|

| Primary silver mines are rare. Big ones are even more rare.

|

| And big, high-grade ones are virtual unicorns.

Which is why it’s such big news when one of the world’s largest undeveloped silver mines suddenly gets much larger and much richer.

It’s virtually unheard of.

|

| But that’s just what Vizsla Silver (VZLA.NYSE-A; VZLA.V) just did — announcing a new resource estimate that elevated it from “one of” the world’s largest undeveloped silver mines to “the” largest.

|

| The best news is that, because the news came out on a day when gold and silver were down, the market reaction was muted...

...And investors still have a chance to pick up one of the best silver opportunities around before a potential major re-rating.

But that’s just the start of this opportunity.

|

| The Market’s Best Resource Jumps In Ounces And Grade

|

| The most recent resource estimate for Vizsla’s Panuco project in Mexico is a win for the company (and shareholders) on a couple of different fronts.

|

| First, drilling on the primary Copala and Napoleon veins has combined with drilling on new targets like the La Luisa vein to deliver an impressive 49% increase in total ounces.

|

| Using a 150 g/t silver equivalent cutoff grade, Panuco is now estimated to host 155.8 million indicated silver equivalent ounces at a silver equivalent grade of 511 g/t and an inferred resource of 169.6 million ounces grading 433 g/t silver equivalent. That combined 325 million silver-equivalent ounce total increases the previous total by almost half.

|

| Moreover, the 511 g/t silver equivalent grade on the indicated resource is a remarkable 17% improvement from the previously reported indicated grade.

|

| That’s a rare double-win for a resource estimate conducted so far into a project’s development, and further support for the world-class nature of the deposit at Panuco.

And it doesn’t stop there. Adding to its luster as a silver play, fully 90% of Vizsla’s resource value comes from precious metals, of which 60% comes silver and 40% from gold. Silver-equivalent resources from other “silver” projects often represent a significant contribution from zinc or other base metals.

Investors looking for highly leveraged, rapidly growing precious metals plays with the turbocharged advantage of silver quickly see that Vizsla stands far above the crowd.

|

|

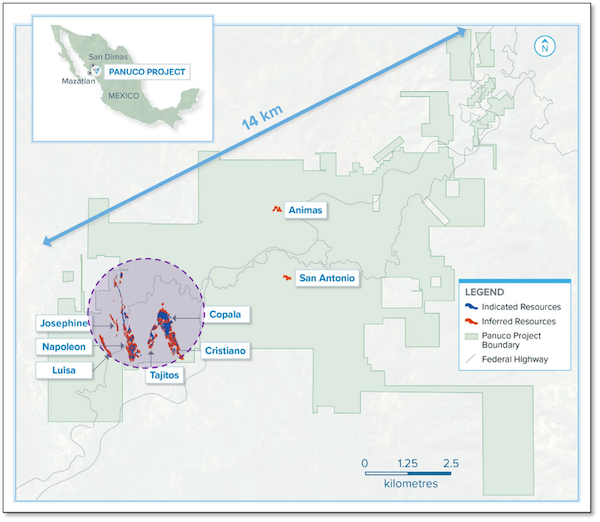

| As large as Panuco’s silver resource is, it represents just a very small fraction of the property and identified vein structures.

Click image to enlarge.

|

| Drills Continue To Turn...

|

| Better still, no less than four drills continue to turn at Panuco, which means it’s very likely to grow significantly larger still.

Consider this: Not only do the big, resource-hosting Copala and Napoleon vein areas have room to grow, but an initial estimate for the recently discovered La Luisa vein of 25 million ounces comes from just a relatively small portion of its 1.6-kilometer strike length. It, too, will grow larger with future estimates.

|

| And the picture gets even better if we pull out and take a larger view: All three of these targets are located on just 10% of the property boundary at Panuco, which covers an area approximately the size of the island of Manhattan.

|

| The central and eastern portions of Panuco contain tens of kilometers of identified vein strike that has been underexplored. Moreover, experience shows that blind targets abound...and an upcoming airborne VTEM survey promises to uncover many of them.

Bottom line: Panuco already hosts a world-class silver resource and yet it remains wide open as the company moves the resource towards production.

|

| Extreme Leverage To Silver

|

| As a rare primary silver project, Panuco makes Vizsla Silver a strong lever for the grey metal.

As it is, silver historically offers leverage to rising gold prices. The relative dearth of equities that boast silver-forward resources multiplies that leverage.

|

| With a gold market that’s about to take off as interest rates finally start to slide, silver is set to take off in sympathy.

|

| And as generalist investors begin to place their bets on the silver sector, they’ll run headfirst into that lack of quality silver names.

Vizsla Silver, with its 325 million ounces of rich, silver-equivalent resource, will stand tall in that environment.

|

| The Obvious Takeout Target

|

| And Vizsla won’t just stand out to the investment community, but also to bigger miners hungry to grow their silver reserves and production profiles.

Panuco is bisected by a major highway and has existing infrastructure on the property that can mitigate the costs of getting a mine into production.

It would be mostly an underground mine with less surface disturbance than open-pit projects, and a relatively shallow mine with the kind of grade that boosts profits.

The buyout element to the Vizsla story gives it an obvious and potentially very profitable exit strategy as drills continue to grow the prize that is Panuco.

|

| Perfect Project, Perfect Timing

|

| It’s hard to imagine a better positioned metals play than Vizsla Silver.

Gold is poised to soar as the Fed starts cutting interest rates, and silver stands to leverage gold’s gains considerably.

As one of the premier silver plays in the world, Vizsla will command investor attention over the weeks ahead.

|

| And with a flood of news coming up — with a massive, 65,000-meter drill program promising to deliver more boomer drill holes...plus potentially another resource update and a preliminary economic assessment this year — Vizsla’s growth curve could dwarf any other silver play around.

|

| But again, the current resource size and grade has yet to be fully factored into the company’s market value, much less all the growth ahead.

|

| It’s hard to believe, but even with this world-class, rapidly growing and high-grade resource, Vizsla is still dramatically undervalued compared against its peers.

For example, its enterprise value per resource ounce is still at just about $0.80/ounce...while its peers trade for $1.20/ounce to $5.00/ounce.

|

| This gap seems destined to close, and soon, as we’re already seeing Western investor attention turning back to silver and gold in the new year.

Which makes this the perfect time to look at Vizsla Silver.

|

| CLICK HERE

To Learn More about Vizsla Silver Corp.

LAST MINUTE UPDATE:

Vizsla Silver is hosting a webinar today to provide full background on the latest resource.

REGISTER now for Vizsla’s live webinar today at 10am PT/1pm ET

|