re still early in this next cycle, and investors are only now starting to jump into mining equities.

|

| That means that there are still bargains galore...although from my experience they won’t last long at these levels.

Which brings me to the biggest news of all...

|

| Discover Today’s 10 Most Explosive Mining Stocks Now...

|

| Using my four decades of experience and exclusive network extending to every corner of the industry, I’ve pinpointed the Top 10 junior mining stock opportunities in today’s market.

The 10 stocks I’ve identified are, in my opinion, the ones best positioned to not only multiply the gains in gold and silver, but also catapult higher regardless of what the metals do.

|

| They’re all detailed in a special report I call “Money Multipliers — The Top Stocks Picked To Triple Or More.”

|

| As you’ll see, each of the stocks I’ve picked for this exclusive special report has the potential to at least triple in price.

Frankly, I believe one or two could come close to duplicating our recent 45-for-1 jackpot with Great Bear Resources.

You’ll get full details on these 10 ultra-high-potential stocks in my Money Multipliers report, including:

|

- A new (and therefore still dramatically undervalued) company with net profits interests and/or equity positions in three of the best copper projects in the world.

Talk about a high-powered play on the global electrification megatrend — this company boasts an enterprise value of $220 million but a current market value of just $54 million!

- A micro-cap exploration company working in Nevada with a goal of finding the next multi-million-ounce Carlin gold deposit. It was amazingly able to secure a big land position in the midst of this elephant country...

...And its latest drill hole was able to confirm precisely the type of target they were looking for. This is a pure exploration play, but the upside potential may be greater than anything else in the market today.

- A silver exploration company that recently announced a huge, high-grade silver resource in one of the world’s top locations...with a new resource update coming up soon.

The problem? A small drill program on the company’s original, overlooked property just turned up eye-popping grades of gold and silver! This new discovery might be worth far more than the previous one — and drills are turning now.

|

| You’ll get all the details on these three companies, and seven more explosive plays, in my Money Multipliers report.

This is a must-read — and urgently so. Because not only are these the best-positioned companies I’ve found using my decades of experience…

…But the timing is also perfect, as the Fed’s rate cuts draw near.

In my opinion, this is a generational opportunity in gold, silver and junior mining stocks. I haven’t seen an opening like this since the metals market first started to move in 2000.

So you absolutely need to get this report now, before these oversold junior mining stocks have a chance to take off.

|

| The good news: Our Money Multipliers report is free with your subscription to Gold Newsletter.

Even better news: You can get Gold Newsletter now for 30% off of its normal price, through this special offer.

|

| Just click on the link below to learn more now….

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. This special offer will close soon, and that’s one reason for the urgency.

The other? Because the next leg in the gold and silver bull market is beginning at this very moment...while prices for these high-powered junior mining companies are at the cheapest levels in history.

Just a day’s delay could mean their stock prices are 10%, 20% or more higher by the time you act. I urge you to act now to secure this opportunity.

|

| CLICK HERE

To Get Your Copy Of

Money Multipliers

And A Year Of Gold Newsletter

At A Deep Discount

|